As we enter January 2025, global markets are showing signs of optimism with cooling inflation and strong bank earnings driving U.S. stocks higher, while European markets benefit from slower-than-expected inflation potentially leading to rate cuts. In this environment, investors might look for high growth tech stocks that can capitalize on these favorable conditions by demonstrating robust innovation and adaptability in a rapidly evolving market landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1225 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

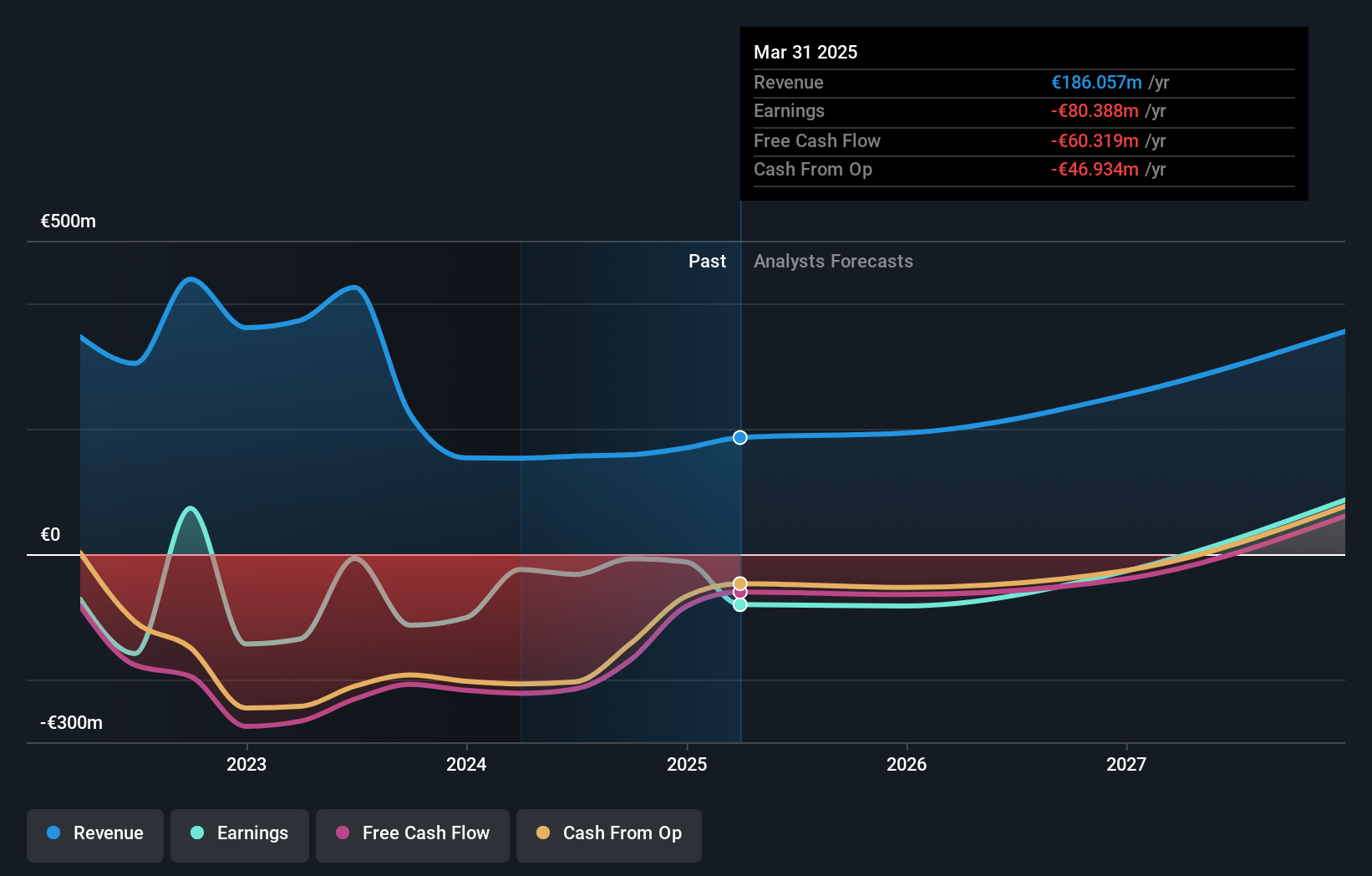

Valneva (ENXTPA:VLA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Valneva SE is a specialty vaccine company focused on developing, manufacturing, and commercializing prophylactic vaccines for infectious diseases with unmet needs, with a market cap of €363.71 million.

Operations: Valneva SE generates revenue primarily through the development, manufacturing, and commercialization of vaccines targeting infectious diseases with unmet needs. As a specialty vaccine company, it focuses on creating prophylactic solutions to address these health challenges.

Valneva SE, navigating through a challenging biotech landscape, has shown promising strides with an expected annual revenue growth of 22.5%, significantly outpacing the French market's 5.5%. Despite currently being unprofitable, the company is projected to shift towards profitability within three years, buoyed by a robust 4.63% forecast in earnings growth annually. Recent strategic moves include a licensing agreement with Serum Institute of India to distribute its chikungunya vaccine in Asia amidst one of India’s worst outbreaks, reflecting not only immediate response capabilities but also long-term market penetration strategies supported by substantial funding from CEPI and the EU totaling $41.3 million. These developments underscore Valneva's proactive approach in expanding its global footprint while enhancing shareholder value through targeted R&D investments and strategic partnerships.

- Delve into the full analysis health report here for a deeper understanding of Valneva.

Understand Valneva's track record by examining our Past report.

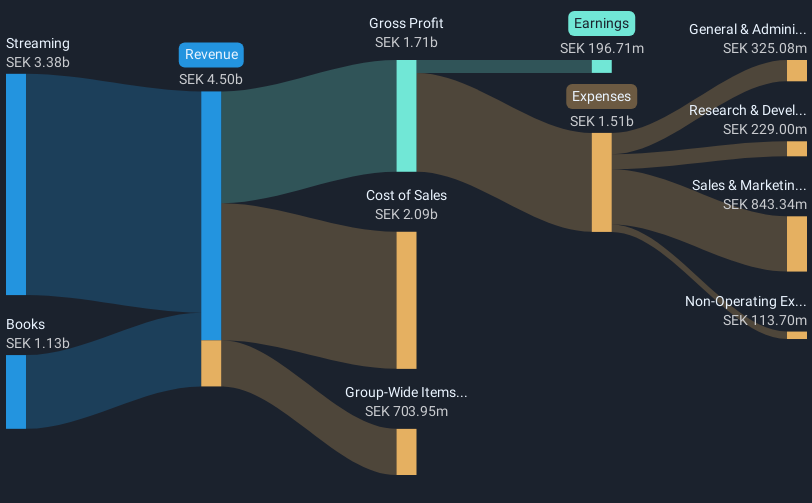

Storytel (OM:STORY B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Storytel AB (publ) offers audiobooks and e-books streaming services and has a market capitalization of approximately SEK5.57 billion.

Operations: Storytel generates revenue primarily from its books segment, amounting to SEK859.34 million. The company also reports a segment adjustment of SEK3.51 billion, which impacts its overall financial performance.

Storytel's strategic partnership with Vodafone Turkey, announced on January 9, 2025, marks a significant expansion into the Turkish market, leveraging Vodafone's extensive customer base to enhance access to its vast library of over 750,000 audio and ebook titles. This move is poised to bolster Storytel's market presence in Turkey and reflects its agile adaptation to consumer demands for digital content. Financially, Storytel has demonstrated a robust turnaround with third-quarter sales rising to SEK 954 million from SEK 896 million year-over-year and swinging from a net loss to a profit of SEK 51.36 million. This performance underscores Storytel’s potential in harnessing strategic partnerships and operational efficiencies amidst competitive media landscapes.

- Click here to discover the nuances of Storytel with our detailed analytical health report.

Evaluate Storytel's historical performance by accessing our past performance report.

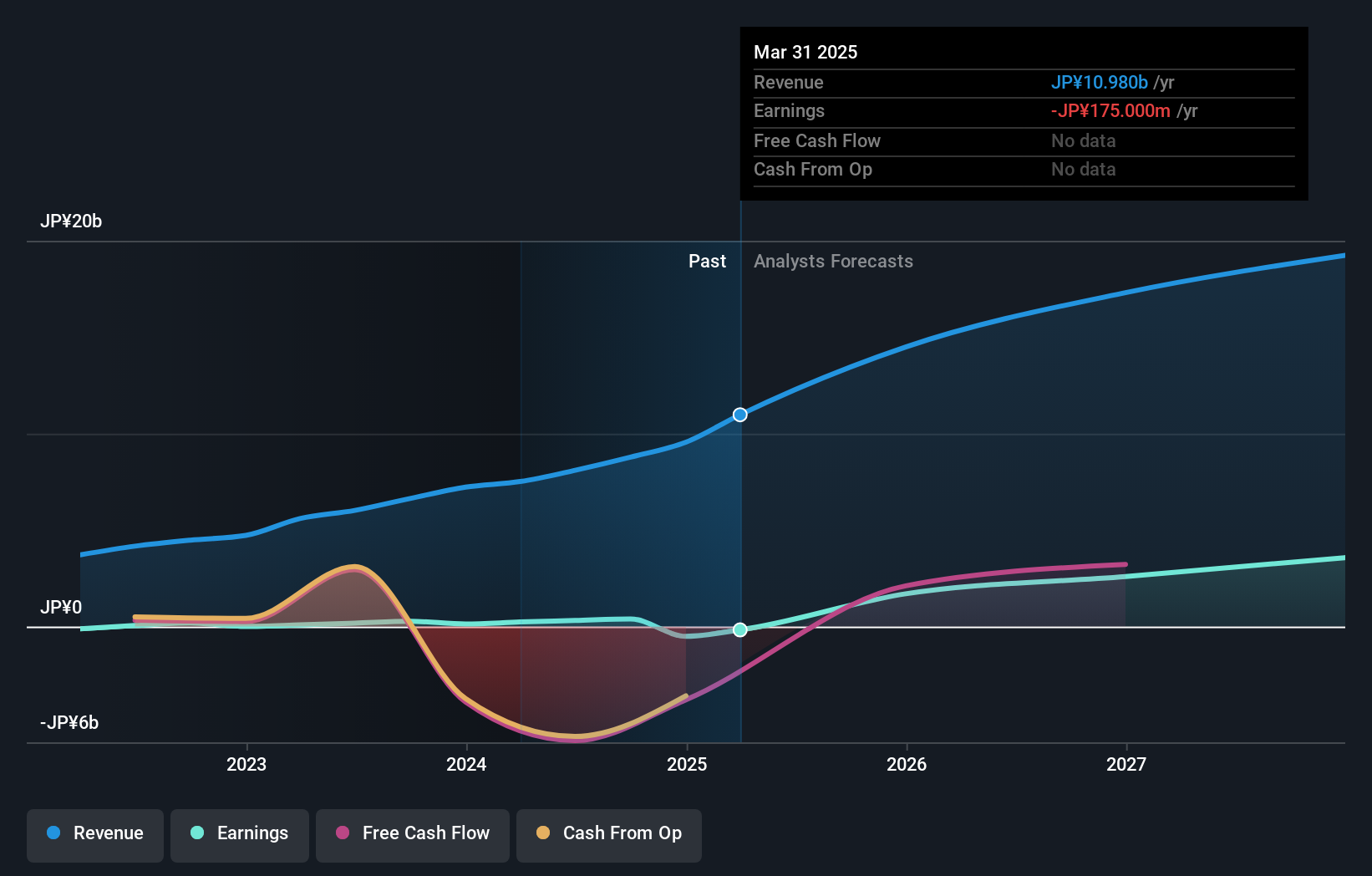

giftee (TSE:4449)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Giftee Inc. operates in the Internet service sector in Japan with a market capitalization of ¥39.58 billion.

Operations: The company generates revenue primarily through its E-Gift Platform Business, which reported earnings of ¥8.78 billion.

Giftee Inc. is navigating a promising trajectory with an expected annual revenue growth of 26.7%, surpassing the Japanese market's average of 4.3%. This growth is complemented by a robust earnings forecast, anticipated to surge by 63.3% annually, significantly outpacing the broader market's 8.1%. Recent strategic moves include planning stock acquisition rights for employees and projecting substantial financial targets for FY ending December 2024, with net sales aimed at JPY 9.1 billion and an operating profit of JPY 1.7 billion. These initiatives highlight Giftee’s aggressive approach to capitalizing on digital transaction trends and enhancing shareholder value through dividends, setting a solid foundation for future expansion in the interactive media and services sector.

- Unlock comprehensive insights into our analysis of giftee stock in this health report.

Assess giftee's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Dive into all 1225 of the High Growth Tech and AI Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Storytel, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:STORY B

Flawless balance sheet with high growth potential.