Bonesupport Holding (OM:BONEX) Margin Decline Challenges Bull Case Despite Strong Growth Forecasts

Reviewed by Simply Wall St

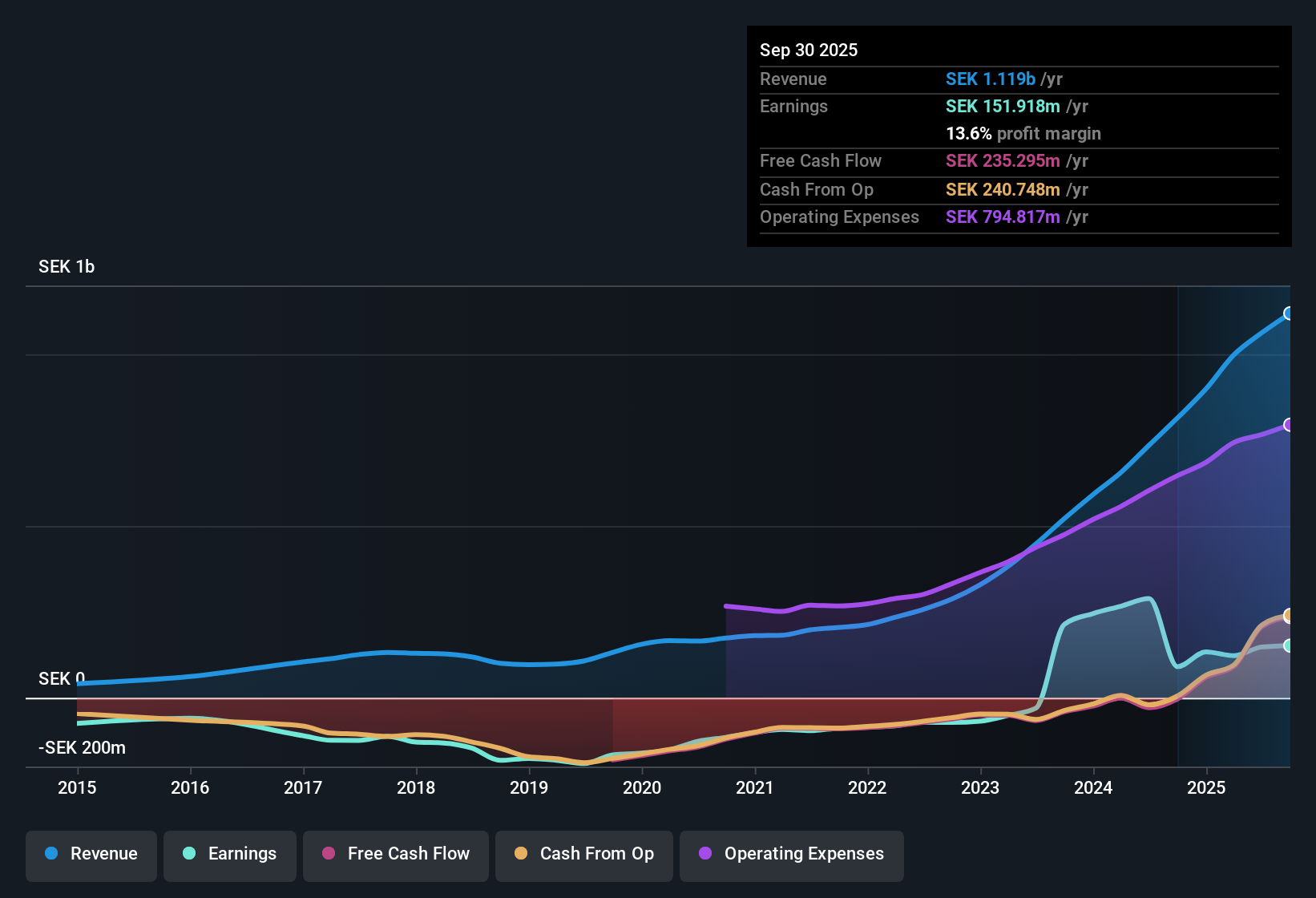

Bonesupport Holding (OM:BONEX) reported high-quality earnings, turning profitable over the last five years and achieving impressive earnings growth of 63% per year during that period. Net profit margins for the most recent period landed at 13.9%, below last year’s 39.3%. Earnings are projected to accelerate by 58.25% per year going forward, outpacing not just the Swedish market but also revenue, which is forecast to grow 30.4% annually compared to a local benchmark of 3.6%. Despite robust growth projections and the stock trading below its estimated fair value, investors will note that net profit margins have declined and the forward P/E ratio sits far above both industry and peer averages, highlighting the company's premium valuation and raising questions about sustainable profitability.

See our full analysis for Bonesupport Holding.In the next section, we will see how the numbers measure up against the current market narratives and community expectations. Some long-held views may be confirmed, while others could be challenged.

See what the community is saying about Bonesupport Holding

NTAP Expiry and Currency Shifts Squeeze Margins

- Net profit margins currently stand at 13.9%, down sharply from last year’s 39.3%. Analysts link this decline to escalating selling expenses and ongoing currency headwinds.

- Consensus narrative notes that high repeat usage and new indications in the U.S. are fueling revenue growth. However, these gains are being undermined by two major pressures:

- Currency fluctuations, especially swings in the U.S. dollar to Swedish krona, have significantly reduced reported operating profits and are expected to continue impacting net margins.

- The recent or upcoming expiration of NTAP reimbursement for CERAMENT G may reduce sales unless permanent increases are secured, adding to the risk that margin expansion will lag revenue growth.

Price-to-Earnings Ratio Dwarfs Peers

- Bonesupport Holding’s current price-to-earnings ratio of 106.1x is far above the biotech industry average of 18x and its peer group at 28x, raising questions relative to the profit outlook.

- According to analysts’ consensus view, this premium valuation is only justified if robust annual earnings growth of 58.25% and a forecasted margin expansion to 32.1% are delivered as planned:

- By 2028, the analysts’ scenario assumes SEK 2.6 billion in revenue and SEK 843.6 million in earnings, resulting in a forward P/E of 37.9x. This remains higher than the SE Biotechs industry average of 32.5x.

- The current share price of 238.4 sits below the analyst target price of 407.8. Whether this gap narrows depends on the company sustaining growth and achieving higher profitability in the coming years.

Analyst Targets Outpace Current Price

- The current share price of 238.4 is 41.5% below the analyst price target of 407.8 and 46% below the DCF fair value of 444.74. This positions Bonesupport as undervalued by these benchmarks.

- Consensus narrative points out that for this upside to be realized, investors must accept both the high-growth forecasts and the risks of margin volatility:

- To reach the price target, the company must achieve aggressive earnings and margin goals while overcoming ongoing cost and regulatory challenges.

- There is a notable spread between the most bullish analyst (targeting 474.0) and the most bearish (targeting 375.0), highlighting ongoing debate about whether high selling expenses, competitive pressures, and margin erosion could affect future gains.

What drives those bold analyst targets, and can they withstand the margin and cost challenges? See inside the consensus case with the latest narrative. 📊 Read the full Bonesupport Holding Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Bonesupport Holding on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Thinking about the numbers from a new angle? Put your view together in just a few minutes and shape your own story. Do it your way.

A great starting point for your Bonesupport Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Bonesupport Holding’s declining net margins, outsized P/E, and margin volatility raise real concerns about valuation and the sustainability of forecasted growth.

If premium pricing and profit pressure do not appeal to you, find more reasonable prospects trading below their worth by using these 876 undervalued stocks based on cash flows now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Bonesupport Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BONEX

Bonesupport Holding

An orthobiologics company, develops and sells injectable bio-ceramic bone graft substitutes in Europe, North America, and internationally.

Exceptional growth potential with flawless balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)