- Sweden

- /

- Medical Equipment

- /

- OM:ICO

Companies Like Iconovo (STO:ICO) Are In A Position To Invest In Growth

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

So, the natural question for Iconovo (STO:ICO) shareholders is whether they should be concerned by its rate of cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

View our latest analysis for Iconovo

Does Iconovo Have A Long Cash Runway?

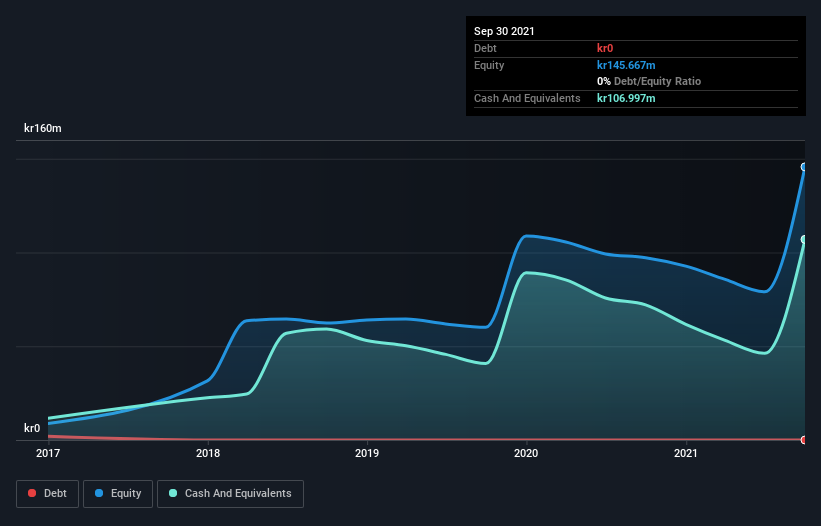

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. When Iconovo last reported its balance sheet in September 2021, it had zero debt and cash worth kr107m. In the last year, its cash burn was kr35m. So it had a cash runway of about 3.0 years from September 2021. Notably, analysts forecast that Iconovo will break even (at a free cash flow level) in about 4 years. Essentially, that means the company will either reduce its cash burn, or else require more cash. The image below shows how its cash balance has been changing over the last few years.

How Well Is Iconovo Growing?

At first glance it's a bit worrying to see that Iconovo actually boosted its cash burn by 36%, year on year. On a more positive note, the operating revenue improved by 102% over the period, offering an indication that the expenditure may well be worthwhile. If revenue is maintained once spending on growth decreases, that could well pay off! We think it is growing rather well, upon reflection. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can Iconovo Raise Cash?

We are certainly impressed with the progress Iconovo has made over the last year, but it is also worth considering how costly it would be if it wanted to raise more cash to fund faster growth. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Iconovo has a market capitalisation of kr752m and burnt through kr35m last year, which is 4.7% of the company's market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

Is Iconovo's Cash Burn A Worry?

It may already be apparent to you that we're relatively comfortable with the way Iconovo is burning through its cash. In particular, we think its revenue growth stands out as evidence that the company is well on top of its spending. Although its increasing cash burn does give us reason for pause, the other metrics we discussed in this article form a positive picture overall. One real positive is that analysts are forecasting that the company will reach breakeven. Looking at all the measures in this article, together, we're not worried about its rate of cash burn; the company seems well on top of its medium-term spending needs. An in-depth examination of risks revealed 4 warning signs for Iconovo that readers should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

If you're looking to trade Iconovo, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:ICO

Undervalued with high growth potential.