Health Check: How Prudently Does Calliditas Therapeutics (STO:CALTX) Use Debt?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Calliditas Therapeutics AB (publ) (STO:CALTX) does use debt in its business. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Calliditas Therapeutics

What Is Calliditas Therapeutics's Debt?

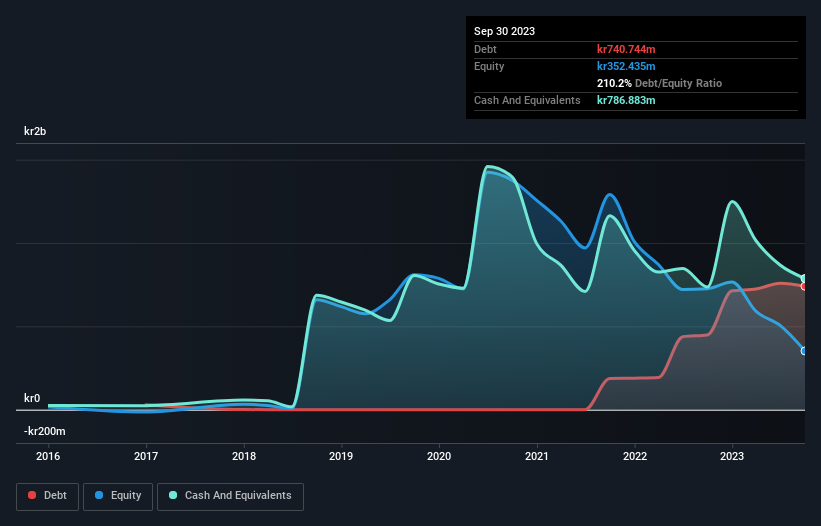

The image below, which you can click on for greater detail, shows that at September 2023 Calliditas Therapeutics had debt of kr740.7m, up from kr448.1m in one year. However, its balance sheet shows it holds kr786.9m in cash, so it actually has kr46.1m net cash.

How Strong Is Calliditas Therapeutics' Balance Sheet?

We can see from the most recent balance sheet that Calliditas Therapeutics had liabilities of kr344.7m falling due within a year, and liabilities of kr914.7m due beyond that. Offsetting these obligations, it had cash of kr786.9m as well as receivables valued at kr130.5m due within 12 months. So its liabilities total kr342.0m more than the combination of its cash and short-term receivables.

Since publicly traded Calliditas Therapeutics shares are worth a total of kr7.16b, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. While it does have liabilities worth noting, Calliditas Therapeutics also has more cash than debt, so we're pretty confident it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Calliditas Therapeutics's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Calliditas Therapeutics wasn't profitable at an EBIT level, but managed to grow its revenue by 192%, to kr1.2b. So there's no doubt that shareholders are cheering for growth

So How Risky Is Calliditas Therapeutics?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And in the last year Calliditas Therapeutics had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through kr230m of cash and made a loss of kr451m. But the saving grace is the kr46.1m on the balance sheet. That kitty means the company can keep spending for growth for at least two years, at current rates. Importantly, Calliditas Therapeutics's revenue growth is hot to trot. While unprofitable companies can be risky, they can also grow hard and fast in those pre-profit years. For riskier companies like Calliditas Therapeutics I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you're looking to trade Calliditas Therapeutics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:CALTX

Calliditas Therapeutics

A commercial-stage bio-pharmaceutical company, focused on identifying, developing, and commercializing novel treatments in orphan indications with an initial focus on renal and hepatic diseases with significant unmet medical needs in the United States, Europe, and Asia.

Exceptional growth potential and undervalued.

Market Insights

Community Narratives