- Sweden

- /

- Medical Equipment

- /

- OM:VIMIAN

European Value Stock Insights For October 2025

Reviewed by Simply Wall St

As European markets continue to rally, with the STOXX Europe 600 Index reaching record levels and major indices like Germany's DAX and France's CAC 40 posting solid gains, investors are keenly observing the impact of anticipated lower U.S. borrowing costs on market sentiment. In this environment of heightened optimism, identifying undervalued stocks becomes crucial for investors seeking potential opportunities amidst broader economic shifts and inflationary pressures in the eurozone.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Spindox (BIT:SPN) | €12.75 | €24.73 | 48.4% |

| SBO (WBAG:SBO) | €27.10 | €53.20 | 49.1% |

| Robit Oyj (HLSE:ROBIT) | €1.15 | €2.20 | 47.8% |

| Profoto Holding (OM:PRFO) | SEK17.80 | SEK35.08 | 49.3% |

| Lingotes Especiales (BME:LGT) | €5.75 | €11.22 | 48.7% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.375 | €0.72 | 47.8% |

| Echo Investment (WSE:ECH) | PLN5.58 | PLN10.71 | 47.9% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.39 | €6.63 | 48.9% |

| Atea (OB:ATEA) | NOK146.00 | NOK282.33 | 48.3% |

| Allegro.eu (WSE:ALE) | PLN33.495 | PLN66.20 | 49.4% |

Here's a peek at a few of the choices from the screener.

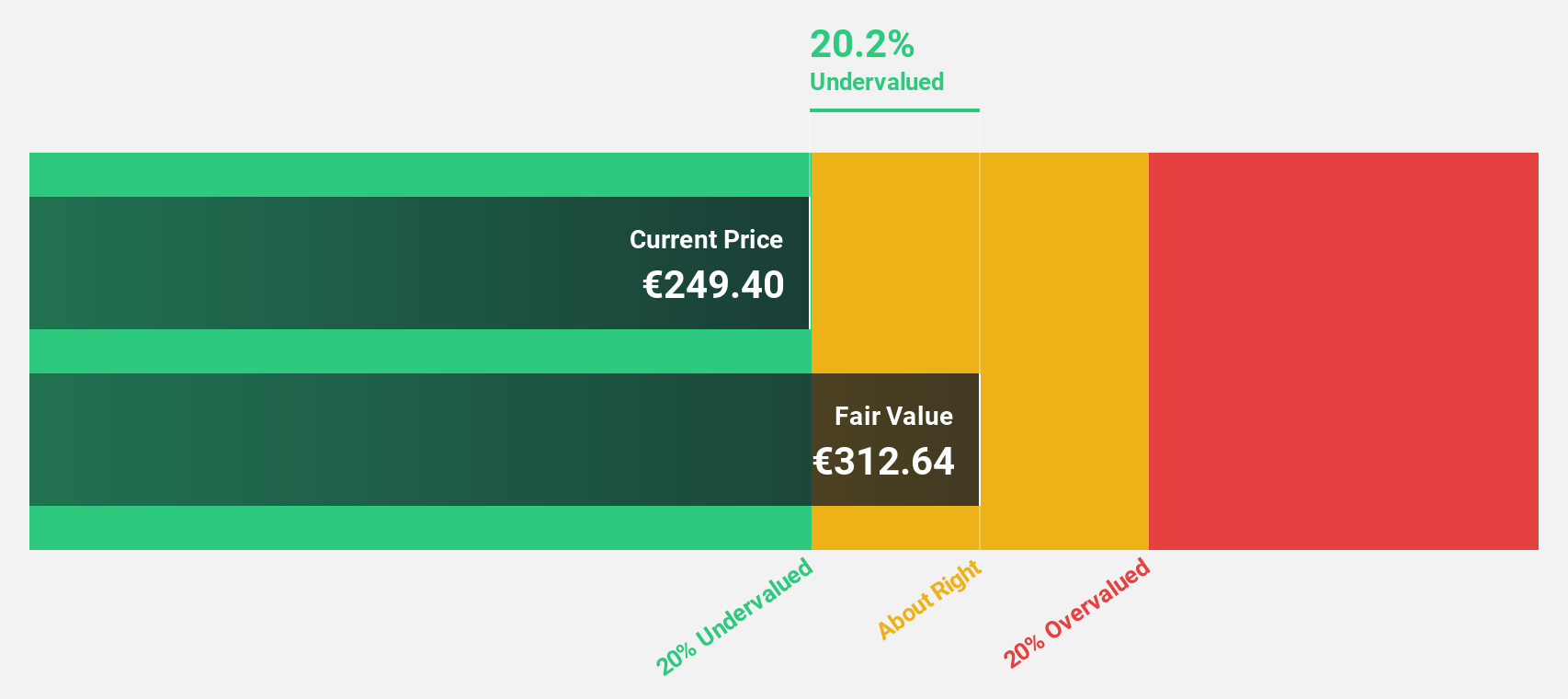

Thales (ENXTPA:HO)

Overview: Thales S.A. operates globally, offering solutions in defence and security, aerospace and space, as well as digital identity and security markets, with a market cap of €54.38 billion.

Operations: The company's revenue is primarily derived from its Defence segment at €11.96 billion, followed by Aerospace at €5.81 billion, and Cyber & Digital services contributing €4.08 billion.

Estimated Discount To Fair Value: 26.3%

Thales is trading at €264.80, below its estimated fair value of €359.18, suggesting potential undervaluation based on cash flows. Earnings are forecast to grow 16.8% annually, outpacing the French market's 12.2%. Recent developments include a €450 million EIB loan for R&D in aeronautics and radar technologies and an interim dividend of €0.95 per share for 2025, reflecting ongoing strategic investments and shareholder returns amidst steady revenue growth projections of 7.6% annually.

- According our earnings growth report, there's an indication that Thales might be ready to expand.

- Dive into the specifics of Thales here with our thorough financial health report.

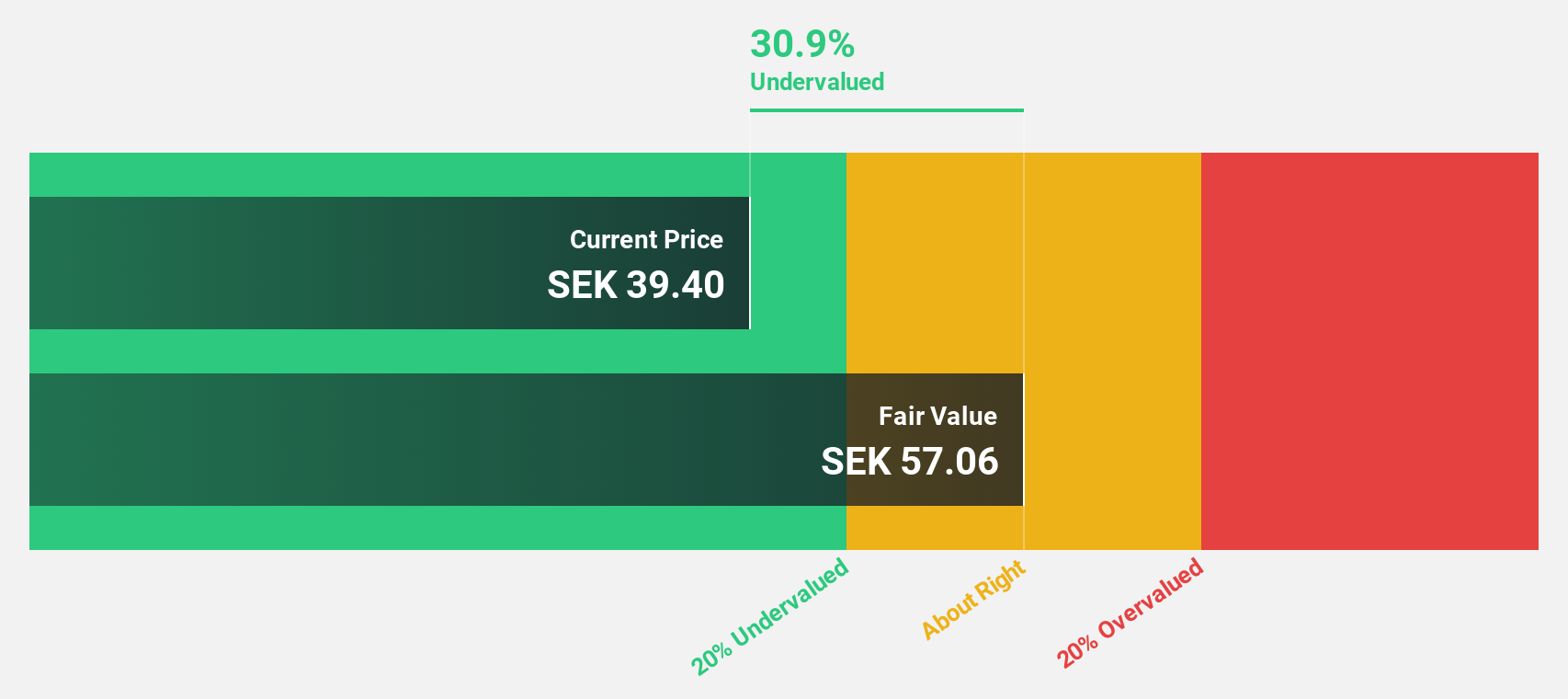

Vimian Group (OM:VIMIAN)

Overview: Vimian Group AB (publ) operates in the animal health industry globally and has a market cap of SEK15.10 billion.

Operations: The company's revenue is derived from four main segments: Medtech (€142.10 million), Diagnostics (€22.50 million), Specialty Pharma (€178.20 million), and Veterinary Services (€61.60 million).

Estimated Discount To Fair Value: 30.1%

Vimian Group, trading at SEK28.66, is valued below its estimated fair value of SEK41.01, reflecting potential undervaluation based on cash flows. Earnings are expected to grow significantly at 42.55% annually, surpassing the Swedish market's growth rate. Recent earnings report shows a rise in sales to EUR 104.3 million for Q2 2025 from EUR 91 million a year earlier, with net income increasing to EUR 8.3 million from EUR 4.9 million despite leadership changes impacting stability.

- Our comprehensive growth report raises the possibility that Vimian Group is poised for substantial financial growth.

- Click here to discover the nuances of Vimian Group with our detailed financial health report.

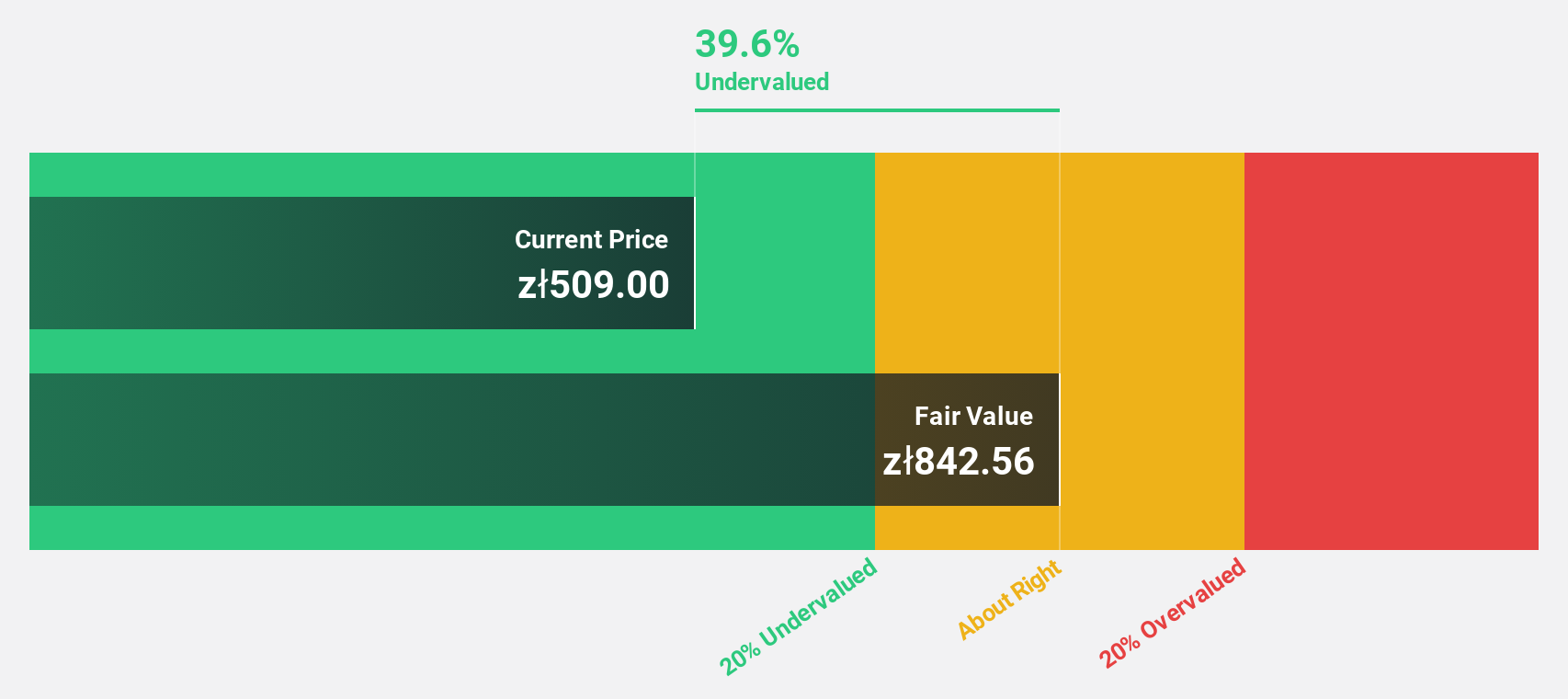

Dino Polska (WSE:DNP)

Overview: Dino Polska S.A. operates a network of mid-sized grocery supermarkets under the Dino brand in Poland, with a market cap of PLN42.84 billion.

Operations: The company's revenue primarily comes from sales in its retail network and online platform, totaling PLN31.09 billion.

Estimated Discount To Fair Value: 38%

Dino Polska, trading at PLN43.7, is significantly undervalued with an estimated fair value of PLN70.54, offering potential based on cash flows. Its earnings are projected to grow 20.2% annually, outpacing the Polish market's 15.7%. Recent Q2 results show sales increased to PLN8.62 billion from PLN7.24 billion year-on-year, and net income rose to PLN397.52 million from PLN347.87 million, reflecting strong financial health despite slower revenue growth compared to top-performing peers.

- In light of our recent growth report, it seems possible that Dino Polska's financial performance will exceed current levels.

- Take a closer look at Dino Polska's balance sheet health here in our report.

Taking Advantage

- Reveal the 208 hidden gems among our Undervalued European Stocks Based On Cash Flows screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VIMIAN

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion