- Sweden

- /

- Medical Equipment

- /

- OM:XVIVO

Xvivo Perfusion (OM:XVIVO) Reports Strong Q3 Earnings with Strategic Alliances Boosting Growth

Reviewed by Simply Wall St

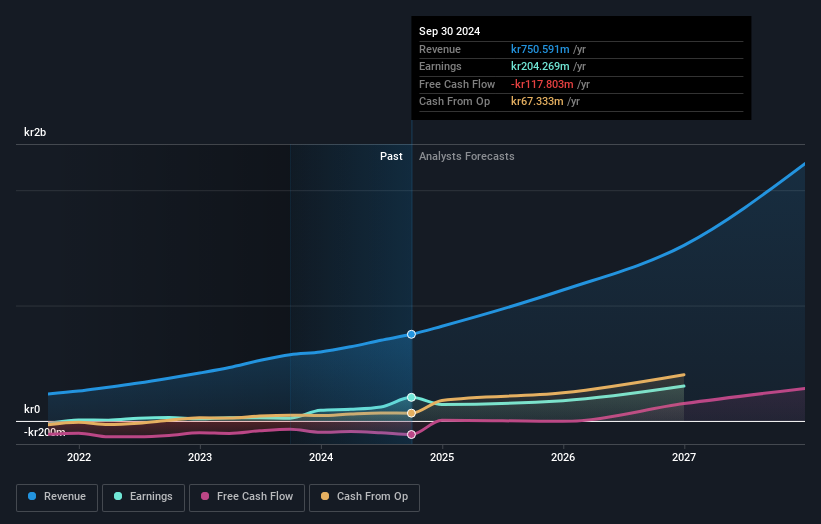

Xvivo Perfusion (OM:XVIVO) has announced impressive third-quarter results, with sales soaring to SEK 198.48 million and net income reaching SEK 85.82 million, reflecting a significant year-on-year growth. The company's financial health, underscored by a debt-free status and high net profit margins, positions it well to capitalize on market demand despite operational challenges such as supply chain delays and high costs. As readers explore the report, they should anticipate insights into Xvivo's strategic initiatives, including partnerships and product innovations, which are crucial for navigating regulatory hurdles and sustaining growth in a competitive market.

Dive into the specifics of Xvivo Perfusion here with our thorough analysis report.

Key Assets Propelling Xvivo Perfusion Forward

With a revenue growth forecast of 30.1% per year, Xvivo Perfusion is capitalizing on strong market demand. The company's significant past earnings growth of 748.3% over the past year underscores its ability to leverage innovative products effectively. Strategic partnerships, such as the collaboration with a leading healthcare provider, are enhancing its distribution channels and expanding its market reach. Additionally, the company's debt-free status and high net profit margins of 27.2% reflect strong financial health. Experienced leadership is driving these initiatives, ensuring strategic goals are met, as evidenced by the impressive third-quarter results showing sales of SEK 198.48 million and net income of SEK 85.82 million. However, XVIVO is considered expensive based on its high Price-To-Earnings Ratio (69.1x) compared to peers and industry averages, despite trading below the estimated fair value.

To dive deeper into how Xvivo Perfusion's valuation metrics are shaping its market position, check out our detailed analysis of Xvivo Perfusion's Valuation.Critical Issues Affecting the Performance of Xvivo Perfusion and Areas for Growth

Operational inefficiencies, such as supply chain delays, pose risks to meeting demand fully. The company faces a high cost structure, with a 15% rise in the cost of goods sold, impacting profitability. Slower-than-expected growth in Europe highlights challenges in market penetration. The earnings growth forecast of 13.4% per year lags behind the Swedish market average, and a low Return on Equity of 9.8% indicates room for improvement. Addressing these issues is crucial for maintaining competitive positioning.

To gain deeper insights into Xvivo Perfusion's historical performance, explore our detailed analysis of past performance.Areas for Expansion and Innovation for Xvivo Perfusion

Analysts predict a target price over 20% higher than the current share price, suggesting potential for stock appreciation. Trading at 45% below estimated fair value presents an opportunity for investors. Product innovation, with recent launches, strengthens market position and attracts new customers. Strategic alliances are pivotal in enhancing brand visibility and driving sales in new markets, offering a platform for growth and innovation.

See what the latest analyst reports say about Xvivo Perfusion's future prospects and potential market movements.Regulatory Challenges Facing Xvivo Perfusion

Economic headwinds and intense market competition present significant threats. The company is vigilant about potential downturns affecting sales projections. Regulatory hurdles, particularly in Europe, require strategic navigation to avoid growth impediments. The competitive environment demands differentiation to maintain margins and market share. These external factors necessitate proactive management to sustain growth.

Explore the current health of Xvivo Perfusion and how it reflects on its financial stability and growth potential.Conclusion

Xvivo Perfusion is positioned for substantial growth, with a projected revenue increase of 30.1% annually, driven by strong market demand and innovative product offerings. However, the company's high Price-To-Earnings Ratio of 69.1x, compared to industry peers, suggests that investors may be paying a premium for its future growth potential, despite shares trading below estimated fair value. Addressing operational inefficiencies and cost challenges is crucial for sustaining competitive advantage and improving profitability. Strategic partnerships and product innovations are expected to enhance market reach and drive future sales, while proactive management of regulatory challenges and economic threats will be essential for maintaining momentum and achieving long-term success.

Summing It All Up

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

If you're looking to trade Xvivo Perfusion, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About OM:XVIVO

Xvivo Perfusion

A medical technology company, develops and markets machines and perfusion solutions for assessing usable organs and maintains in optimal condition pending transplantation in Sweden.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives