Here's Why HEXPOL (STO:HPOL B) Can Manage Its Debt Responsibly

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that HEXPOL AB (publ) (STO:HPOL B) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for HEXPOL

What Is HEXPOL's Debt?

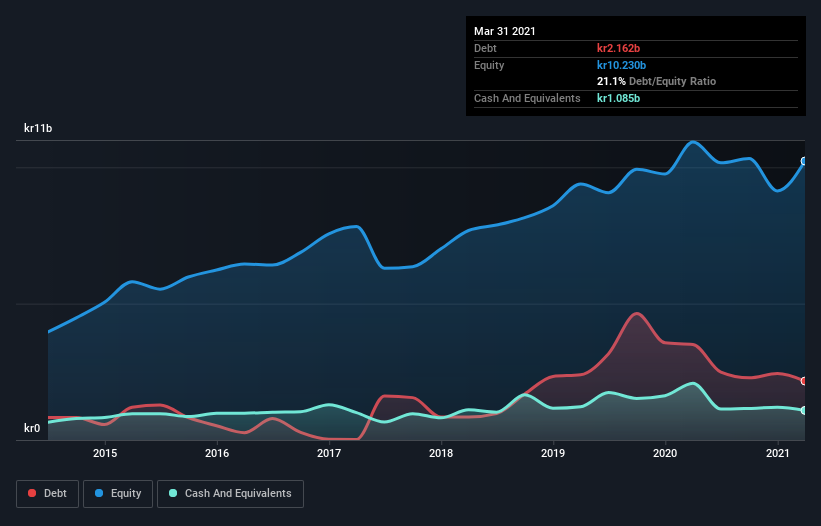

The image below, which you can click on for greater detail, shows that HEXPOL had debt of kr2.16b at the end of March 2021, a reduction from kr3.50b over a year. However, it does have kr1.09b in cash offsetting this, leading to net debt of about kr1.08b.

How Strong Is HEXPOL's Balance Sheet?

We can see from the most recent balance sheet that HEXPOL had liabilities of kr3.52b falling due within a year, and liabilities of kr2.78b due beyond that. On the other hand, it had cash of kr1.09b and kr2.59b worth of receivables due within a year. So it has liabilities totalling kr2.62b more than its cash and near-term receivables, combined.

Given HEXPOL has a market capitalization of kr35.8b, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

HEXPOL's net debt is only 0.45 times its EBITDA. And its EBIT easily covers its interest expense, being 39.1 times the size. So we're pretty relaxed about its super-conservative use of debt. On the other hand, HEXPOL saw its EBIT drop by 3.2% in the last twelve months. That sort of decline, if sustained, will obviously make debt harder to handle. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if HEXPOL can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, HEXPOL recorded free cash flow worth a fulsome 92% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Our View

Happily, HEXPOL's impressive interest cover implies it has the upper hand on its debt. But, on a more sombre note, we are a little concerned by its EBIT growth rate. Zooming out, HEXPOL seems to use debt quite reasonably; and that gets the nod from us. While debt does bring risk, when used wisely it can also bring a higher return on equity. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that HEXPOL insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade HEXPOL, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if HEXPOL might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:HPOL B

HEXPOL

Develops, manufactures, and sells various polymer compounds and engineered gaskets, seals, and wheels in Sweden, rest of Europe, the United States, rest of the Americas, and Asia.

6 star dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026