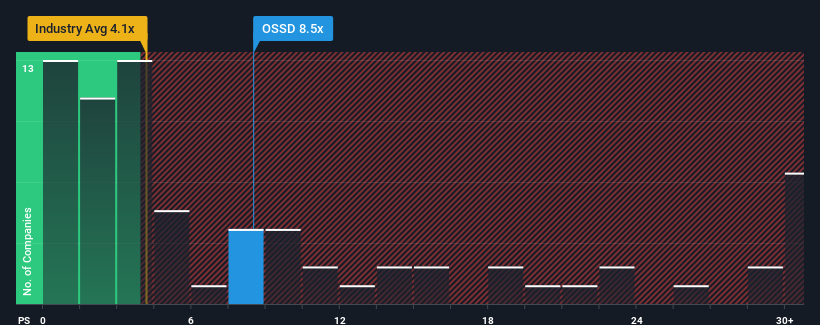

OssDsign AB (publ)'s (STO:OSSD) price-to-sales (or "P/S") ratio of 8.5x might make it look like a strong sell right now compared to the Medical Equipment industry in Sweden, where around half of the companies have P/S ratios below 4.1x and even P/S below 2x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for OssDsign

How OssDsign Has Been Performing

Recent times have been advantageous for OssDsign as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on OssDsign will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For OssDsign?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like OssDsign's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 97% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 27% per year during the coming three years according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 37% per year, which is noticeably more attractive.

In light of this, it's alarming that OssDsign's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does OssDsign's P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for OssDsign, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Having said that, be aware OssDsign is showing 2 warning signs in our investment analysis, you should know about.

If you're unsure about the strength of OssDsign's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:OSSD

OssDsign

Designs, manufactures, and sells implants and material technology for bone regeneration in Sweden, Germany, the United States, the United Kingdom, rest of Europe, and internationally.

Flawless balance sheet with limited growth.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)