- Hong Kong

- /

- Real Estate

- /

- SEHK:1821

3 Growth Companies With High Insider Ownership Expecting Up To 86% Earnings Growth

Reviewed by Simply Wall St

In a week marked by record highs in major U.S. stock indexes, growth stocks have notably outperformed their value counterparts, driven by strong performances in sectors like consumer discretionary and information technology. Amid this backdrop of economic optimism and mixed sector performance, investors are increasingly focusing on growth companies with high insider ownership as potential opportunities for significant earnings expansion. In the current market environment, such companies can be appealing due to the alignment of interests between insiders and shareholders, potentially offering a robust foundation for future growth.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 31.7% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.4% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Here's a peek at a few of the choices from the screener.

Medicover (OM:MCOV B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Medicover AB (publ) offers healthcare and diagnostic services in Poland, Sweden, and internationally with a market cap of SEK28.59 billion.

Operations: The company generates revenue from Diagnostic Services amounting to €631.90 million and Healthcare Services totaling €1.39 billion.

Insider Ownership: 11.1%

Earnings Growth Forecast: 41.8% p.a.

Medicover demonstrates potential as a growth company with high insider ownership, despite recent financial challenges. The company's earnings are forecast to grow significantly at 41.8% annually, outpacing the Swedish market. However, recent quarterly results showed a net loss of €4.4 million, highlighting volatility in performance. Insiders have shown confidence by buying more shares than selling over the past three months, while revenue is expected to grow faster than the market at 12.5% per year.

- Click here to discover the nuances of Medicover with our detailed analytical future growth report.

- The analysis detailed in our Medicover valuation report hints at an inflated share price compared to its estimated value.

ESR Group (SEHK:1821)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ESR Group Limited operates in logistics real estate development, leasing, and management across various regions including Hong Kong, China, Japan, South Korea, Australia, New Zealand, Southeast Asia, India, Europe and internationally with a market cap of HK$51.20 billion.

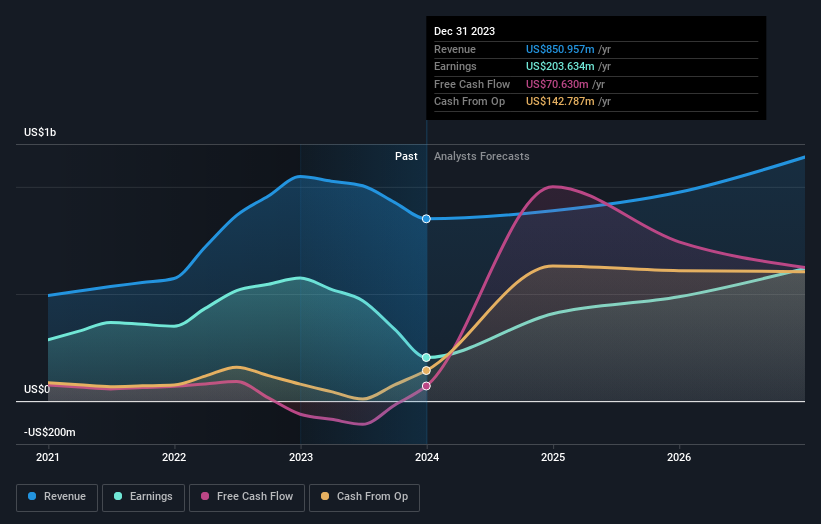

Operations: The company's revenue segments include Fund Management with $627.98 million and New Economy Development with $113.33 million.

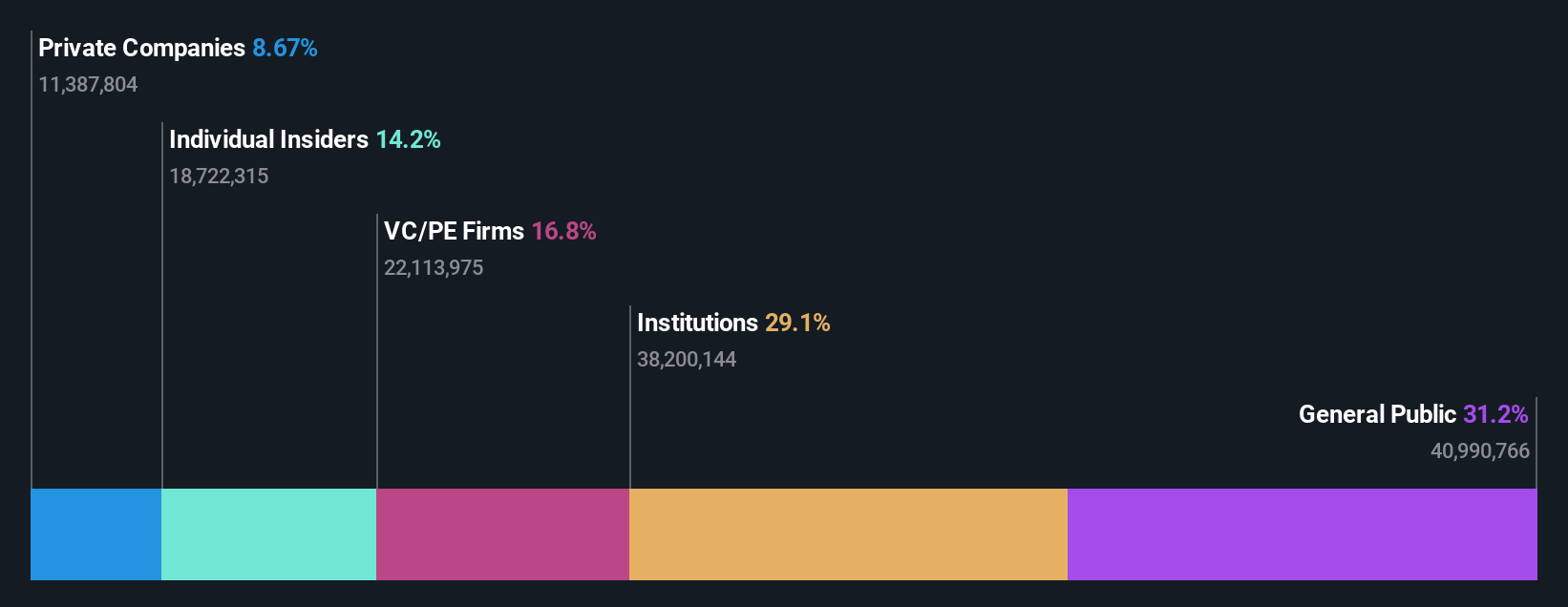

Insider Ownership: 13%

Earnings Growth Forecast: 86.8% p.a.

ESR Group is undergoing significant changes, with a recent M&A transaction involving major stakeholders acquiring a 60.09% stake. The company is forecast to become profitable in three years, with earnings expected to grow by 86.81% annually, indicating strong growth potential despite revenue growth being slower than desired at 15.4%. Trading below its estimated fair value suggests possible investment appeal, although interest payments are not well covered by earnings and return on equity remains low at 5.1%.

- Navigate through the intricacies of ESR Group with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of ESR Group shares in the market.

3Peak (SHSE:688536)

Simply Wall St Growth Rating: ★★★★★☆

Overview: 3Peak Incorporated focuses on the research, development, and sale of analog integrated circuit products both in China and internationally, with a market cap of CN¥14.60 billion.

Operations: The company's revenue from the integrated circuit industry amounts to CN¥1.13 billion.

Insider Ownership: 14.8%

Earnings Growth Forecast: 75% p.a.

3Peak's revenue is forecast to grow significantly faster than the Chinese market, with expectations of a 32.1% annual increase. Despite current losses, the company is projected to become profitable within three years, reflecting above-average market growth potential. Recent financial results show increased sales but a net loss of CNY 98.73 million for nine months ending September 2024. The company's share price has been highly volatile recently, and insider trading activity remains minimal over the past three months.

- Take a closer look at 3Peak's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that 3Peak is priced higher than what may be justified by its financials.

Key Takeaways

- Unlock our comprehensive list of 1510 Fast Growing Companies With High Insider Ownership by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if ESR Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1821

ESR Group

Engages in the logistics real estate development, leasing, and management activities in Hong Kong, China, Japan, South Korea, Australia, New Zealand, Southeast Asia, India, Europe, and internationally.

Reasonable growth potential and slightly overvalued.