Exploring European Undervalued Small Caps With Insider Action In July 2025

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index remained relatively flat, mixed returns across major European stock indexes reflect a cautious market sentiment amid steady inflation and a resilient labor market. In this environment, identifying small-cap stocks with potential insider activity can offer unique opportunities for investors looking to navigate the nuanced landscape of Europe's equity markets.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Hoist Finance | 8.6x | 1.8x | 20.08% | ★★★★★☆ |

| Instabank | 9.9x | 2.9x | 26.11% | ★★★★★☆ |

| A.G. BARR | 19.2x | 1.8x | 47.11% | ★★★★☆☆ |

| Renold | 11.0x | 0.7x | 4.56% | ★★★★☆☆ |

| Seeing Machines | NA | 3.0x | 43.41% | ★★★★☆☆ |

| Europris | 20.0x | 1.0x | 36.63% | ★★★☆☆☆ |

| Italmobiliare | 12.4x | 1.6x | -232.47% | ★★★☆☆☆ |

| Yubico | 34.2x | 4.9x | 7.94% | ★★★☆☆☆ |

| Absolent Air Care Group | 24.5x | 1.9x | 46.68% | ★★★☆☆☆ |

| CVS Group | 45.4x | 1.3x | 38.12% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

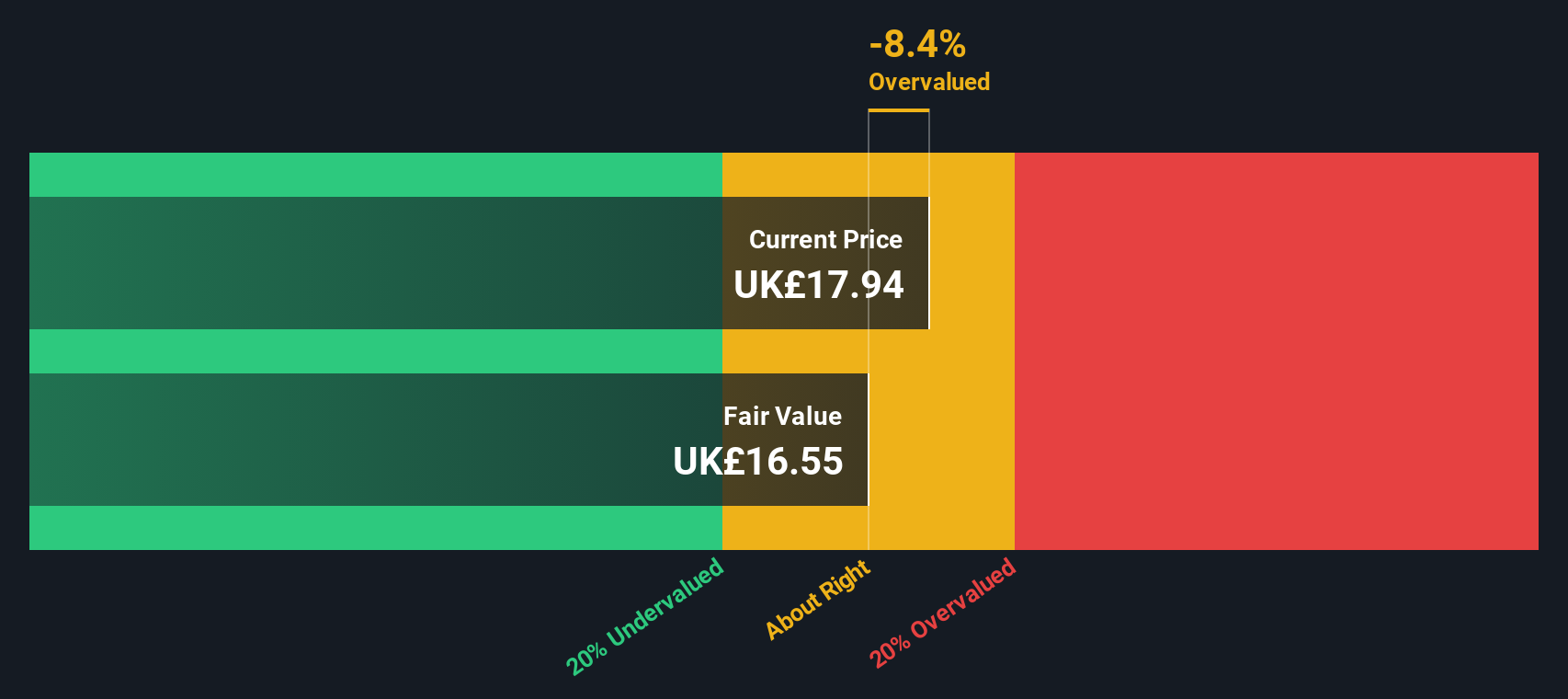

Oxford Instruments (LSE:OXIG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Oxford Instruments is a company specializing in the development and manufacturing of high-technology tools and systems for research and industry, with a market capitalization of approximately £1.30 billion.

Operations: Imaging & Analysis and Advanced Technologies are the primary revenue streams, contributing £330.50 million and £171.10 million respectively. The company's gross profit margin reached 52.40% in September 2023, showing a notable increase from earlier periods such as March 2014 when it was at 45.09%.

PE: 44.5x

Oxford Instruments, a European small-cap company, has demonstrated insider confidence through recent share repurchase announcements worth £50 million. Despite a drop in net income to £26 million from £50.7 million last year and reduced profit margins, the firm maintains growth potential with expected annual earnings growth of 27%. Their strategic divestment of the NanoScience business funds this buyback program. A proposed dividend increase further signals shareholder value focus amidst evolving financial dynamics.

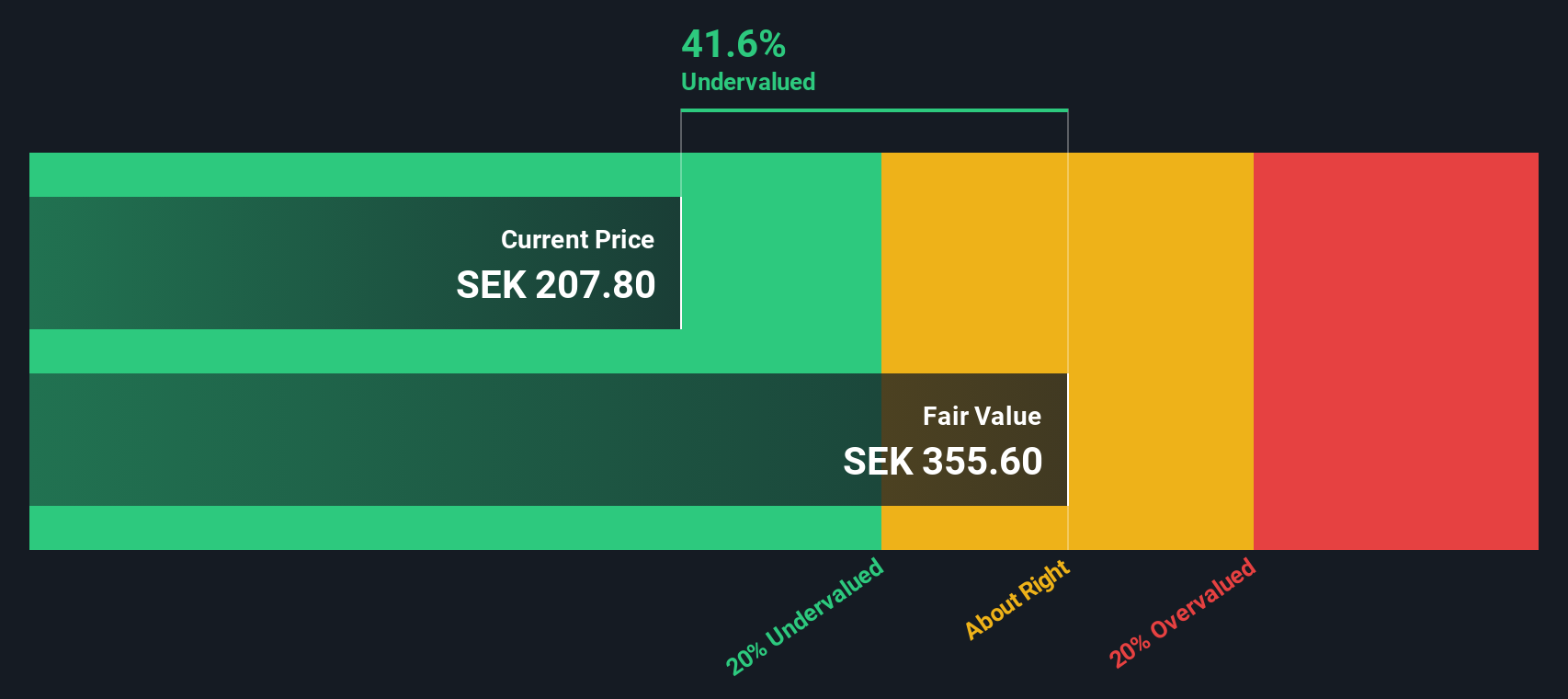

Inwido (OM:INWI)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Inwido is a company specializing in the design, manufacture, and sale of windows and doors across various regions including Scandinavia, Eastern Europe, and Western Europe, with a market capitalization of SEK 9.45 billion.

Operations: The company generates revenue primarily from its operations in Scandinavia, Eastern Europe, Western Europe, and E-Commerce. The gross profit margin has fluctuated over the years, reaching 25.86% for the quarter ending March 31, 2025. Operating expenses include significant allocations to sales and marketing as well as general and administrative functions.

PE: 22.8x

Inwido, a company with external borrowing as its sole funding source, recently experienced insider confidence when Per Bertland purchased 1,000 shares in April 2025 for approximately SEK 210,190. This purchase may signal belief in the company's potential despite its reliance on higher-risk funding. In Q1 2025, sales increased to SEK 1.99 billion from SEK 1.81 billion a year prior, while net income rose to SEK 37.9 million from SEK 21.3 million. Earnings per share also improved significantly during this period.

- Navigate through the intricacies of Inwido with our comprehensive valuation report here.

Examine Inwido's past performance report to understand how it has performed in the past.

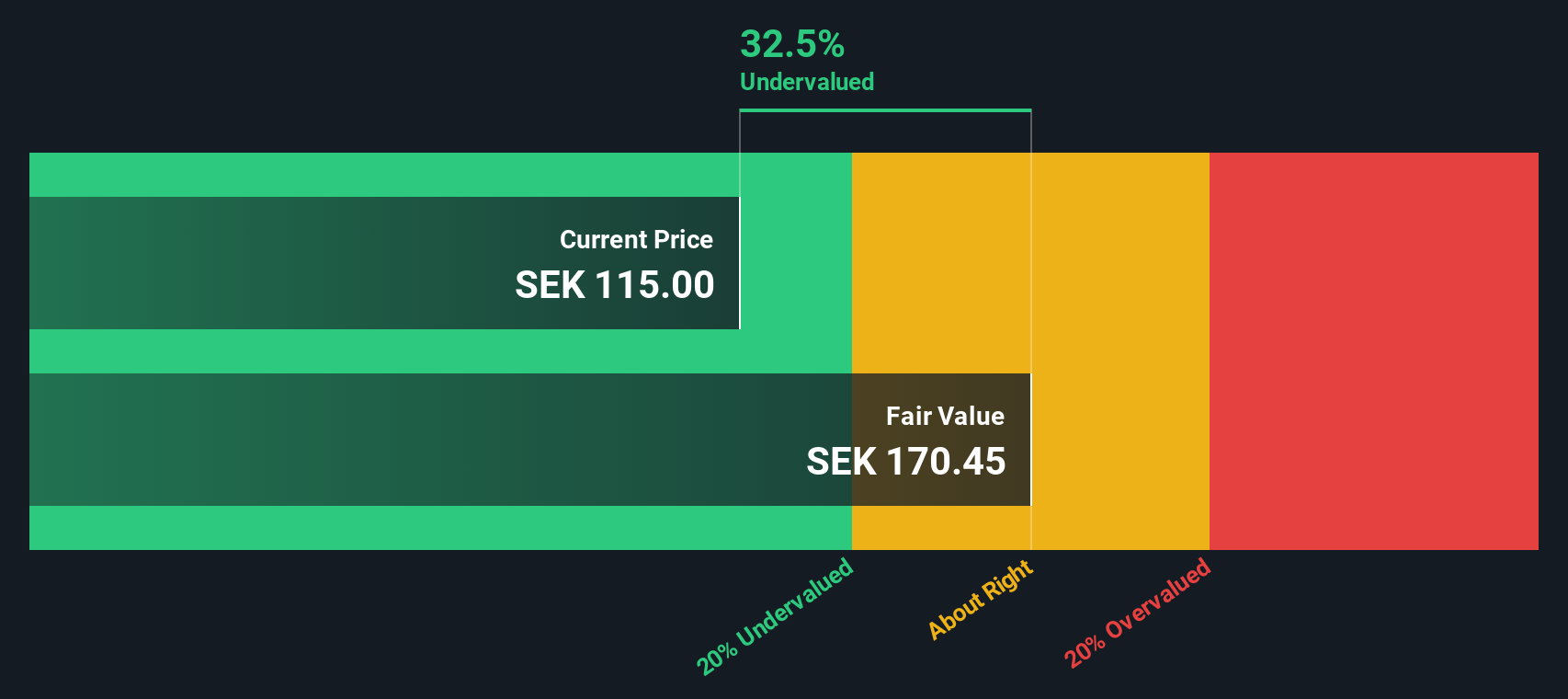

Karnov Group (OM:KAR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Karnov Group is a provider of legal and tax information services, operating primarily in Northern and Southern regions, with a market capitalization of approximately SEK 5.76 billion.

Operations: Karnov Group's revenue is primarily derived from Region North and Region South, with the latter contributing slightly more. The company has experienced fluctuations in its gross profit margin, which was 42.58% as of March 2025. Operating expenses have consistently been a significant part of the cost structure, accompanied by notable non-operating expenses and depreciation & amortization costs over time.

PE: 220.0x

Karnov Group's recent earnings report for Q1 2025 shows promising growth, with sales reaching SEK 672.5 million, up from SEK 631.7 million a year ago, and net income turning positive at SEK 77.4 million from a previous loss. Insider confidence is evident with recent share purchases indicating belief in future prospects. Despite relying on external borrowing for funding, Karnov anticipates a significant earnings growth of over 54% annually, suggesting potential value in this niche market player.

- Take a closer look at Karnov Group's potential here in our valuation report.

Review our historical performance report to gain insights into Karnov Group's's past performance.

Summing It All Up

- Discover the full array of 64 Undervalued European Small Caps With Insider Buying right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:OXIG

Oxford Instruments

Oxford Instruments plc provide scientific technology products and services for academic and commercial organizations worldwide.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives