- Japan

- /

- Healthtech

- /

- TSE:4480

Top Growth Companies With Insider Ownership In January 2025

Reviewed by Simply Wall St

As global markets continue to reach new highs, buoyed by optimism over potential trade deals and advancements in artificial intelligence infrastructure, growth stocks have notably outperformed their value counterparts. In this environment of heightened investor confidence, companies with high insider ownership often attract attention due to the perceived alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 25.7% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.6% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| HANA Micron (KOSDAQ:A067310) | 18.2% | 119.4% |

Here's a peek at a few of the choices from the screener.

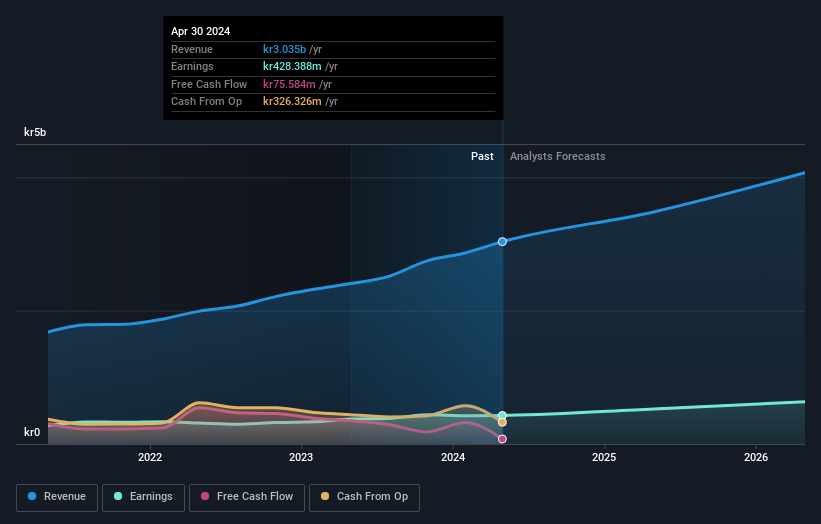

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sectra AB (publ) offers solutions in medical IT and cybersecurity across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market cap of SEK48.30 billion.

Operations: The company's revenue is primarily derived from its Imaging IT Solutions segment, which generated SEK2.61 billion, followed by Secure Communications at SEK425.85 million and Business Innovation at SEK85.07 million.

Insider Ownership: 30.3%

Sectra's earnings are forecast to grow significantly at 27.9% annually, outpacing the Swedish market. Despite recent declines in quarterly revenue and net income, Sectra has secured strategic contracts with major healthcare providers like Helse Nord RHF and UZ Leuven for its enterprise imaging solutions. These agreements highlight Sectra's innovative digital pathology offerings that enhance diagnostic efficiency and patient care, supporting its growth trajectory amidst high insider ownership stability.

- Get an in-depth perspective on Sectra's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Sectra's share price might be on the expensive side.

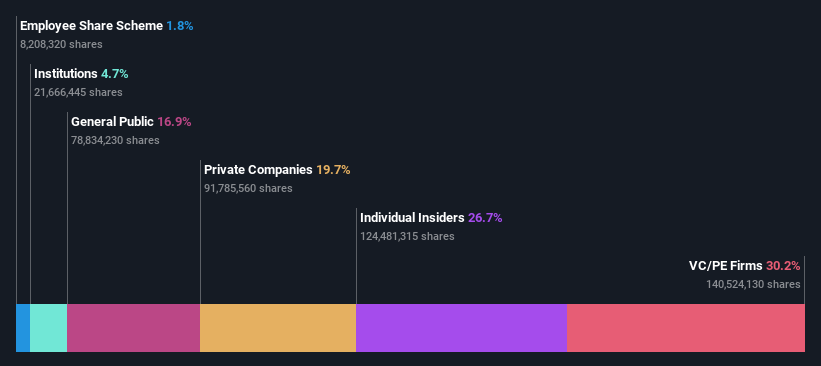

Xiamen Yan Palace Bird's Nest Industry (SEHK:1497)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xiamen Yan Palace Bird's Nest Industry Co., Ltd. operates in the research, development, production, and marketing of edible bird’s nest products in China, with a market cap of HK$3.96 billion.

Operations: The company's revenue segments include CN¥21.07 million from sales to online distributors, CN¥508.94 million from sales to offline distributors, CN¥907.52 million from direct sales to online customers, CN¥344.32 million from direct sales to offline customers, and CN¥290.51 million from direct sales to e-commerce platforms.

Insider Ownership: 26.7%

Xiamen Yan Palace Bird's Nest Industry is poised for growth with earnings projected to increase by 15.9% annually, outpacing the Hong Kong market's average. Revenue is also expected to grow at 13.1%, surpassing the market rate of 7.7%. Despite no recent insider trading activity, the company's high non-cash earnings quality and forecasted return on equity of 24.2% in three years underscore its potential amidst stable insider ownership levels.

- Delve into the full analysis future growth report here for a deeper understanding of Xiamen Yan Palace Bird's Nest Industry.

- Our comprehensive valuation report raises the possibility that Xiamen Yan Palace Bird's Nest Industry is priced higher than what may be justified by its financials.

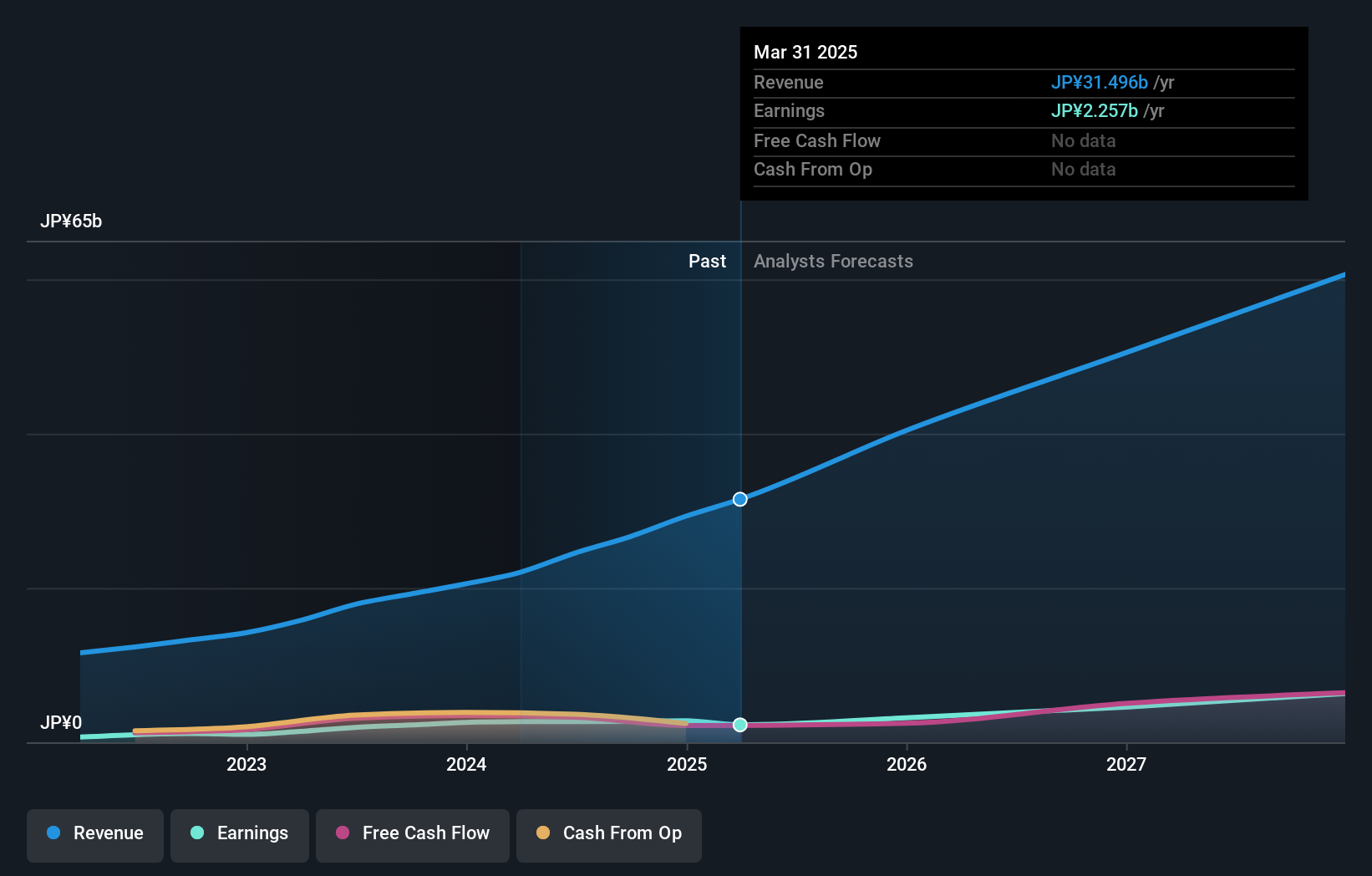

Medley (TSE:4480)

Simply Wall St Growth Rating: ★★★★★★

Overview: Medley, Inc. operates platforms focused on recruitment and medical businesses in Japan and the United States, with a market cap of ¥132.86 billion.

Operations: The company's revenue segments include the Medical Platform Business, generating ¥6.52 billion, and the Human Resource Platform Business, contributing ¥19.45 billion, alongside New Services at ¥713 million.

Insider Ownership: 34.1%

Medley is positioned for significant growth with earnings forecasted to rise by 27.3% annually, far exceeding the JP market average. Revenue is expected to grow at 20.9%, also surpassing market rates, despite recent share price volatility and large one-off items impacting results. Insider ownership remains stable, with no substantial insider trading activity in the past three months. Recent strategic moves include acquiring AxisRoot Holdings and forming an alliance with Alfresa Corporation through a private placement.

- Navigate through the intricacies of Medley with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Medley shares in the market.

Make It Happen

- Investigate our full lineup of 1482 Fast Growing Companies With High Insider Ownership right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Medley, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4480

Medley

Operates platforms for recruitment and medical businesses in Japan and the United States.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives