- Sweden

- /

- Medical Equipment

- /

- OM:SUS

Insiders Favor These 3 Prominent Growth Stocks

Reviewed by Simply Wall St

As global markets navigate a choppy start to the year, with U.S. equities facing pressure from inflation concerns and political uncertainties, investors are keenly observing how insider ownership might signal confidence in potential growth opportunities. In this environment, companies where insiders hold significant stakes can often be seen as promising investments, as their leadership has a vested interest in the long-term success of the business amidst economic fluctuations.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 25.4% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Medley (TSE:4480) | 34% | 27.2% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.3% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

We're going to check out a few of the best picks from our screener tool.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. operates in music production, publishing, and artist development and management, with a market cap of ₩9.27 trillion.

Operations: The company's revenue is derived from three main segments: Label (₩1.29 trillion), Platform (₩337.18 billion), and Solution (₩1.21 trillion).

Insider Ownership: 32.5%

Revenue Growth Forecast: 16.7% p.a.

HYBE is navigating leadership changes with Shin Seon-jeong as Big Hit Music's new CEO, reinforcing Bang Si-hyuk's authority. The company aims to enhance global competitiveness amid slower revenue growth forecasts of 16.7% annually, outpacing the KR market. Despite a challenging third quarter with significant declines in net income and earnings per share, HYBE trades at 15.8% below its estimated fair value and is expected to achieve above-average market profit growth over the next three years.

- Click here and access our complete growth analysis report to understand the dynamics of HYBE.

- Our valuation report unveils the possibility HYBE's shares may be trading at a premium.

Surgical Science Sweden (OM:SUS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Surgical Science Sweden AB (publ) develops and markets virtual reality simulators for evidence-based medical training globally, with a market cap of SEK8.93 billion.

Operations: The company's revenue is divided into two main segments: Industry/OEM, generating SEK419.66 million, and Educational Products, contributing SEK440.17 million.

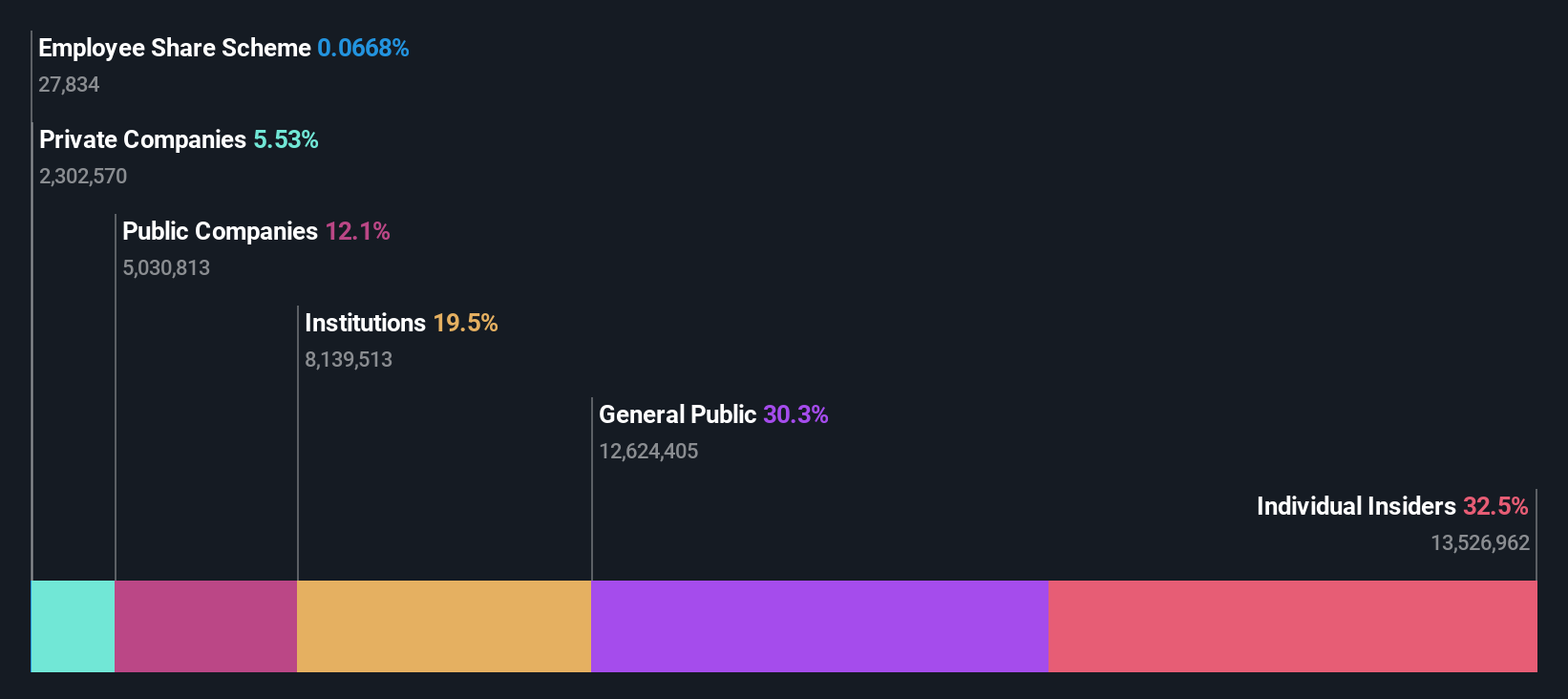

Insider Ownership: 26.6%

Revenue Growth Forecast: 17.2% p.a.

Surgical Science Sweden is poised for significant growth, with revenue expected to rise 17.2% annually, outpacing the Swedish market. Earnings are forecast to grow substantially at 36.1% per year, despite a recent dip in net income and earnings per share for Q3 and the first nine months of 2024. The company trades at a considerable discount to its estimated fair value and is expanding through strategic acquisitions like Intelligent Ultrasound Group plc.

- Get an in-depth perspective on Surgical Science Sweden's performance by reading our analyst estimates report here.

- Our valuation report here indicates Surgical Science Sweden may be overvalued.

Wuhan Jingce Electronic GroupLtd (SZSE:300567)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuhan Jingce Electronic Group Co., Ltd. engages in the research, development, production, and sale of display, semiconductor, and new energy detection systems with a market cap of CN¥16.52 billion.

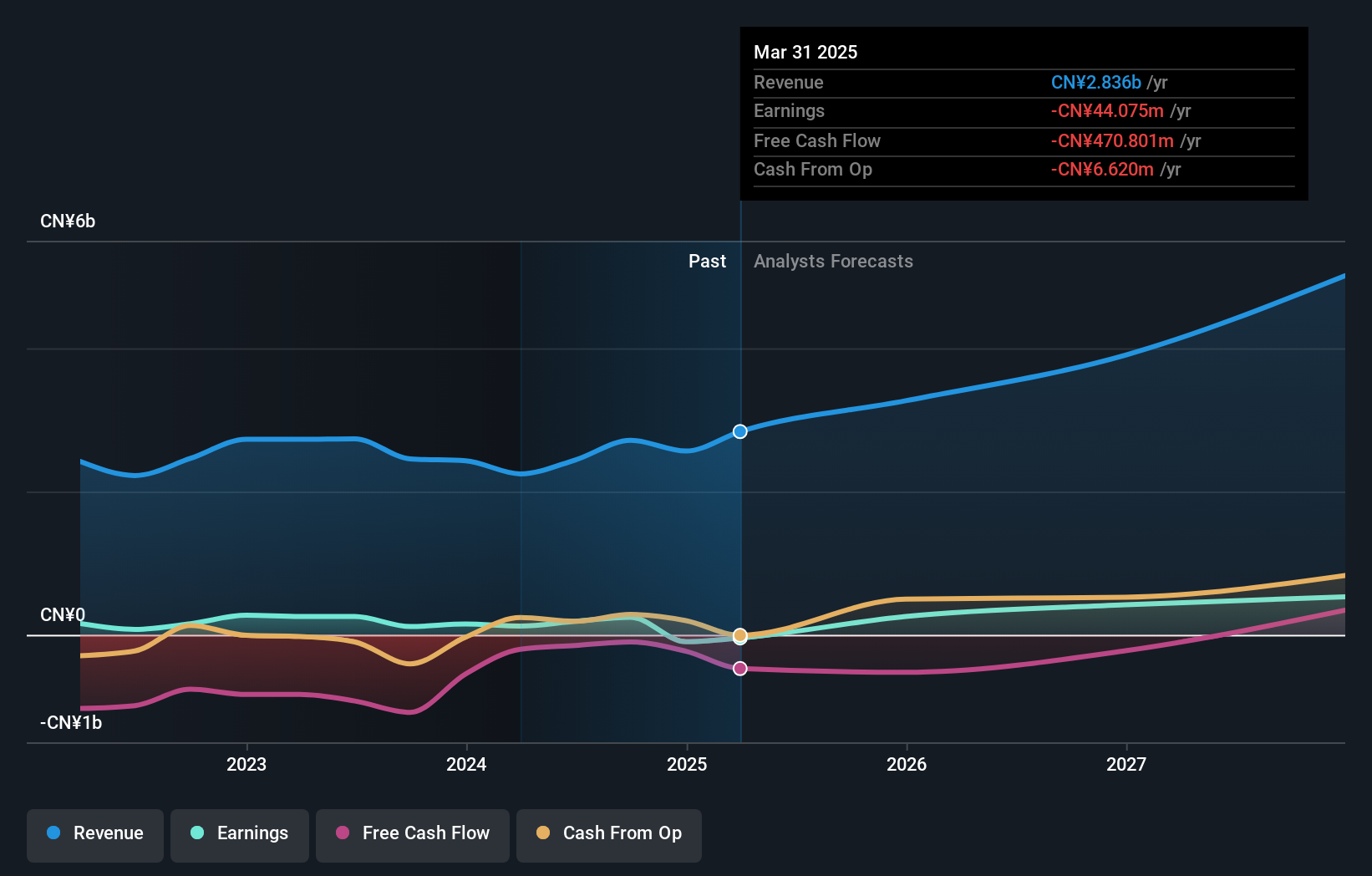

Operations: The company generates revenue of CN¥2.72 billion from its Electron Product segment.

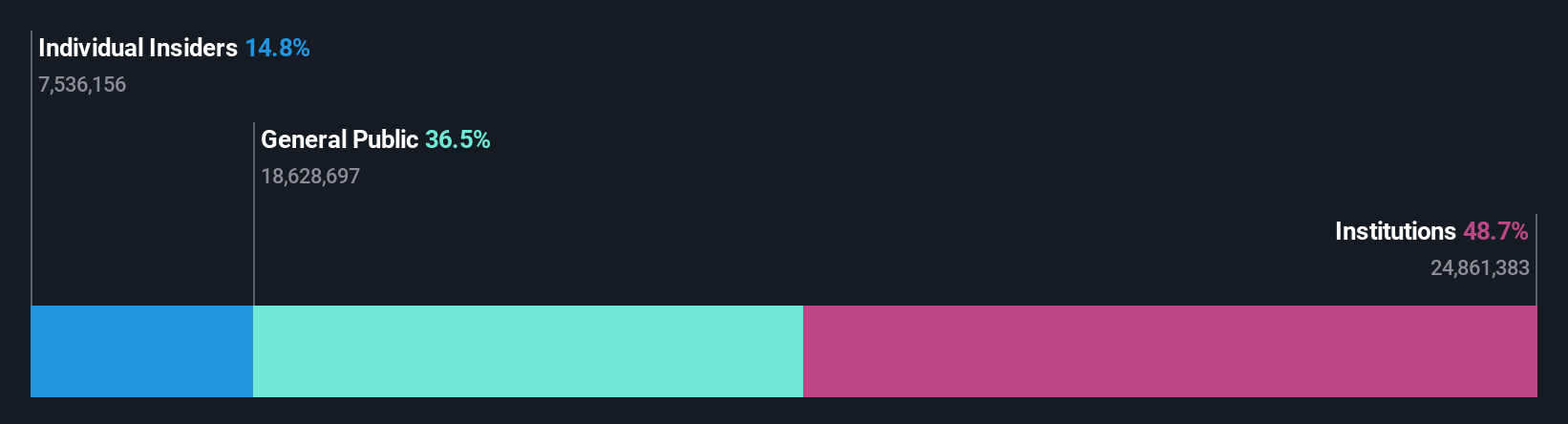

Insider Ownership: 37.4%

Revenue Growth Forecast: 20.1% p.a.

Wuhan Jingce Electronic Group Ltd is positioned for robust growth, with earnings projected to increase significantly at 35.48% annually, surpassing the Chinese market's forecast. Revenue is expected to grow faster than the market at 20.1% per year. Despite low forecasted return on equity and debt challenges, recent financial results show a turnaround with net income reaching CNY 82.24 million from a previous loss, highlighting improved operational performance amidst strategic capital management initiatives.

- Unlock comprehensive insights into our analysis of Wuhan Jingce Electronic GroupLtd stock in this growth report.

- The valuation report we've compiled suggests that Wuhan Jingce Electronic GroupLtd's current price could be inflated.

Next Steps

- Dive into all 1455 of the Fast Growing Companies With High Insider Ownership we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SUS

Surgical Science Sweden

Develops and markets virtual reality simulators for evidence-based medical training in Europe, North and South America, Asia, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives