- Sweden

- /

- Capital Markets

- /

- OM:TRAC B

Exploring Sweden's Top Dividend Stocks For May 2024

Reviewed by Simply Wall St

As global markets display a mixed performance with varying trajectories across major indices, Sweden's market dynamics offer a unique landscape for dividend-seeking investors. Amidst fluctuating economic signals and interest rate speculations, understanding the fundamentals of robust dividend stocks becomes crucial for those looking to enhance their investment portfolios in May 2024.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Betsson (OM:BETS B) | 6.16% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 4.17% | ★★★★★☆ |

| Loomis (OM:LOOMIS) | 4.26% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.16% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.03% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.58% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.19% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.75% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.15% | ★★★★★☆ |

| AB Traction (OM:TRAC B) | 4.02% | ★★★★☆☆ |

Click here to see the full list of 24 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

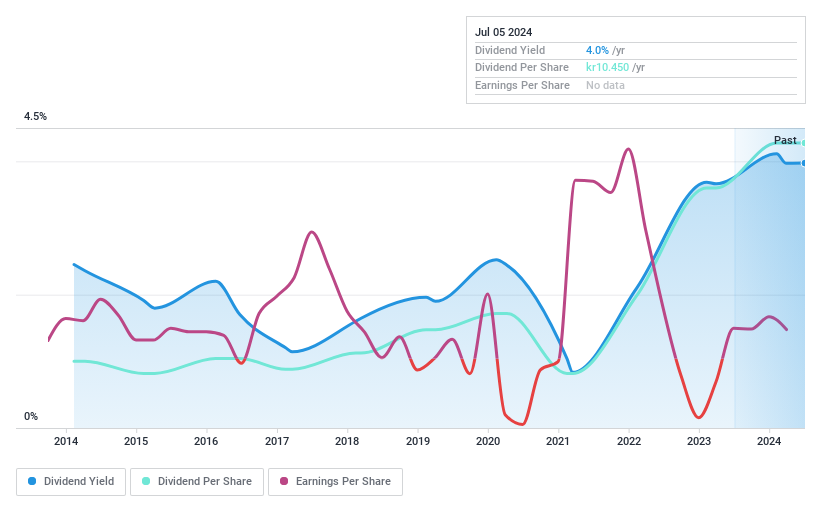

Bravida Holding (OM:BRAV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bravida Holding AB operates in Sweden, Norway, Denmark, and Finland, offering technical services and installations for buildings and industrial facilities with a market capitalization of SEK 16.77 billion.

Operations: Bravida Holding AB generates its revenue from providing technical services and installations across four key regions: Sweden, Norway, Denmark, and Finland.

Dividend Yield: 4.3%

Bravida Holding's dividend yield at 4.34% ranks in the top 25% of Swedish dividend payers, supported by a reasonable payout ratio of 61.7% and a cash payout ratio of 43.5%, indicating that dividends are well-covered by both earnings and cash flow. Despite a relatively short history of dividend payments—only eight years—the company has shown commitment to growing dividends, as evidenced by the recent increase announced at their AGM on May 7, 2024, where shareholders approved a dividend payment totaling SEK 714.29 million for FY2023. However, Bravida's recent challenges include overbilling issues leading to managerial changes and could impact investor confidence.

- Dive into the specifics of Bravida Holding here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Bravida Holding shares in the market.

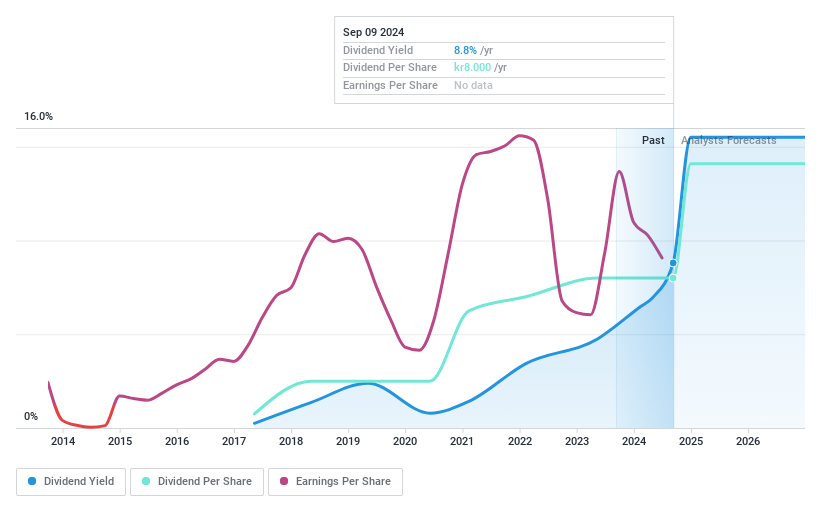

G5 Entertainment (OM:G5EN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: G5 Entertainment AB, based in Sweden, specializes in developing and publishing free-to-play games for smartphones, tablets, and personal computers with a market capitalization of SEK 1.10 billion.

Operations: G5 Entertainment AB generates its revenue primarily through the development and sales of casual games, which totaled SEK 1.27 billion.

Dividend Yield: 5.8%

G5 Entertainment's recent financial performance shows a decline, with Q1 2024 sales dropping to SEK 297.41 million from SEK 345.37 million year-over-year, and net income falling to SEK 37.48 million from SEK 47.76 million. Despite this, the company maintains a sustainable dividend policy with a payout ratio of 54.4% and cash payout ratio of 36.1%, indicating dividends are well-covered by earnings and cash flow respectively. However, G5 Entertainment has been paying dividends for less than ten years, suggesting potential concerns about the long-term stability of its dividend payments.

- Click to explore a detailed breakdown of our findings in G5 Entertainment's dividend report.

- In light of our recent valuation report, it seems possible that G5 Entertainment is trading behind its estimated value.

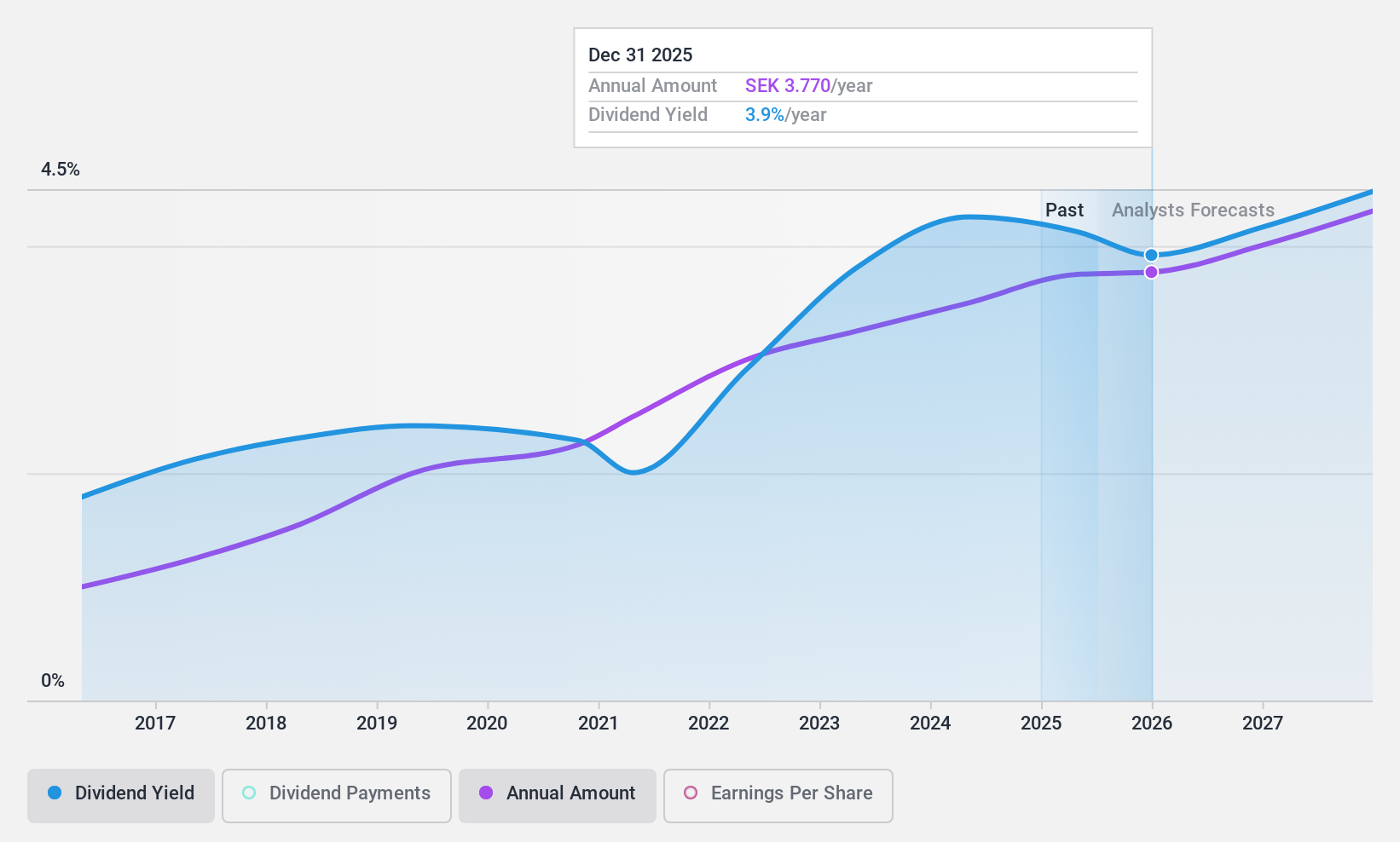

AB Traction (OM:TRAC B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AB Traction is a private equity firm in Sweden, focusing on various investment strategies including distressed assets and buyouts, with a market capitalization of SEK 3.85 billion.

Operations: AB Traction's revenue is primarily generated from its financial investments segment, amounting to SEK 237.90 million.

Dividend Yield: 4%

AB Traction's dividend sustainability is moderately supported with an earnings payout ratio of 82.6% and a similar cash payout ratio, indicating dividends are mostly covered by both earnings and cash flows. However, the firm's dividend history over the past decade has been inconsistent, marked by volatility in payments. Recently, AB Traction reported a decrease in Q1 2024 net income to SEK 128.2 million from SEK 211 million year-over-year, potentially impacting future dividend reliability despite current coverage levels.

- Delve into the full analysis dividend report here for a deeper understanding of AB Traction.

- Our expertly prepared valuation report AB Traction implies its share price may be too high.

Where To Now?

- Get an in-depth perspective on all 24 Top Dividend Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade AB Traction, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TRAC B

AB Traction

A private equity firm specializing in distressed, middle market, later stage, mature, bridge, recapitalization, buyouts and PIPES investments.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives