David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies New Nordic Healthbrands AB (publ) (STO:NNH) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for New Nordic Healthbrands

What Is New Nordic Healthbrands's Net Debt?

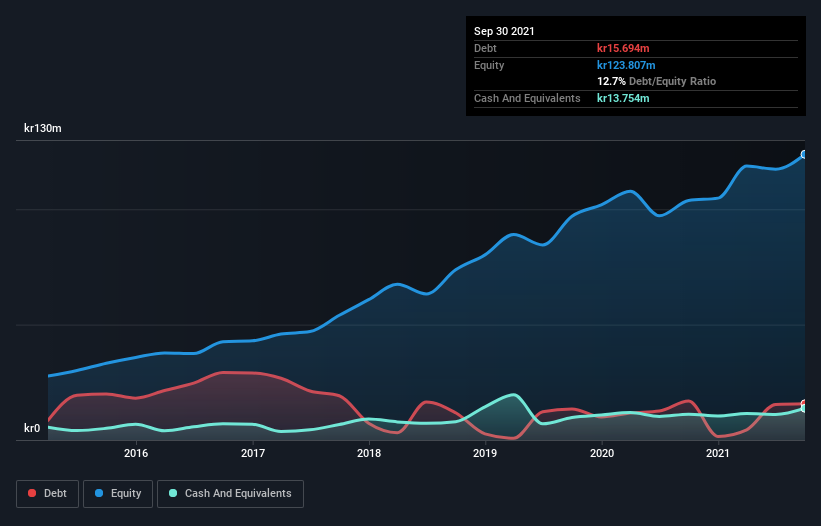

As you can see below, New Nordic Healthbrands had kr15.7m of debt at September 2021, down from kr16.9m a year prior. However, it also had kr13.8m in cash, and so its net debt is kr1.94m.

How Strong Is New Nordic Healthbrands' Balance Sheet?

According to the last reported balance sheet, New Nordic Healthbrands had liabilities of kr117.1m due within 12 months, and liabilities of kr3.42m due beyond 12 months. Offsetting this, it had kr13.8m in cash and kr117.8m in receivables that were due within 12 months. So it can boast kr11.0m more liquid assets than total liabilities.

This short term liquidity is a sign that New Nordic Healthbrands could probably pay off its debt with ease, as its balance sheet is far from stretched. Carrying virtually no net debt, New Nordic Healthbrands has a very light debt load indeed.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

New Nordic Healthbrands has very little debt (net of cash), and boasts a debt to EBITDA ratio of 0.051 and EBIT of 106 times the interest expense. So relative to past earnings, the debt load seems trivial. In addition to that, we're happy to report that New Nordic Healthbrands has boosted its EBIT by 41%, thus reducing the spectre of future debt repayments. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since New Nordic Healthbrands will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, New Nordic Healthbrands's free cash flow amounted to 32% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

New Nordic Healthbrands's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But truth be told we feel its conversion of EBIT to free cash flow does undermine this impression a bit. Looking at the bigger picture, we think New Nordic Healthbrands's use of debt seems quite reasonable and we're not concerned about it. After all, sensible leverage can boost returns on equity. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should be aware of the 4 warning signs we've spotted with New Nordic Healthbrands .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you're looking to trade New Nordic Healthbrands, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if New Nordic Healthbrands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:NNH

New Nordic Healthbrands

Develops and markets dietary supplements, herbal remedies, and personal care products in the Nordic countries, rest of Europe, North America, and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives