- Sweden

- /

- Auto Components

- /

- OM:BULTEN

3 Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a period of volatility marked by inflation concerns and fluctuating interest rates, investors are seeking stability in their portfolios. In this environment, dividend stocks can offer a reliable income stream and potential for growth, making them an attractive option for those looking to balance risk with reward.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.12% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.53% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.53% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.42% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.66% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.99% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.96% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.93% | ★★★★★★ |

Click here to see the full list of 1994 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

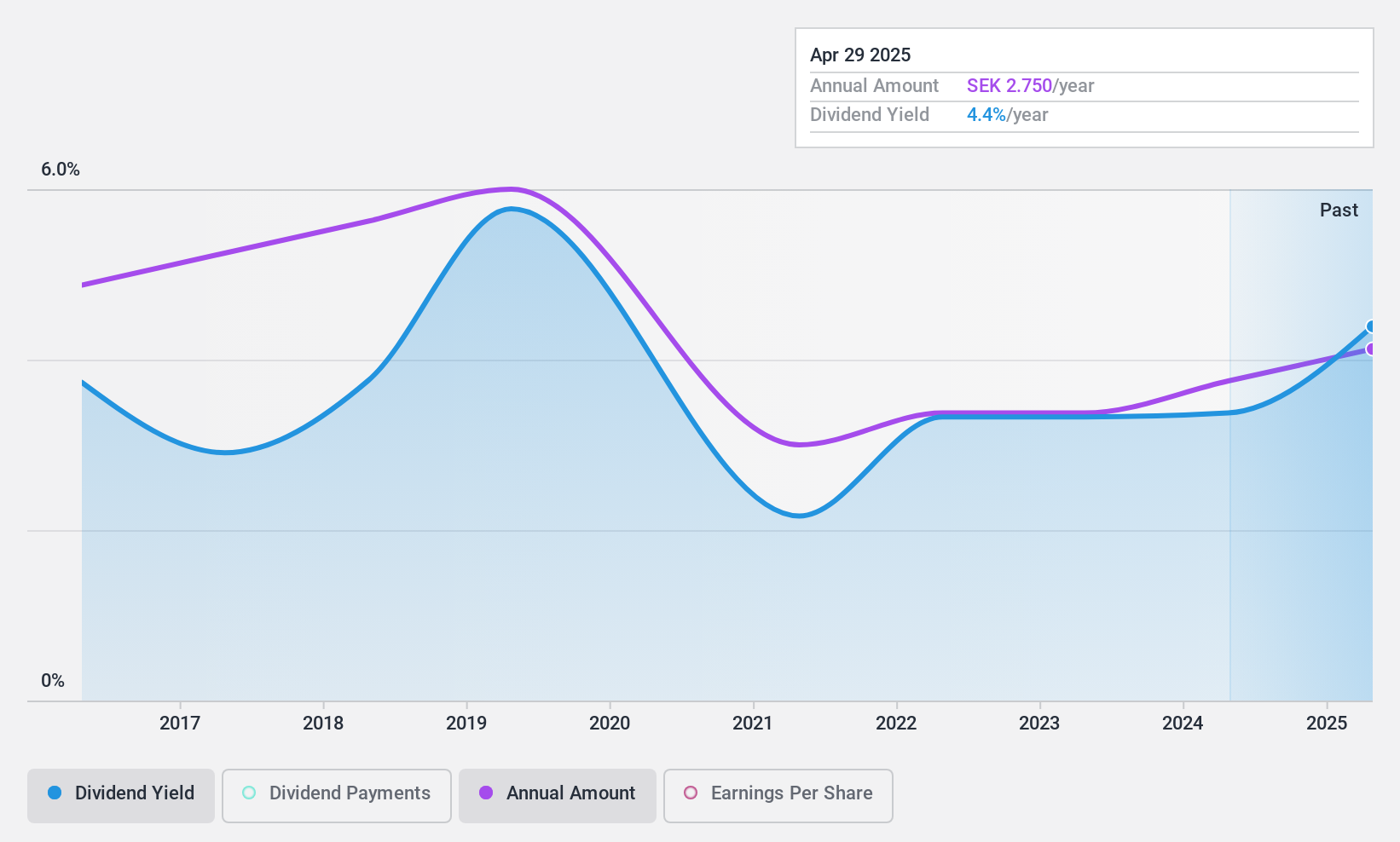

Bulten (OM:BULTEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bulten AB (publ) manufactures and distributes fasteners and related services for various industries including automotive and consumer electronics, operating internationally with a market cap of SEK1.50 billion.

Operations: Bulten AB (publ) generates SEK5.98 billion in revenue from its fasteners and related services across diverse industries, including automotive and consumer electronics, on a global scale.

Dividend Yield: 3.4%

Bulten's dividend payments have been volatile over the past decade, with a payout ratio of 33.6% indicating good earnings coverage. However, cash flow coverage is less robust at 68.1%. The company's price-to-earnings ratio of 9.8x suggests it may be undervalued compared to the broader Swedish market at 23.2x. Recent strategic ventures in Vietnam and India aim to tap into growing demand, potentially supporting future profitability and dividend stability despite high debt levels.

- Dive into the specifics of Bulten here with our thorough dividend report.

- Our valuation report unveils the possibility Bulten's shares may be trading at a premium.

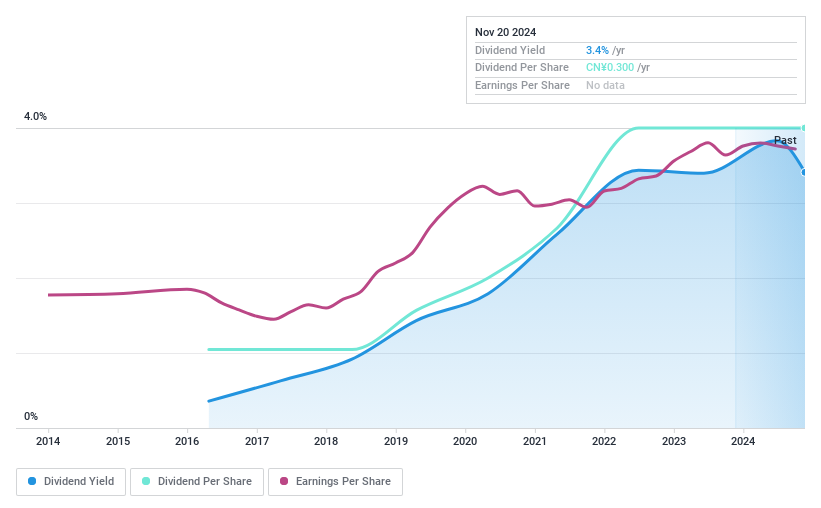

Luyan PharmaLtd (SZSE:002788)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Luyan Pharma Co., Ltd. focuses on the research, development, production, and sale of human health products in China with a market cap of CN¥3.16 billion.

Operations: Luyan Pharma Co., Ltd. generates its revenue through the research, development, production, and sale of human health products in China.

Dividend Yield: 3.7%

Luyan Pharma Ltd.'s dividend is well-supported by both earnings and cash flows, with a payout ratio of 32.3% and a cash payout ratio of 23.3%. Although dividends have been stable and growing, the company has only offered them for nine years. Despite recent earnings growth of just 0.7%, its dividend yield remains competitive in the Chinese market at 3.69%. However, concerns about debt coverage by operating cash flow persist.

- Unlock comprehensive insights into our analysis of Luyan PharmaLtd stock in this dividend report.

- Upon reviewing our latest valuation report, Luyan PharmaLtd's share price might be too pessimistic.

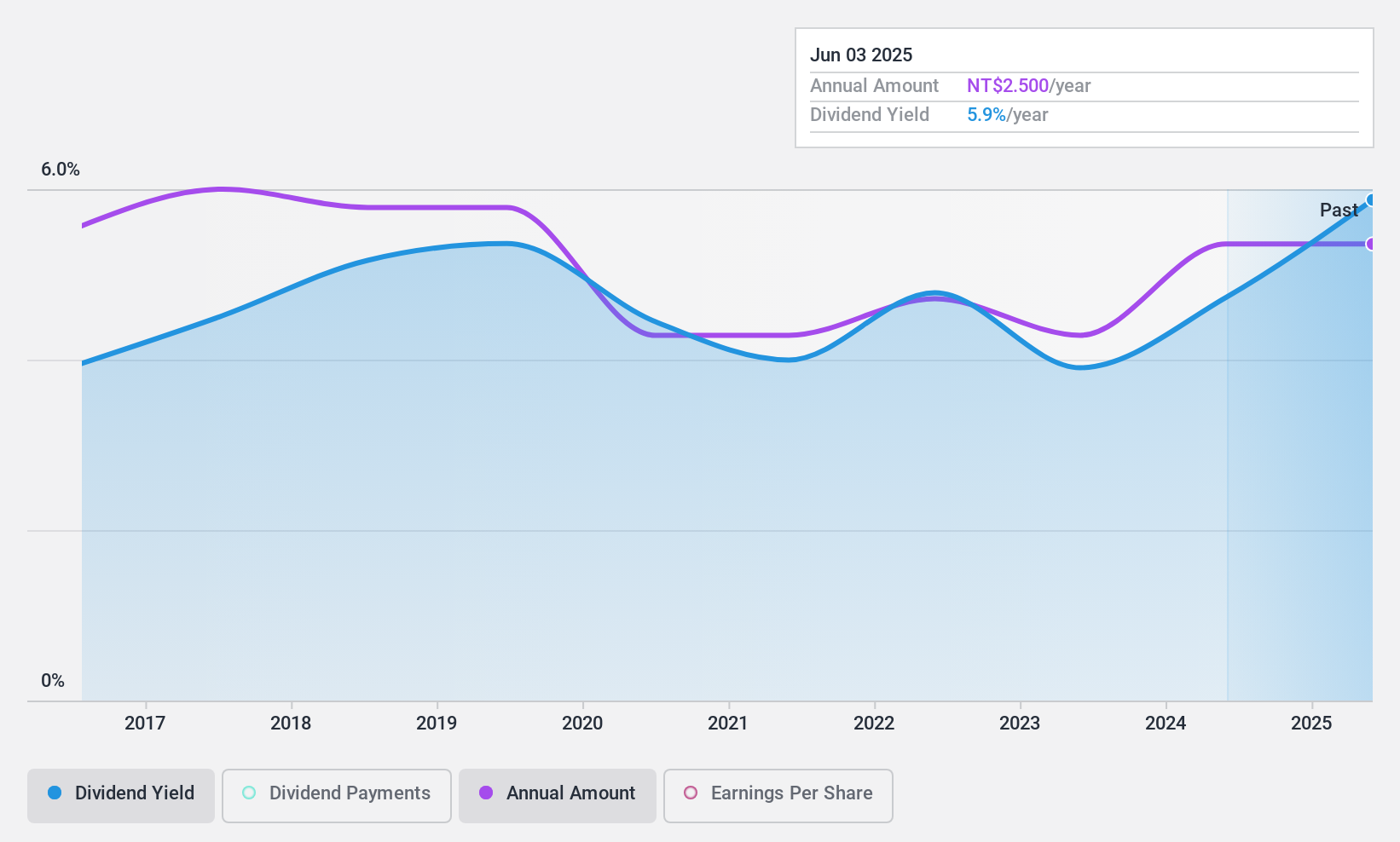

Namchow Holdings (TWSE:1702)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Namchow Holdings Co., Ltd. operates in Taiwan, China, and Thailand, focusing on the manufacture and sale of edible and non-edible oil, frozen dough, and detergents with a market cap of approximately NT$12.29 billion.

Operations: Namchow Holdings Co., Ltd. generates revenue through various segments, including NT$13.29 billion from edible and non-edible oil detergent products, NT$4.47 billion from food excluding frozen dough, NT$2.39 billion from frozen dough, NT$2.09 billion from ice products, NT$859.42 million from catering, and NT$479.49 million from cleaning products in Taiwan, China, and Thailand.

Dividend Yield: 5%

Namchow Holdings' dividend yield is in the top 25% of the TW market, supported by earnings and cash flows with payout ratios of 53.5% and 63.9%, respectively. Despite a history of volatility, dividends have grown over the past decade. Recent financials show increased sales but decreased quarterly net income to TWD 141.99 million from TWD 279.03 million year-on-year, potentially impacting future dividend reliability amidst portfolio changes announced at a recent board meeting.

- Click to explore a detailed breakdown of our findings in Namchow Holdings' dividend report.

- In light of our recent valuation report, it seems possible that Namchow Holdings is trading behind its estimated value.

Key Takeaways

- Dive into all 1994 of the Top Dividend Stocks we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bulten might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BULTEN

Bulten

Manufactures and distributes fasteners and related services and solutions for light vehicles, heavy commercial vehicles, automotive suppliers, consumer electronics, and other industries in Sweden, Poland, Germany, the United Kingdom, rest of Europe, the United States, China, Taiwan, and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives