- Sweden

- /

- Healthtech

- /

- OM:SECT B

Why We Think The CEO Of Sectra AB (publ) (STO:SECT B) May Soon See A Pay Rise

Shareholders will be pleased by the impressive results for Sectra AB (publ) (STO:SECT B) recently and CEO Torbjörn Kronander has played a key role. At the upcoming AGM on 14 September 2021, they will get a chance to hear the board review the company results, discuss future strategy and cast their vote on any resolutions such as executive remuneration. Here we will show why we think CEO compensation is appropriate and discuss the case for a pay rise.

Check out our latest analysis for Sectra

Comparing Sectra AB (publ)'s CEO Compensation With the industry

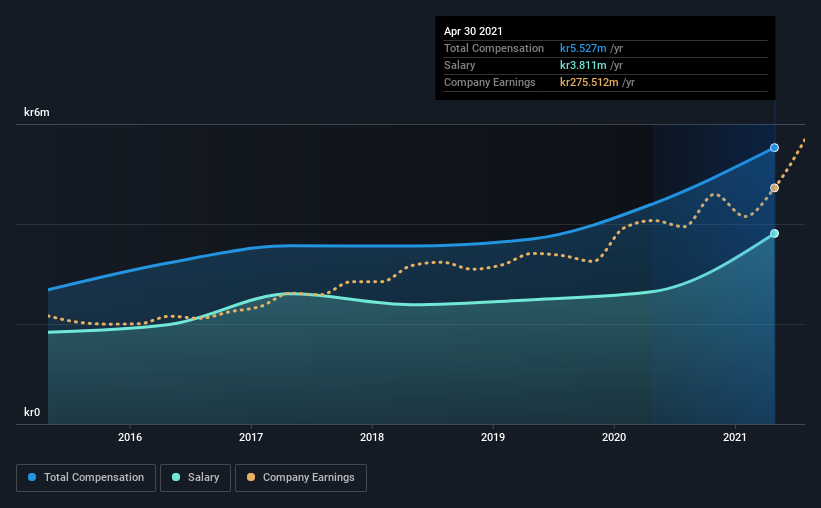

According to our data, Sectra AB (publ) has a market capitalization of kr37b, and paid its CEO total annual compensation worth kr5.5m over the year to April 2021. That's a notable increase of 25% on last year. We note that the salary portion, which stands at kr3.81m constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the same industry with market capitalizations ranging between kr17b and kr55b had a median total CEO compensation of kr33m. In other words, Sectra pays its CEO lower than the industry median. Furthermore, Torbjörn Kronander directly owns kr3.0b worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | kr3.8m | kr2.7m | 69% |

| Other | kr1.7m | kr1.8m | 31% |

| Total Compensation | kr5.5m | kr4.4m | 100% |

On an industry level, roughly 72% of total compensation represents salary and 28% is other remuneration. Sectra is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Sectra AB (publ)'s Growth

Sectra AB (publ) has seen its earnings per share (EPS) increase by 20% a year over the past three years. It achieved revenue growth of 6.9% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Sectra AB (publ) Been A Good Investment?

Boasting a total shareholder return of 287% over three years, Sectra AB (publ) has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Given the company's decent performance, the CEO remuneration policy might not be shareholders' central point of focus in the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 2 warning signs for Sectra (of which 1 doesn't sit too well with us!) that you should know about in order to have a holistic understanding of the stock.

Important note: Sectra is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade Sectra, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:SECT B

Sectra

Provides solutions for medical IT and cybersecurity sectors in Sweden, the United Kingdom, the Netherlands, and rest of Europe.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives