- Sweden

- /

- Diversified Financial

- /

- OM:CRED A

3 Undiscovered Gems In Europe With Strong Potential

Reviewed by Simply Wall St

Amid heightened trade tensions and economic uncertainties, the European market has experienced fluctuations, with the STOXX Europe 600 Index recently closing 1.92% lower. As central banks in the eurozone and UK increase their vigilance, investors are on the lookout for resilient small-cap stocks that can navigate these turbulent times. Identifying companies with strong fundamentals and potential for growth can be key to uncovering hidden opportunities in this challenging environment.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Linc | NA | 19.35% | 23.17% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Moury Construct | 2.93% | 10.42% | 27.28% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| Dekpol | 73.04% | 15.36% | 16.35% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Flow Traders (ENXTAM:FLOW)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Flow Traders Ltd. is a financial technology-enabled multi-asset class liquidity provider operating in Europe, the Americas, and Asia with a market cap of approximately €1.31 billion.

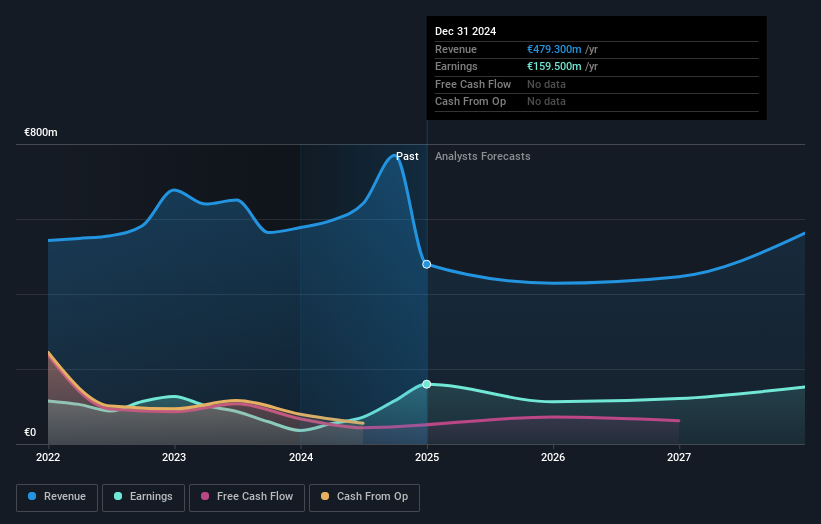

Operations: Flow Traders generates revenue primarily from unclassified services, totaling approximately €800.78 million.

Flow Traders, a financial technology-enabled liquidity provider, has seen significant growth with earnings surging 341.3% over the past year, outpacing the Capital Markets industry. The company's debt to equity ratio improved from 479.4% to 249.1% in five years, showcasing better financial health as it holds more cash than total debt. Despite these strengths, challenges loom with digital asset volatility and rising operating expenses potentially impacting future profits and net margins. Recent full-year results highlighted revenue of €479 million and net income of €159 million, reflecting robust performance compared to prior periods despite market uncertainties.

Creades (OM:CRED A)

Simply Wall St Value Rating: ★★★★★★

Overview: Creades AB is a private equity and venture capital investment firm that focuses on early to late-stage venture, emerging growth, middle market, growth capital, and buyout investments with a market cap of approximately SEK9.72 billion.

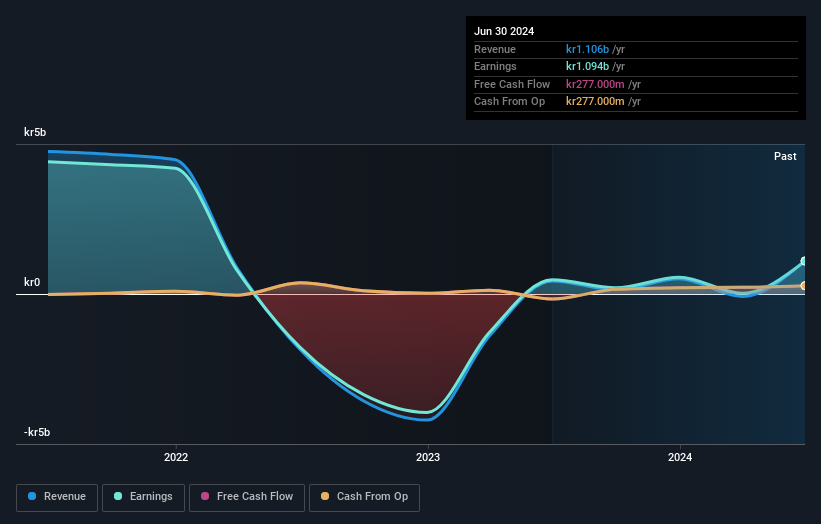

Operations: Creades AB generates revenue primarily from its investments, with a notable contribution of SEK1.26 billion from online retailers. The firm's market capitalization is approximately SEK9.72 billion.

Creades, an intriguing player in the financial space, has shown remarkable earnings growth of 115% over the past year, outpacing its industry peers. Despite a challenging five-year period with a 25% annual decline in earnings, Creades remains debt-free and boasts high-quality earnings. The company's price-to-earnings ratio stands at 8.1x, notably lower than the Swedish market's average of 20.3x, suggesting potential undervaluation. Recent figures indicate a significant drop in revenue to SEK 344 million from SEK 1.26 billion last year; however, net income was SEK 287 million compared to SEK 1.19 billion previously reported for the same quarter.

- Navigate through the intricacies of Creades with our comprehensive health report here.

Explore historical data to track Creades' performance over time in our Past section.

RaySearch Laboratories (OM:RAY B)

Simply Wall St Value Rating: ★★★★★★

Overview: RaySearch Laboratories AB (publ) is a medical technology company that develops software solutions for cancer care across various regions including the Americas, Europe, Africa, the Asia-Pacific, and the Middle East, with a market cap of SEK7.71 billion.

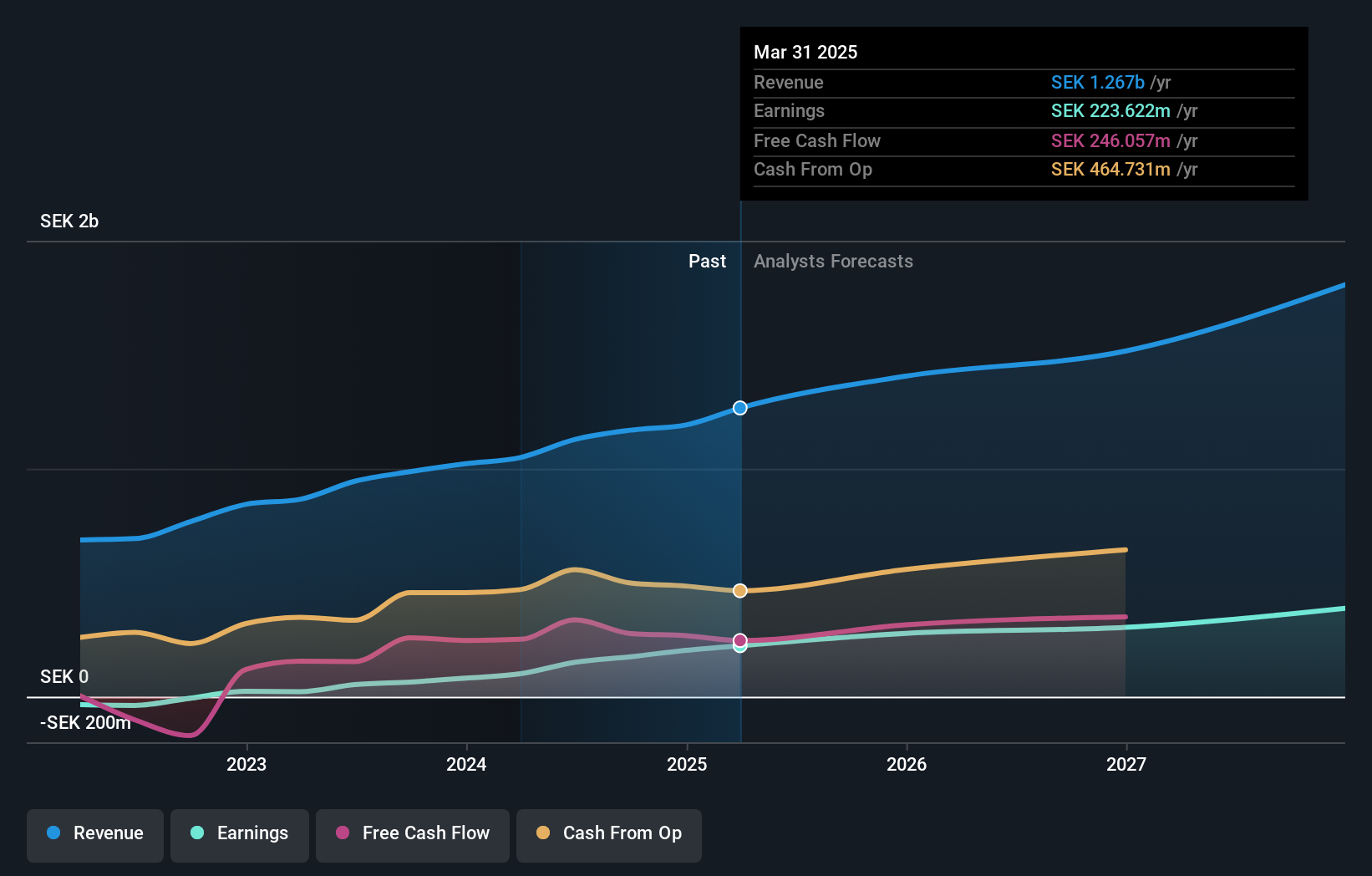

Operations: RaySearch Laboratories generates revenue primarily from its healthcare software segment, amounting to SEK1.19 billion. The company's financial performance is characterized by a net profit margin that reflects its operational efficiency in the competitive medical technology market.

RaySearch Laboratories, a nimble player in the healthcare technology sector, has been making waves with its robust earnings growth of 149.5% over the past year, outpacing the Healthcare Services industry at 28.2%. The company is debt-free, a significant improvement from five years ago when its debt to equity ratio was 7%, and boasts high-quality earnings. Recently, RaySearch secured a significant order worth RMB 51 million (approximately SEK 77 million) from Heyou Hospital in China for its RayStation treatment planning system. Additionally, they completed a follow-on equity offering of SEK 500 million to bolster their financial position further.

- Dive into the specifics of RaySearch Laboratories here with our thorough health report.

Gain insights into RaySearch Laboratories' past trends and performance with our Past report.

Summing It All Up

- Unlock our comprehensive list of 352 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Creades, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CRED A

Creades

A private equity and venture capital investment firm specializing in early, mid & late venture, emerging growth, middle market, growth capital and buyout investments.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives