- Sweden

- /

- Medical Equipment

- /

- OM:ELOS B

Here's Why I Think Elos Medtech (STO:ELOS B) Is An Interesting Stock

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Elos Medtech (STO:ELOS B). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Elos Medtech

How Fast Is Elos Medtech Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Elos Medtech has grown EPS by 19% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

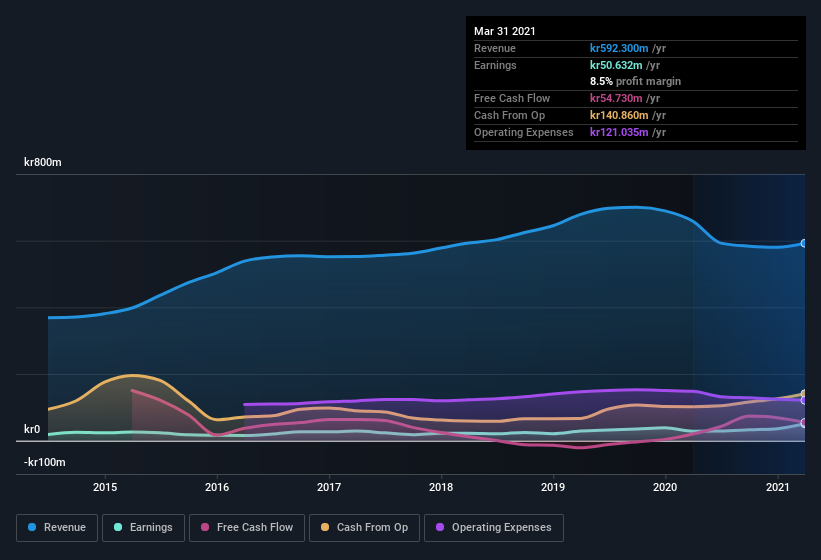

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Unfortunately, Elos Medtech's revenue dropped 10% last year, but the silver lining is that EBIT margins improved from 8.3% to 13%. That falls short of ideal.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Elos Medtech is no giant, with a market capitalization of kr1.4b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Elos Medtech Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Over the last 12 months Elos Medtech insiders spent kr820k more buying shares than they received from selling them. On balance, that's a good sign. It is also worth noting that it was President & CEO Jan Wahlström who made the biggest single purchase, worth kr801k, paying kr131 per share.

On top of the insider buying, it's good to see that Elos Medtech insiders have a valuable investment in the business. Indeed, they hold kr316m worth of its stock. That's a lot of money, and no small incentive to work hard. That amounts to 23% of the company, demonstrating a degree of high-level alignment with shareholders.

Should You Add Elos Medtech To Your Watchlist?

You can't deny that Elos Medtech has grown its earnings per share at a very impressive rate. That's attractive. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So it's fair to say I think this stock may well deserve a spot on your watchlist. Even so, be aware that Elos Medtech is showing 2 warning signs in our investment analysis , you should know about...

The good news is that Elos Medtech is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Elos Medtech, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Elos Medtech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:ELOS B

Elos Medtech

Elos Medtech AB (publ) engages in the development and contract manufacturing of medical devices and components for dental, orthopedics, diagnostics, and hearing and other medical device markets.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives