- Sweden

- /

- Medical Equipment

- /

- OM:BACTI B

Bactiguard Holding (STO:BACTI B) Has A Pretty Healthy Balance Sheet

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Bactiguard Holding AB (publ) (STO:BACTI B) makes use of debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Bactiguard Holding

What Is Bactiguard Holding's Debt?

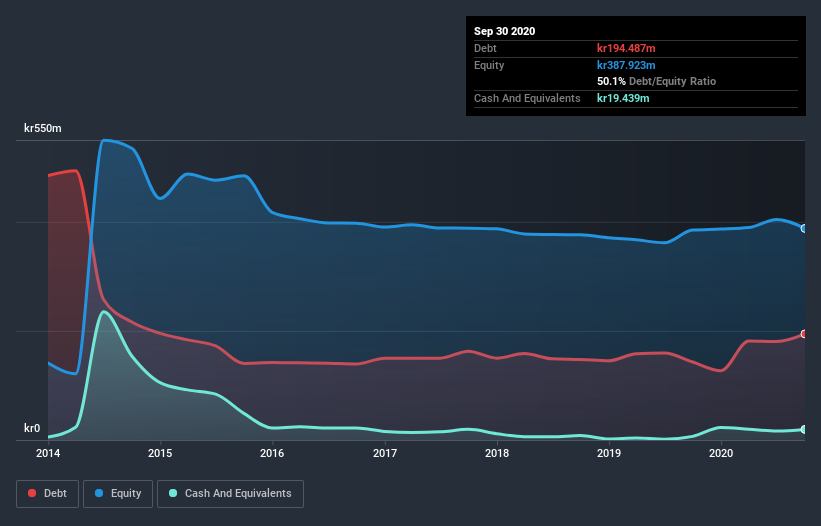

You can click the graphic below for the historical numbers, but it shows that as of September 2020 Bactiguard Holding had kr194.5m of debt, an increase on kr143.1m, over one year. However, because it has a cash reserve of kr19.4m, its net debt is less, at about kr175.0m.

How Healthy Is Bactiguard Holding's Balance Sheet?

The latest balance sheet data shows that Bactiguard Holding had liabilities of kr38.1m due within a year, and liabilities of kr272.5m falling due after that. On the other hand, it had cash of kr19.4m and kr59.6m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by kr231.5m.

Since publicly traded Bactiguard Holding shares are worth a total of kr5.20b, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While we wouldn't worry about Bactiguard Holding's net debt to EBITDA ratio of 3.5, we think its super-low interest cover of 1.5 times is a sign of high leverage. In large part that's due to the company's significant depreciation and amortisation charges, which arguably mean its EBITDA is a very generous measure of earnings, and its debt may be more of a burden than it first appears. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. However, the silver lining was that Bactiguard Holding achieved a positive EBIT of kr22m in the last twelve months, an improvement on the prior year's loss. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Bactiguard Holding will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Happily for any shareholders, Bactiguard Holding actually produced more free cash flow than EBIT over the last year. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

The good news is that Bactiguard Holding's demonstrated ability to convert EBIT to free cash flow delights us like a fluffy puppy does a toddler. But we must concede we find its interest cover has the opposite effect. We would also note that Medical Equipment industry companies like Bactiguard Holding commonly do use debt without problems. Looking at all the aforementioned factors together, it strikes us that Bactiguard Holding can handle its debt fairly comfortably. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. We'd be motivated to research the stock further if we found out that Bactiguard Holding insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading Bactiguard Holding or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bactiguard Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About OM:BACTI B

Bactiguard Holding

A medical device company, provides infection prevention solutions in orthopedics, urology, intravascular/critical care, dental, and wound care therapeutic areas in the United States, Sweden, Malaysia, India, Bangladesh, Indonesia, the Kingdom of Saudi Arabia, and internationally.

Reasonable growth potential and fair value.