I-Tech AB Just Beat EPS By 46%: Here's What Analysts Think Will Happen Next

I-Tech AB (STO:ITECH) just released its quarterly report and things are looking bullish. Statutory revenue of kr38m and earnings of kr0.70 both blasted past expectations, beating expectations by 21% and 46%, respectively, ahead of expectations. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

Check out our latest analysis for I-Tech

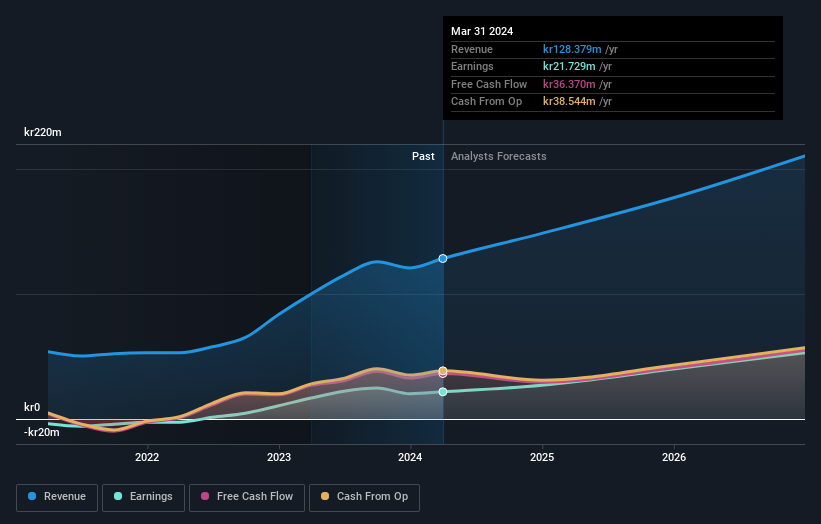

Taking into account the latest results, the current consensus from I-Tech's two analysts is for revenues of kr148.5m in 2024. This would reflect a decent 16% increase on its revenue over the past 12 months. In the lead-up to this report, the analysts had been modelling revenues of kr140.5m and earnings per share (EPS) of kr2.26 in 2024. The thing that stands out most is that, while there's been a slight bump in revenue estimates, the consensus no longer provides an EPS estimate. This impliesthat revenue is more important following the latest results.

The average price target fell 28% to kr65.00, withthe analysts clearly having become less optimistic about I-Tech'sprospects following its latest earnings.

Of course, another way to look at these forecasts is to place them into context against the industry itself. The period to the end of 2024 brings more of the same, according to the analysts, with revenue forecast to display 21% growth on an annualised basis. That is in line with its 26% annual growth over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 8.3% per year. So although I-Tech is expected to maintain its revenue growth rate, it's definitely expected to grow faster than the wider industry.

The Bottom Line

The highlight for us was that the analysts increased their revenue forecasts for I-Tech next year. Pleasantly, they also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow faster than the wider industry. The consensus price target fell measurably, with the analysts seemingly not reassured by the latest results, leading to a lower estimate of I-Tech's future valuation.

At least one of I-Tech's two analysts has provided estimates out to 2026, which can be seen for free on our platform here.

We don't want to rain on the parade too much, but we did also find 2 warning signs for I-Tech that you need to be mindful of.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ITECH

I-Tech

A biotechnology company, develops, markets, and sells antifouling coating products in Sweden.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)