- Sweden

- /

- Healthtech

- /

- OM:RAY B

Exploring Bouvet And 2 Other European Small Caps With Strong Fundamentals

Reviewed by Simply Wall St

As the European market navigates mixed signals from major indices, with Germany's DAX showing modest gains and the UK experiencing economic contraction, investors are closely watching for opportunities amid potential interest rate adjustments by the ECB. In this climate of uncertainty, small-cap stocks with robust fundamentals can offer a compelling proposition for those seeking to uncover hidden value in Europe's diverse markets.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 5.37% | 4.80% | 13.56% | ★★★★★★ |

| Dekpol | 61.42% | 9.03% | 14.54% | ★★★★★★ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Dn Agrar Group | NA | 29.02% | 36.03% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Bouvet (OB:BOUV)

Simply Wall St Value Rating: ★★★★★★

Overview: Bouvet ASA is a consultancy firm offering IT and digital communication services to both public and private sectors across Norway, Sweden, and internationally, with a market capitalization of NOK6.50 billion.

Operations: Bouvet derives its revenue primarily from IT consulting services, amounting to NOK3.94 billion. The company's net profit margin is 7.5%.

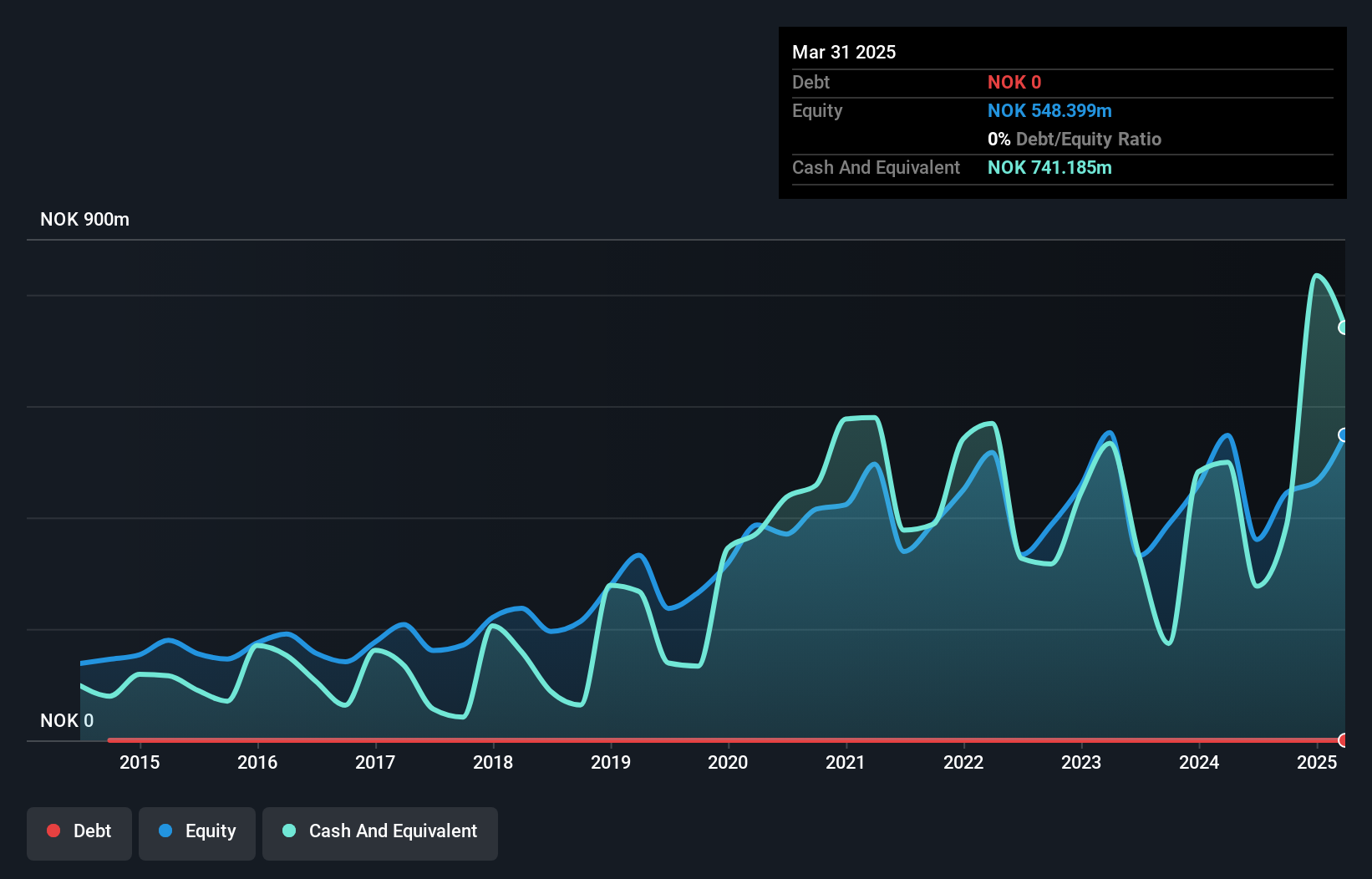

Bouvet, a nimble player in the IT sector, showcases resilience with earnings growth of 1.7% over the past year, outpacing the industry average of -2.1%. Trading at 13.8% below its estimated fair value, Bouvet appears attractively priced compared to peers. Despite recent insider selling activity and a slight dip in Q3 net income to NOK 70.09 million from NOK 77.91 million last year, Bouvet remains debt-free for five years and boasts high-quality earnings. The company is poised for future growth with projected annual earnings increases of 4.52%, underscoring its potential as an investment opportunity in Europe’s tech landscape.

- Get an in-depth perspective on Bouvet's performance by reading our health report here.

Examine Bouvet's past performance report to understand how it has performed in the past.

RaySearch Laboratories (OM:RAY B)

Simply Wall St Value Rating: ★★★★★★

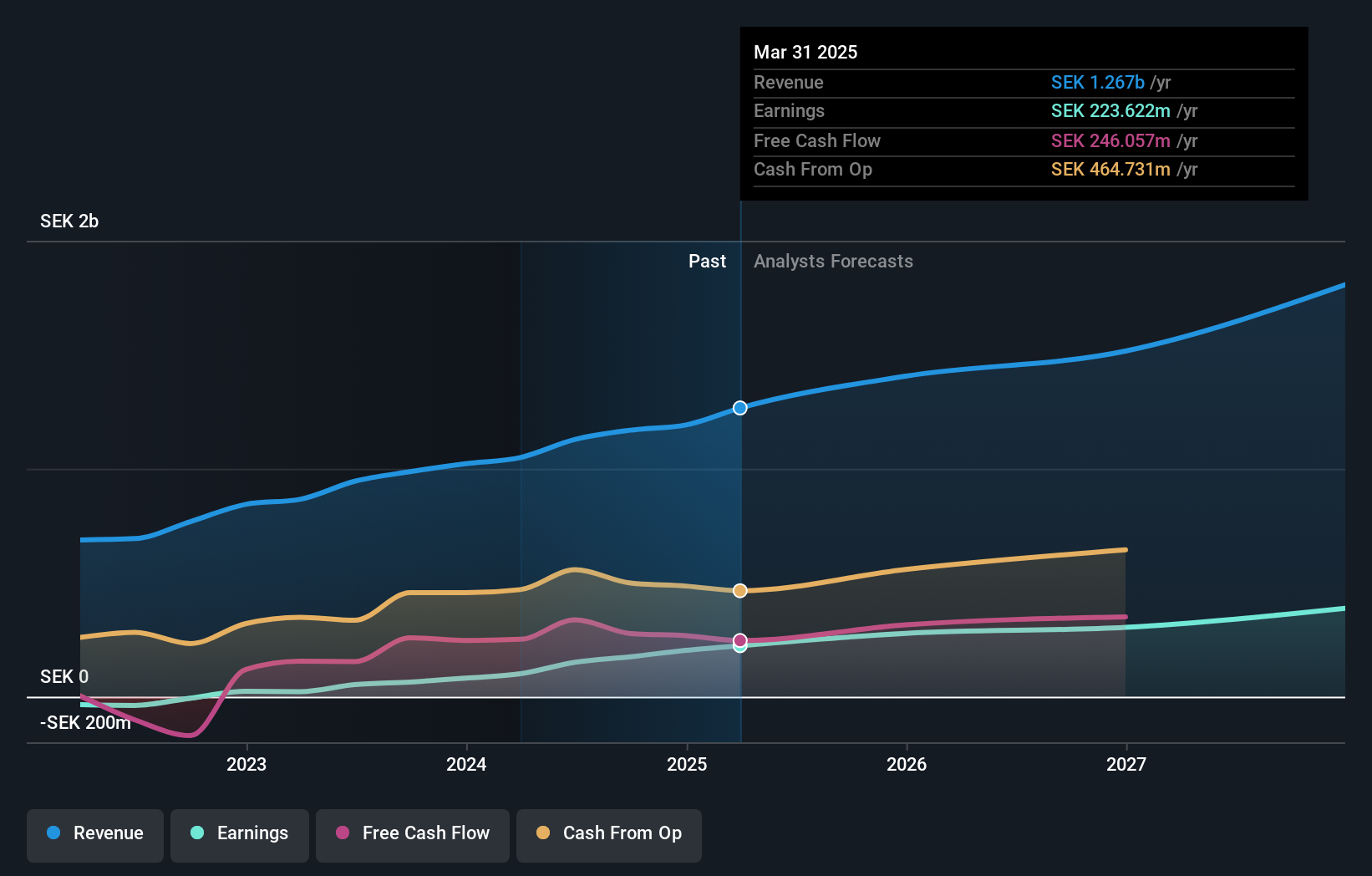

Overview: RaySearch Laboratories AB (publ) is a medical technology company that offers software solutions for cancer treatment globally, with a market capitalization of approximately SEK7.78 billion.

Operations: RaySearch Laboratories generates revenue primarily from its healthcare software segment, amounting to SEK1.29 billion.

RaySearch Laboratories, a nimble player in the healthcare technology sector, is making strides with its innovative cancer treatment solutions. The company recently reported third-quarter sales of SEK 332.3 million, up from SEK 293.3 million last year, and net income climbed to SEK 71.6 million from SEK 45.4 million previously. With no debt on its books now compared to a debt-to-equity ratio of 22.9% five years ago, RaySearch is trading at an attractive valuation—15% below estimated fair value—and continues to outperform industry peers with a robust earnings growth rate of 25%.

- Click to explore a detailed breakdown of our findings in RaySearch Laboratories' health report.

Gain insights into RaySearch Laboratories' past trends and performance with our Past report.

Fabryka Farb i Lakierów Sniezka (WSE:SKA)

Simply Wall St Value Rating: ★★★★★★

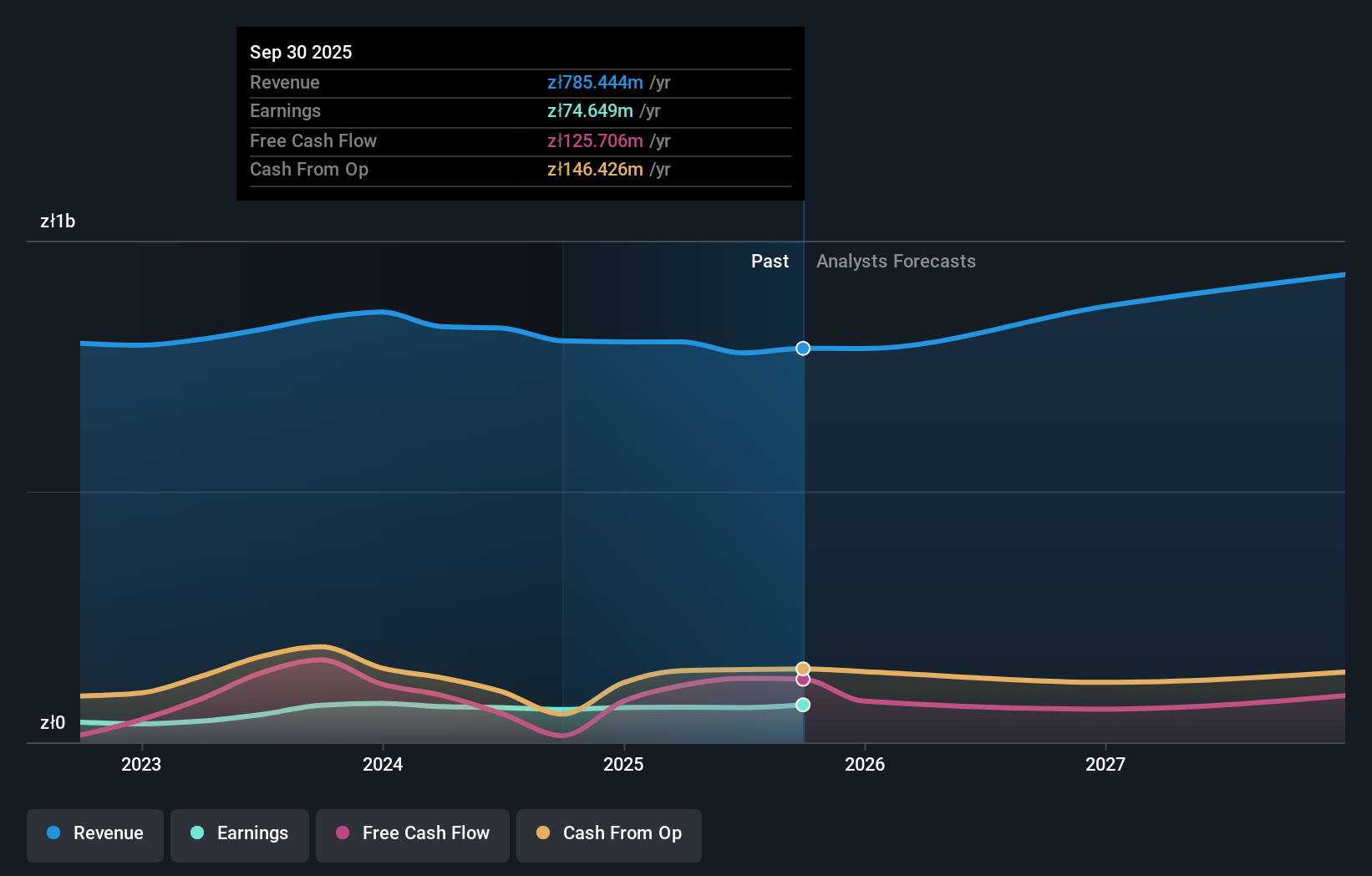

Overview: Fabryka Farb i Lakierów Sniezka SA is a company that manufactures and sells decorative paints across Poland, Hungary, Ukraine, Belarus, and other international markets with a market capitalization of PLN1.04 billion.

Operations: Sniezka generates revenue primarily from its paint and related products segment, amounting to PLN785.44 million.

Fabryka Farb i Lakierów Sniezka, a notable player in the European paint industry, showcases financial resilience despite mixed performance. The company trades at 14.5% below its estimated fair value and boasts high-quality past earnings. Over the past year, earnings grew by 14.4%, slightly trailing the Chemicals industry's 17.2%. With a satisfactory net debt to equity ratio of 36.7%, Sniezka's debt management is commendable, having reduced from 66.2% five years ago to 41.7%. Recent results highlight a third-quarter sales increase to PLN 254 million from PLN 245 million last year, with net income rising to PLN 39.92 million from PLN 34.62 million previously.

Key Takeaways

- Get an in-depth perspective on all 306 European Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:RAY B

RaySearch Laboratories

A medical technology company, provides software solutions for cancer treatment worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)