- Sweden

- /

- Healthtech

- /

- OM:RAY B

European Growth Companies With High Insider Ownership In April 2025

Reviewed by Simply Wall St

As European markets experience a lift, buoyed by easing trade tensions and positive signals from major indices like Germany’s DAX and France’s CAC 40, investors are increasingly focused on growth companies with solid insider ownership. In such a climate, stocks where company insiders hold significant stakes can be particularly attractive as they often indicate confidence in the company's potential to navigate economic uncertainties effectively.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| Vow (OB:VOW) | 13.1% | 111.2% |

| Elicera Therapeutics (OM:ELIC) | 23.8% | 97.2% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 50.8% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| MilDef Group (OM:MILDEF) | 15.3% | 74% |

| Lokotech Group (OB:LOKO) | 13.6% | 58.1% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Ortoma (OM:ORT B) | 27.7% | 68.6% |

Here's a peek at a few of the choices from the screener.

Plejd (NGM:PLEJD)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Plejd AB (publ) is a technology company that develops products and services for smart lighting control across several countries including Sweden, Norway, Finland, the Netherlands, and Germany, with a market cap of SEK6.70 billion.

Operations: The company's revenue is primarily derived from its Electronic Security Devices segment, which generated SEK839.34 million.

Insider Ownership: 33.4%

Revenue Growth Forecast: 16.6% p.a.

Plejd AB demonstrates strong growth potential with its earnings expected to grow significantly at 31% annually, outpacing the Swedish market. Recent financial results show a robust performance, with Q1 2025 net income doubling from the previous year to SEK 44.99 million. Despite substantial insider selling over the past quarter, insider ownership remains influential in strategic decisions. Revenue is projected to grow faster than the market at 16.6% per year, though below high-growth thresholds.

- Delve into the full analysis future growth report here for a deeper understanding of Plejd.

- The analysis detailed in our Plejd valuation report hints at an inflated share price compared to its estimated value.

Edda Wind (OB:EWIND)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Edda Wind ASA develops, builds, owns, operates, and charters service operation vessels and commissioning service operation vessels for offshore wind farms globally, with a market cap of NOK2.97 billion.

Operations: The company generates revenue from its offshore wind segment, amounting to €70.43 million.

Insider Ownership: 31%

Revenue Growth Forecast: 34.8% p.a.

Edda Wind is poised for strong growth, with earnings forecasted to increase by 80.2% annually, significantly outpacing the Norwegian market. Revenue is also expected to grow rapidly at 34.8% per year. Despite recent shareholder dilution and high volatility in share price, the stock trades well below its estimated fair value. Recent M&A activity indicates a potential de-listing from the Oslo Stock Exchange as major shareholders consolidate control through a significant acquisition offer valued at approximately NOK 470 million.

- Take a closer look at Edda Wind's potential here in our earnings growth report.

- Our valuation report unveils the possibility Edda Wind's shares may be trading at a discount.

RaySearch Laboratories (OM:RAY B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: RaySearch Laboratories AB (publ) is a medical technology company that provides software solutions for cancer treatment globally, with a market cap of SEK9.18 billion.

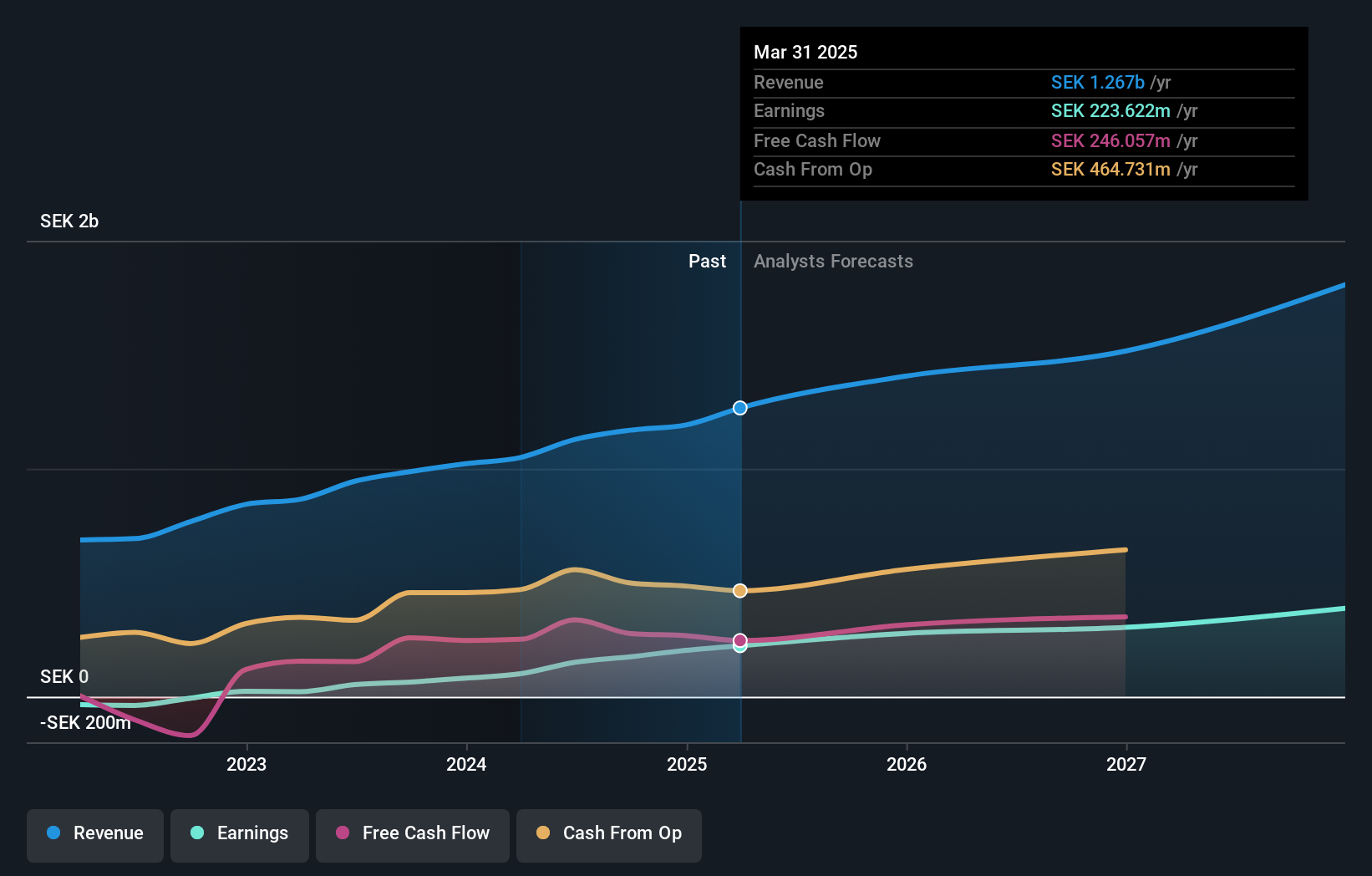

Operations: The company generates revenue from its healthcare software segment, which amounted to SEK1.19 billion.

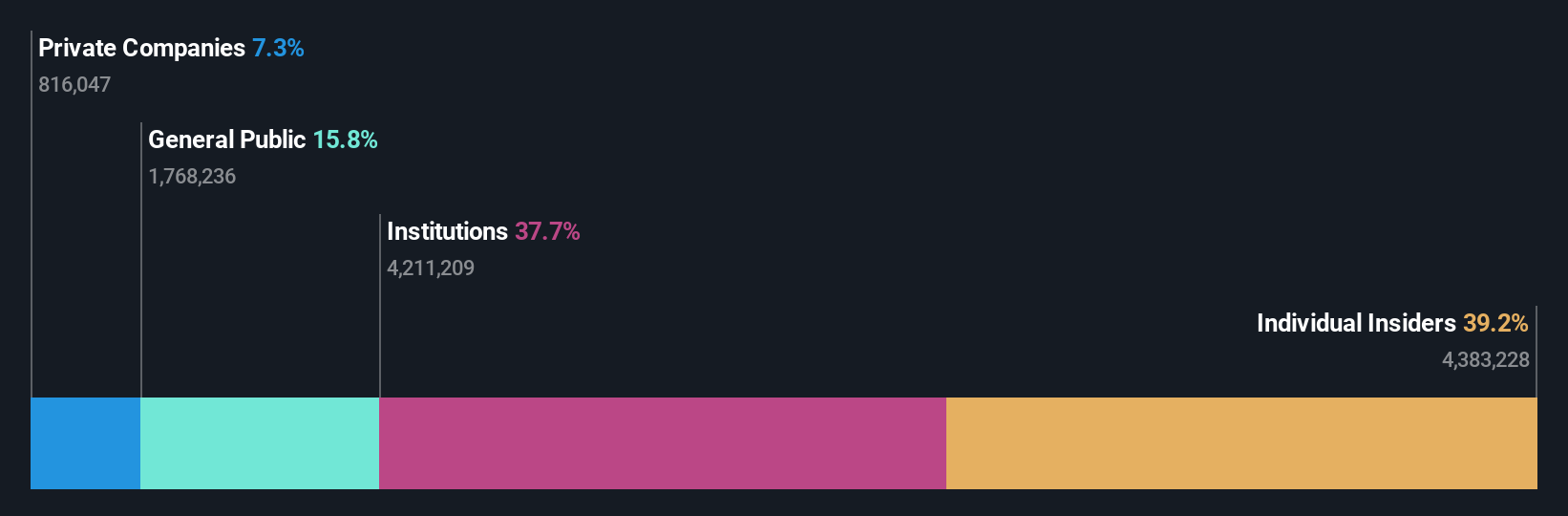

Insider Ownership: 16.9%

Revenue Growth Forecast: 13.4% p.a.

RaySearch Laboratories is experiencing robust growth, with earnings projected to rise by 20.2% annually, surpassing the Swedish market's forecast. Revenue is also expected to grow faster than the market at 13.4% per year. Despite recent substantial insider selling, insider ownership remains significant. Recent developments include a SEK 500 million equity offering and major orders from Odense University Hospital and Heyou Hospital, enhancing its position in automated radiotherapy solutions and particle treatment planning in China.

- Click here to discover the nuances of RaySearch Laboratories with our detailed analytical future growth report.

- According our valuation report, there's an indication that RaySearch Laboratories' share price might be on the expensive side.

Turning Ideas Into Actions

- Unlock more gems! Our Fast Growing European Companies With High Insider Ownership screener has unearthed 207 more companies for you to explore.Click here to unveil our expertly curated list of 210 Fast Growing European Companies With High Insider Ownership.

- Ready To Venture Into Other Investment Styles? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade RaySearch Laboratories, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:RAY B

RaySearch Laboratories

A medical technology company, provides software solutions for cancer treatment worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives