Insider Buying Highlights These 3 Undervalued Small Caps Across Regions

Reviewed by Simply Wall St

As global markets navigate a landscape marked by rising inflation and volatile Treasury yields, small-cap stocks have notably lagged behind their larger counterparts, with the Russell 2000 Index trailing the S&P 500 Index. Despite this underperformance, insider buying activity can signal confidence in a company's prospects, highlighting potential opportunities among undervalued small caps across various regions.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 20.8x | 5.3x | 21.72% | ★★★★★★ |

| Maharashtra Seamless | 10.3x | 1.6x | 47.24% | ★★★★★☆ |

| Gamma Communications | 23.1x | 2.4x | 32.76% | ★★★★☆☆ |

| Quanex Building Products | 33.0x | 0.9x | 35.86% | ★★★★☆☆ |

| CVS Group | 29.0x | 1.2x | 37.55% | ★★★★☆☆ |

| Mark Dynamics Indonesia | 12.8x | 4.1x | 2.73% | ★★★☆☆☆ |

| Fourlis Holdings | 8.3x | 0.4x | -193.30% | ★★★☆☆☆ |

| Primaris Real Estate Investment Trust | 19.9x | 3.1x | 42.54% | ★★★☆☆☆ |

| Saturn Oil & Gas | 2.0x | 0.6x | -89.26% | ★★★☆☆☆ |

| Minto Apartment Real Estate Investment Trust | NA | 5.4x | 13.62% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

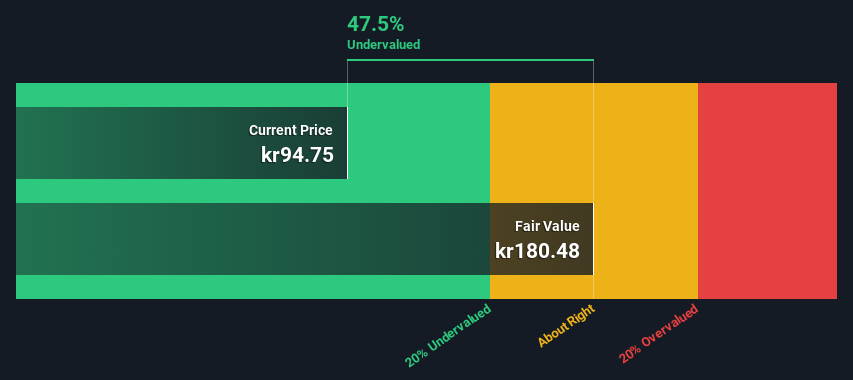

Storytel (OM:STORY B)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Storytel is a company focused on providing audiobook and e-book streaming services, with a market cap of SEK 2.75 billion.

Operations: Storytel generates revenue primarily through its streaming services and book sales, with streaming contributing significantly more to the total. The company's gross profit margin has shown variability over time, reaching 44.91% by the end of 2024. Operating expenses are substantial, with notable allocations towards sales and marketing as well as research and development activities.

PE: 38.1x

Storytel, a smaller player in the audiobook industry, is capturing attention with its recent financial turnaround. For Q4 2024, they reported sales of SEK 1.03 billion and net income of SEK 140.94 million, reversing a previous net loss. Earnings per share improved significantly to SEK 1.83 from a loss of SEK 9.34 last year. Insider confidence is evident with purchases over the past quarter, indicating belief in future growth prospects despite reliance on external borrowing for funding stability concerns. A new partnership with Vodafone Turkey expands their reach to over 20 million subscribers, enhancing market presence and potential revenue streams in this key region.

- Delve into the full analysis valuation report here for a deeper understanding of Storytel.

Review our historical performance report to gain insights into Storytel's's past performance.

D&L Industries (PSE:DNL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: D&L Industries operates in the manufacturing sector, focusing on food ingredients, oleochemicals, resins and powder coatings, colorant and plastic additives, and aerosols with a market capitalization of ₱63.78 billion.

Operations: The company generates revenue primarily from Food Ingredients and Oleochemicals, Resins, and Powder Coatings, with the former contributing ₱24.67 billion. The gross profit margin has shown variability over time, reaching 21.39% in September 2019 before declining to 16.06% by September 2024.

PE: 18.5x

D&L Industries, a smaller company with potential for growth, has caught attention due to its current market valuation. Despite relying solely on external borrowing for funding, which adds risk, the company is poised for earnings growth at 23% annually. Insider confidence is evident as Anne Lao purchased 100,000 shares in February 2025 for PHP624K. This purchase increased their holdings by over 7%, suggesting optimism about future prospects despite financial challenges.

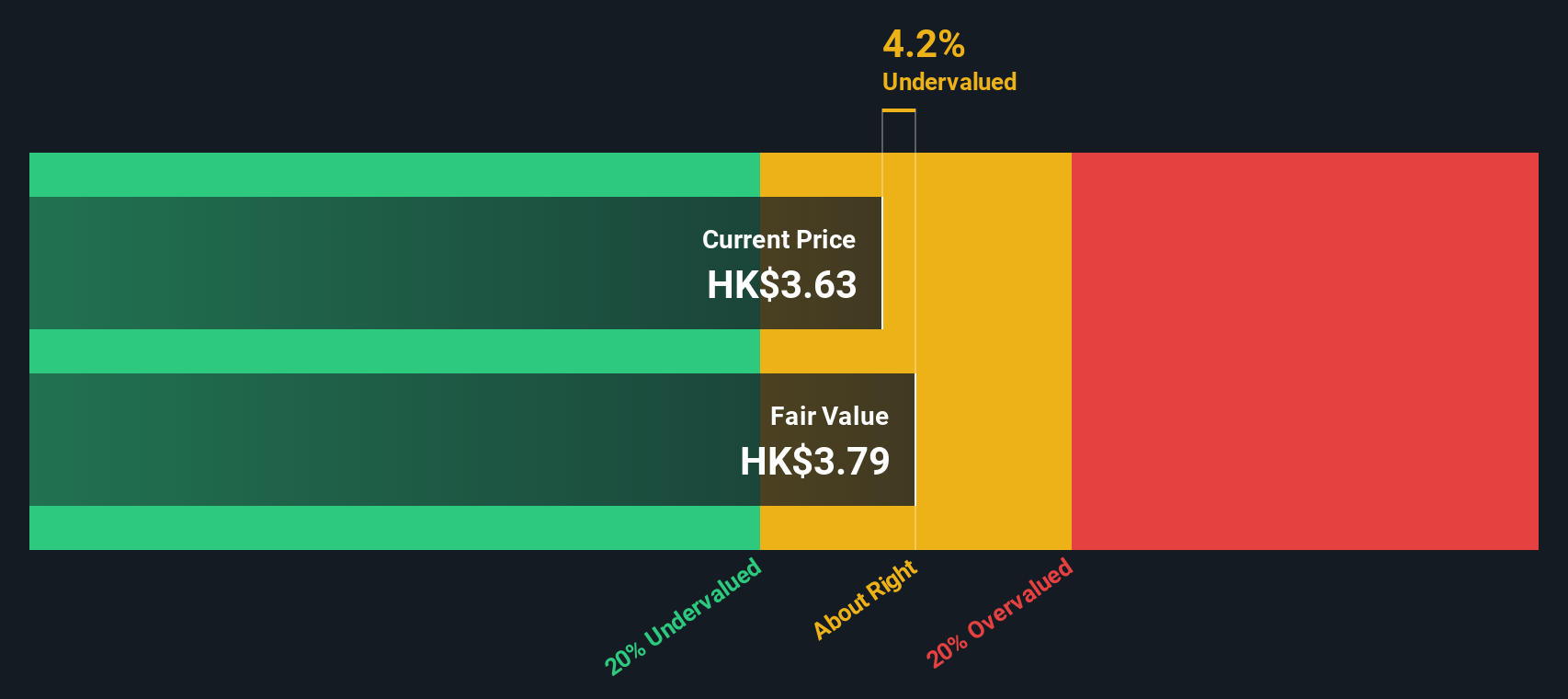

Eagle Nice (International) Holdings (SEHK:2368)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Eagle Nice (International) Holdings is engaged in the manufacturing and trading of sportswear and casual wear, with a market capitalization of HK$1.75 billion.

Operations: The company derives its revenue primarily from the Chinese Mainland, contributing significantly to its total income. Over recent periods, the net profit margin has shown a decreasing trend, moving from 10.90% in March 2018 to 4.80% by September 2024. Operating expenses and non-operating expenses have also increased over time, impacting overall profitability.

PE: 10.8x

Eagle Nice (International) Holdings, a small-cap company, displays potential for investors seeking undervalued opportunities. Despite its reliance on external borrowing for funding, the company's financial position is supported by operating cash flow covering its debt. Profit margins have decreased from 7% to 4.8%, yet insider confidence remains strong with Executive Director Yongbiao Huang purchasing 160,000 shares for HK$727,936 in recent months. This insider activity suggests optimism about future prospects despite current challenges.

Seize The Opportunity

- Unlock our comprehensive list of 184 Undervalued Small Caps With Insider Buying by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:STORY B

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives