- Netherlands

- /

- Entertainment

- /

- ENXTAM:BNJ

High Growth Tech And 2 Other Stocks With Promising Potential

Reviewed by Simply Wall St

As global markets close out a strong year with mixed performances, the S&P 500 and Nasdaq Composite have both achieved significant annual gains, despite recent economic indicators like the Chicago PMI signaling contraction in manufacturing. In this environment, identifying promising stocks often involves looking for companies with robust growth potential and resilience to broader market fluctuations, particularly in high-growth tech sectors that continue to capture investor interest.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1266 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Banijay Group (ENXTAM:BNJ)

Simply Wall St Growth Rating: ★★★★☆☆

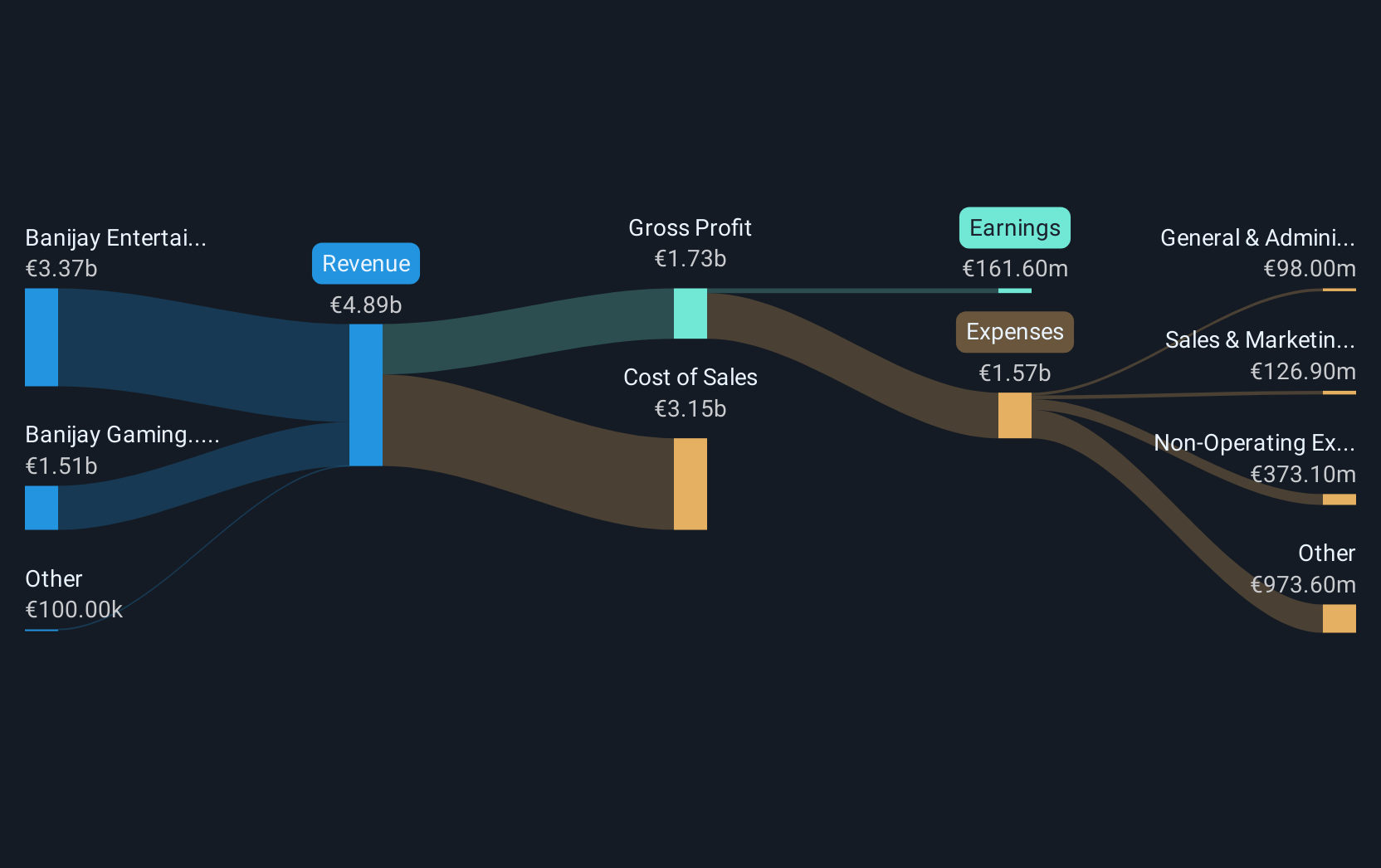

Overview: Banijay Group N.V. operates in content production, distribution, online sports betting, and gaming across the USA, Europe, and globally with a market cap of €3.60 billion.

Operations: Banijay Group N.V. generates revenue primarily from its Banijay Entertainment & Banijay Live segment, contributing €3.26 billion, and its Banijay Gaming segment, which brings in €1.32 billion. The company's operations span content production and distribution as well as online sports betting and gaming across various regions including the USA and Europe.

Banijay Group N.V. has demonstrated a remarkable earnings growth of 931.6% over the past year, significantly outpacing its industry average of 7.1%. Despite this surge, its revenue growth projection stands at 8.4% per annum, aligning with the broader Dutch market but not exceeding it. The company's R&D commitment is evident from its strategic focus on content production and distribution, which is poised to drive organic revenue with major scripted shows slated for release in late 2024. However, financial challenges persist as interest payments are poorly covered by earnings and shareholders have experienced dilution over the last year. This mixed financial landscape suggests that while Banijay is navigating through rapid changes with substantial earnings growth and promising projects, it must also address underlying financial health issues to sustain its trajectory in the high-growth tech sector.

- Delve into the full analysis health report here for a deeper understanding of Banijay Group.

Understand Banijay Group's track record by examining our Past report.

Solum (KOSE:A248070)

Simply Wall St Growth Rating: ★★★★★☆

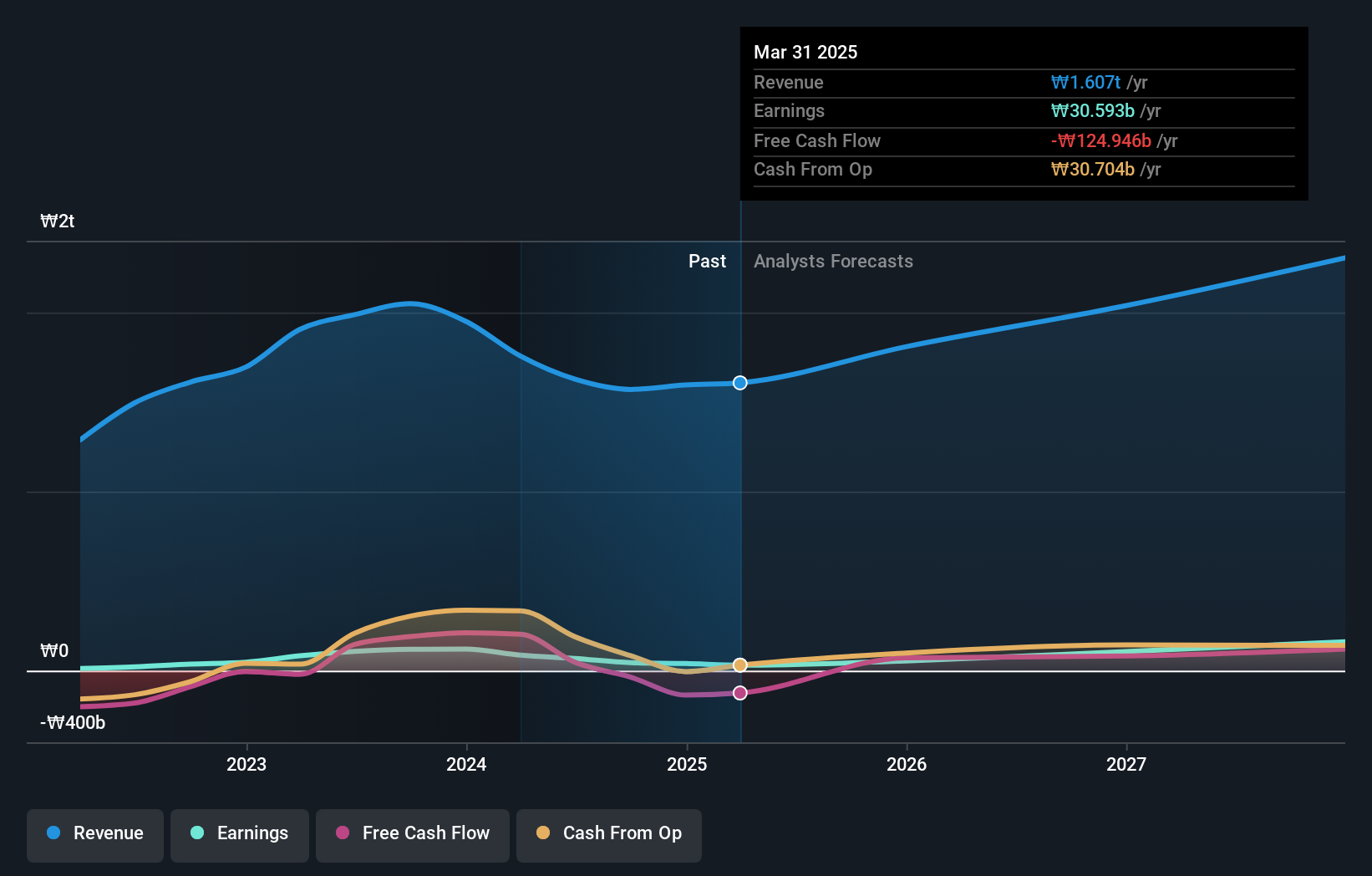

Overview: Solum Co., Ltd. is engaged in the manufacturing and marketing of power modules, digital tuners, and electronic shelf labels for both domestic and international markets, with a market capitalization of approximately ₩953.10 billion.

Operations: The company generates revenue primarily from its ICT Business and Electronic Components Division, with the latter contributing significantly more at ₩1.14 trillion compared to ₩432.21 billion from the ICT segment.

Solum has carved a niche in the tech sector with its robust annual revenue growth of 16%, outpacing the Korean market's average of 9.1%. This growth is underpinned by an aggressive R&D strategy, allocating significant resources to innovation—evident from its R&D expenses which are crucial for maintaining technological leadership. Despite challenges like a high debt level and a recent earnings dip of -62.8% over the past year, Solum's strategic share repurchases, including 166,128 shares for KRW 3.36 billion, signal confidence in its future prospects. Moreover, with earnings expected to surge by 50% annually, surpassing Korea's market projection of 29%, Solum is positioning itself as a resilient contender amidst volatile tech landscapes.

- Dive into the specifics of Solum here with our thorough health report.

Evaluate Solum's historical performance by accessing our past performance report.

Acast (OM:ACAST)

Simply Wall St Growth Rating: ★★★★☆☆

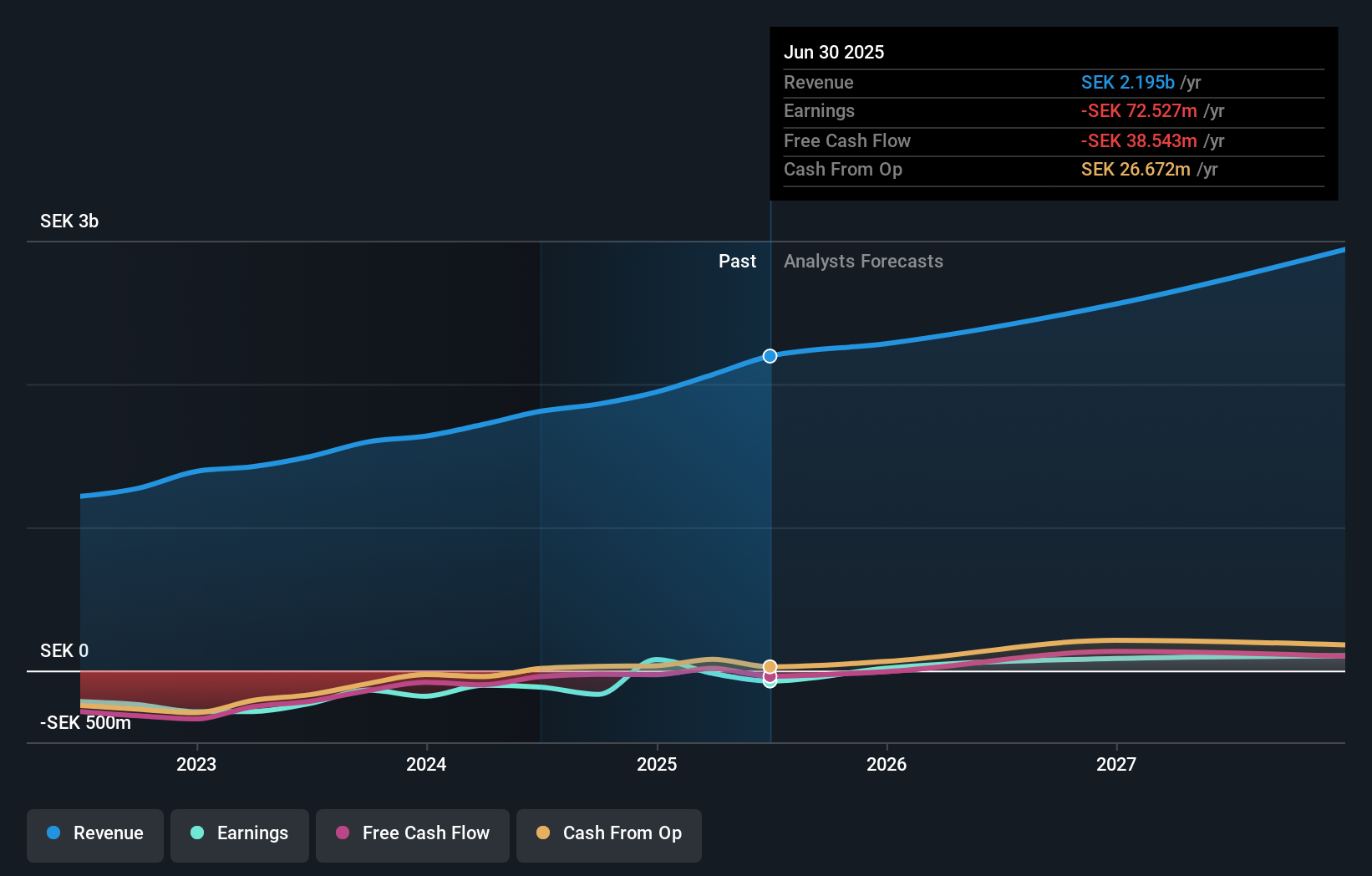

Overview: Acast AB (publ) is a podcasting company with operations in Europe, North America, and internationally, and it has a market cap of SEK3.02 billion.

Operations: Acast generates revenue primarily from advertising and podcast hosting services across its international operations. The company's financials highlight a focus on expanding its reach in the podcasting industry, leveraging diverse markets to drive growth.

Amidst a challenging landscape, Acast is navigating its path towards profitability with an expected profit growth of 120.9% per year. Despite being unprofitable currently, the company's revenue is projected to rise by 15.2% annually, outpacing the Swedish market's growth rate of 1.2%. Strategic partnerships, like those with Casefile True Crime and TED Audio Collective, are enhancing Acast’s global footprint and listener base significantly — a move that could bolster future revenues and market position in the competitive podcasting industry.

- Take a closer look at Acast's potential here in our health report.

Review our historical performance report to gain insights into Acast's's past performance.

Key Takeaways

- Delve into our full catalog of 1266 High Growth Tech and AI Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Banijay Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Banijay Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:BNJ

Banijay Group

Engages in the content production, distribution, online sports betting, and gaming businesses in the United States of America, Europe, and internationally.

Undervalued with high growth potential.

Market Insights

Community Narratives