Last Update 29 Jul 25

Fair value Increased 12%Despite a worsened consensus revenue growth outlook, a substantial increase in Flow Traders' future P/E multiple has driven the analyst price target up from €25.39 to €28.55.

Valuation Changes

Summary of Valuation Changes for Flow Traders

- The Consensus Analyst Price Target has significantly risen from €25.39 to €28.55.

- The Future P/E for Flow Traders has significantly risen from 7.50x to 11.00x.

- The Consensus Revenue Growth forecasts for Flow Traders has significantly fallen from -10.1% per annum to -12.3% per annum.

Key Takeaways

- Volatility in digital asset investments and strategic partnerships may negatively affect future earnings and profitability if gains turn into unrealized losses.

- Rising fixed operating expenses and the need for capital investment may reduce net margins and impact competitiveness, dividends, and market positioning.

- Diversification, strategic partnerships, and capital expansion position Flow Traders for revenue growth and improved margins in emerging and digital asset markets.

Catalysts

About Flow Traders- Operates as a financial technology-enabled multi-asset class liquidity provider in Europe, the Americas, and Asia.

- Concerns about potential volatility and reversals in digital asset investments that have contributed to recent income might impact future earnings negatively if these gains turn into unrealized losses.

- Anticipated increase in fixed operating expenses, projected to be €190 million to €210 million in 2025, could compress net margins due to additional technology investments and hiring of subject matter experts.

- Ongoing need for additional trading capital to capture growth opportunities in emerging markets such as China may require continued retention of earnings or external financing, potentially impacting dividend distributions and return on equity.

- There is a risk of losing market share to better-capitalized competitors, necessitating significant capital investment to remain competitive in providing liquidity, which could affect revenue and market positioning.

- Unrealized gains from strategic investments in digital assets and partnerships may decrease if market dynamics shift, which could reduce other income and overall profitability.

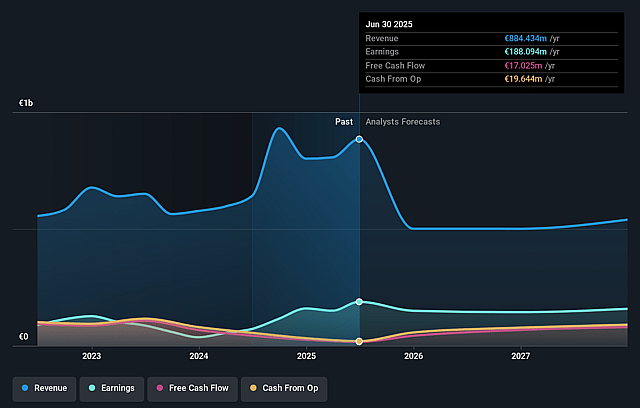

Flow Traders Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Flow Traders's revenue will decrease by 10.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 19.9% today to 31.4% in 3 years time.

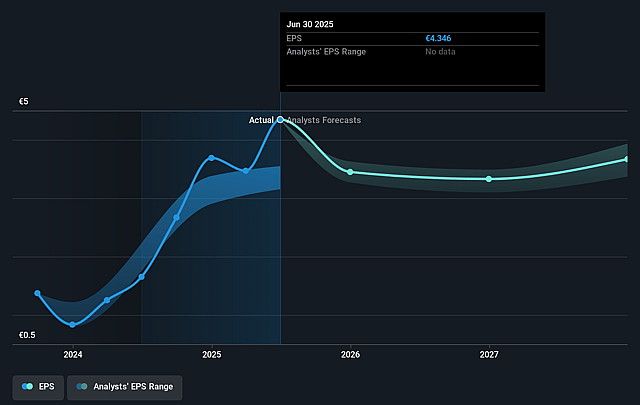

- Analysts expect earnings to reach €182.8 million (and earnings per share of €4.24) by about April 2028, up from €159.5 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €223.1 million in earnings, and the most bearish expecting €162 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.5x on those 2028 earnings, down from 8.2x today. This future PE is lower than the current PE for the GB Capital Markets industry at 11.6x.

- Analysts expect the number of shares outstanding to decline by 1.03% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.91%, as per the Simply Wall St company report.

Flow Traders Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Flow Traders achieved record fourth-quarter results and the second-best annual result in the company's history in 2024, with a strong increase in trading volume and profitability across various asset classes, suggesting continued revenue and earnings growth potential.

- The company's diversification strategy, including investments in digital assets and regional expansions, has positioned it to capture opportunities in emerging markets, potentially boosting revenue and net margins.

- Strategic partnerships and technological investments have enhanced Flow Traders' trading capabilities, which may lead to increased trading efficiency and improved net margins.

- The Trading Capital Expansion Plan and the increase in trading capital by 33% over the year have enhanced Flow Traders' ability to capture market opportunities, potentially raising revenues and returns on capital.

- Megatrends such as the growth in ETPs, digital assets, and electronic trading provide a favorable market environment for Flow Traders, which could support long-term revenue and profit growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €25.875 for Flow Traders based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €31.5, and the most bearish reporting a price target of just €14.3.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €582.2 million, earnings will come to €182.8 million, and it would be trading on a PE ratio of 7.5x, assuming you use a discount rate of 8.9%.

- Given the current share price of €30.24, the analyst price target of €25.88 is 16.9% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.