In recent weeks, the pan-European STOXX Europe 600 Index has shown resilience by ending a streak of losses, buoyed by hopes of increased government spending despite ongoing tensions over U.S. tariffs. As central banks across Europe navigate a complex landscape of growth headwinds and inflation risks, identifying stocks with robust fundamentals and strategic positioning can be crucial for investors seeking opportunities in this dynamic environment.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 6.15% | 4.62% | 14.67% | ★★★★★★ |

| Linc | NA | 19.35% | 23.17% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Dekpol | 73.04% | 15.36% | 16.35% | ★★★★★☆ |

| ABG Sundal Collier Holding | 0.61% | -1.57% | -8.96% | ★★★★☆☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Prim | 10.72% | 10.36% | 0.14% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Clas Ohlson (OM:CLAS B)

Simply Wall St Value Rating: ★★★★★★

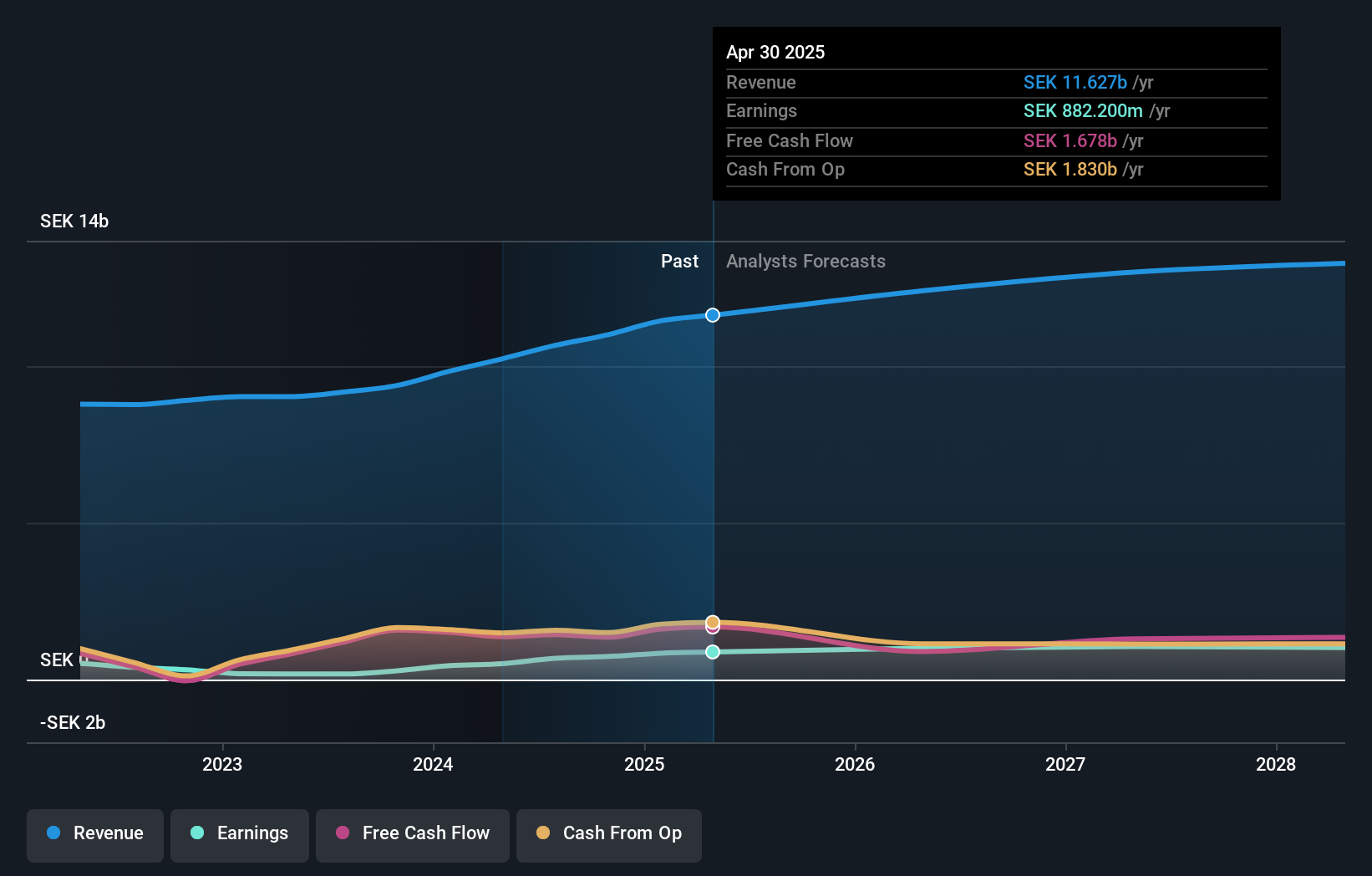

Overview: Clas Ohlson AB (publ) is a retail company that offers a range of hardware, electrical, multimedia, home, and leisure products across Sweden, Norway, Finland, and internationally with a market capitalization of approximately SEK14.42 billion.

Operations: Clas Ohlson generates revenue primarily from its retail specialty segment, amounting to SEK11.45 billion. The company's financial performance is influenced by its ability to manage costs and optimize its net profit margin.

Clas Ohlson, a nimble player in the retail space, has seen impressive earnings growth of 89.5% over the past year, outpacing its industry peers significantly. The company is trading at a notable 46.1% below its estimated fair value and remains debt-free, which bodes well for financial stability. With recent strategic moves like expanding into multi-niche retailing and partnering with Husqvarna to diversify offerings, Clas Ohlson aims to enhance sales growth and operating margins further. However, potential challenges such as currency fluctuations and rising costs could impact future performance despite projected annual revenue growth of 4.4%.

Storytel (OM:STORY B)

Simply Wall St Value Rating: ★★★★★★

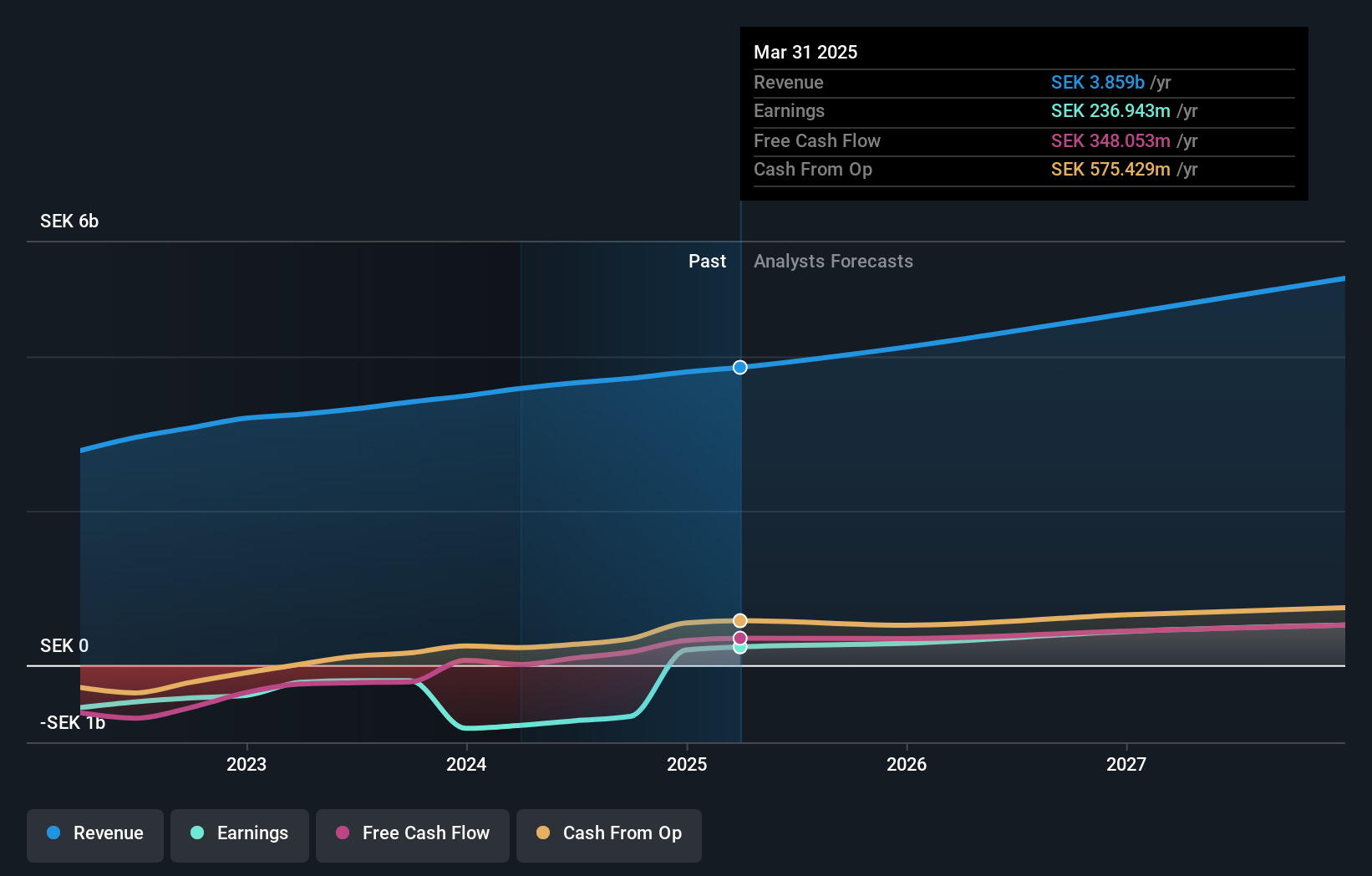

Overview: Storytel AB (publ) is a company that offers streaming services for audiobooks and e-books, with a market capitalization of approximately SEK7.33 billion.

Operations: Storytel's primary revenue comes from its streaming services, generating SEK3.38 billion, complemented by book sales at SEK1.13 billion. The company faces a net impact of SEK-703.95 million from group-wide items and eliminations on its financials.

Storytel, a promising player in the media sector, has turned profitable recently, with earnings forecasted to grow by 38% annually. Its debt management is noteworthy, as the debt-to-equity ratio has decreased from 117% to 42% over five years. Trading at a significant discount of 47% below its estimated fair value suggests potential upside for investors. Recent financials highlight impressive progress; Q4 sales reached SEK 1.03 billion from SEK 946 million last year, and net income swung to SEK 141 million from a loss of SEK 720 million. A strategic partnership with Vodafone Turkey further enhances its market position.

- Unlock comprehensive insights into our analysis of Storytel stock in this health report.

Understand Storytel's track record by examining our Past report.

Vaudoise Assurances Holding (SWX:VAHN)

Simply Wall St Value Rating: ★★★★★☆

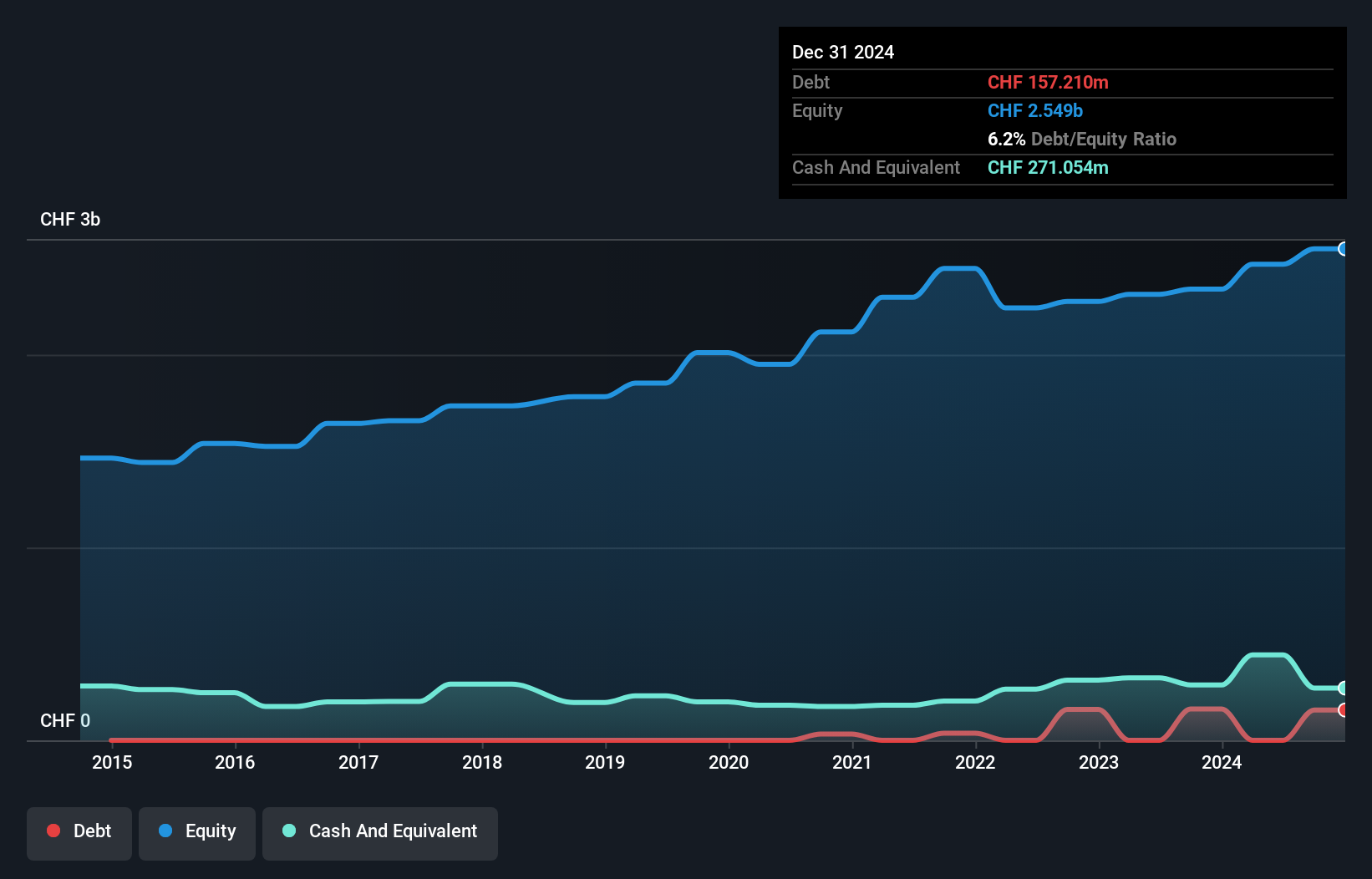

Overview: Vaudoise Assurances Holding SA offers insurance products and services mainly in Switzerland, with a market cap of CHF1.63 billion.

Operations: The company generates revenue through its insurance products and services primarily in Switzerland. It has a market cap of CHF1.63 billion, reflecting its significant presence in the Swiss insurance sector.

Vaudoise Assurances Holding offers an intriguing opportunity, trading at 54.5% below its estimated fair value. Over the past five years, earnings have grown by 1.8% annually, showcasing steady progress despite not outpacing the insurance industry's recent growth of 9.6%. The company is debt-free and boasts high-quality earnings, highlighting a robust financial foundation. With positive free cash flow and a levered free cash flow of approximately CHF210 million as of June 2024, Vaudoise seems well-positioned for sustainable operations without concerns over cash runway or interest coverage due to its lack of debt obligations.

Next Steps

- Unlock more gems! Our European Undiscovered Gems With Strong Fundamentals screener has unearthed 347 more companies for you to explore.Click here to unveil our expertly curated list of 350 European Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Storytel, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:STORY B

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives