- Sweden

- /

- Medical Equipment

- /

- OM:INTEG B

Introducing Integrum (STO:INTEG B), The Stock That Soared 873% In The Last Year

While stock picking isn't easy, for those willing to persist and learn, it is possible to buy shares in great companies, and generate wonderful returns. While not every stock performs well, when investors win, they can win big. For example, the Integrum AB (publ) (STO:INTEG B) share price rocketed moonwards 873% in just one year. On top of that, the share price is up 58% in about a quarter. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report. It is also impressive that the stock is up 191% over three years, adding to the sense that it is a real winner.

It really delights us to see such great share price performance for investors.

See our latest analysis for Integrum

Integrum isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Integrum grew its revenue by 66% last year. That's well above most other pre-profit companies. But the share price seems headed to the moon, up 873% as previously highlighted. Even the most bullish shareholders might be thinking that the share price might drop back a bit, after a gain like that. So this looks like a great watchlist candidate for investors who look for high growth inflexion points.

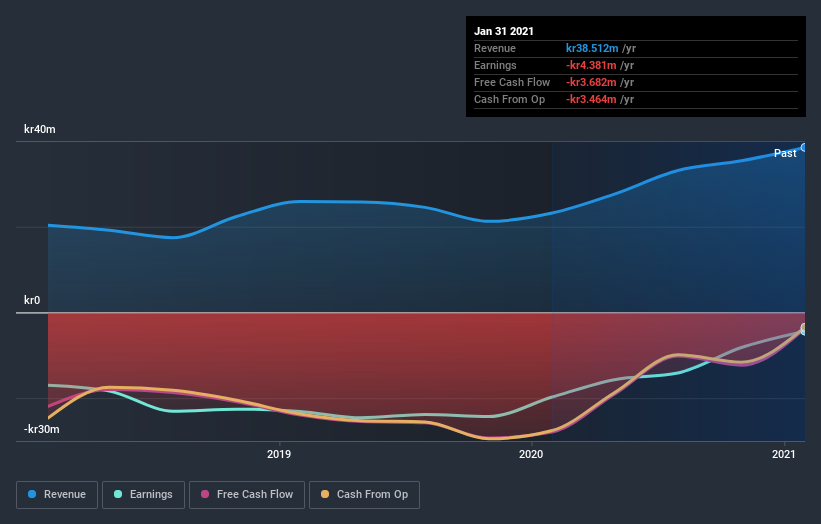

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

We're pleased to report that Integrum rewarded shareholders with a total shareholder return of 873% over the last year. That's better than the annualized TSR of 48% over the last three years. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Integrum has 4 warning signs (and 1 which is significant) we think you should know about.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

If you decide to trade Integrum, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:INTEG B

Integrum

Researches, develops, and sells various systems for bone-anchored prostheses.

Adequate balance sheet and fair value.