- Sweden

- /

- Capital Markets

- /

- OM:RATO B

3 Undiscovered Gems In Sweden To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets react to recent economic developments, including the European Central Bank's rate cut and signs of weakening growth in the eurozone, investors are increasingly looking for opportunities outside traditional sectors. In this environment, small-cap stocks in Sweden offer unique potential for portfolio enhancement due to their resilience and growth prospects.

Top 10 Undiscovered Gems With Strong Fundamentals In Sweden

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Softronic | NA | 3.58% | 7.41% | ★★★★★★ |

| Duni | 29.33% | 10.78% | 22.98% | ★★★★★★ |

| Bahnhof | NA | 9.02% | 15.02% | ★★★★★★ |

| AB Traction | NA | 5.38% | 5.19% | ★★★★★★ |

| Firefly | NA | 16.04% | 32.29% | ★★★★★★ |

| AQ Group | 7.30% | 14.89% | 22.26% | ★★★★★★ |

| Svolder | NA | -22.68% | -24.17% | ★★★★★★ |

| Creades | NA | -28.54% | -27.09% | ★★★★★★ |

| Byggmästare Anders J Ahlström Holding | NA | 30.31% | -9.00% | ★★★★★★ |

| Linc | NA | 56.01% | 0.54% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Ratos (OM:RATO B)

Simply Wall St Value Rating: ★★★★☆☆

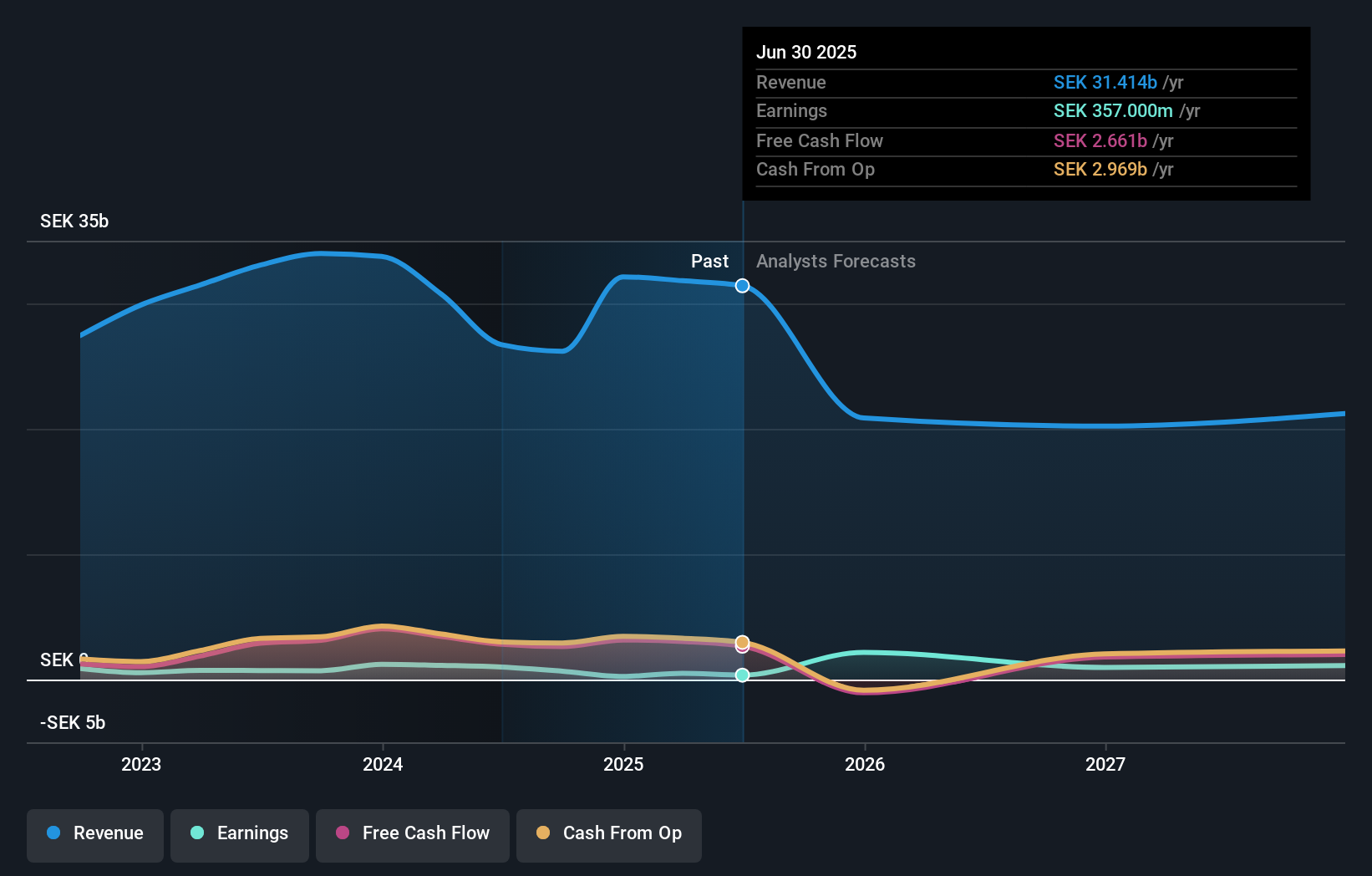

Overview: Ratos AB (publ) is a private equity firm that focuses on buyouts, turnarounds, add-on acquisitions, and middle market transactions with a market cap of approximately SEK11.39 billion.

Operations: Ratos AB (publ) generates revenue primarily from three segments: Consumer (SEK 5.65 billion), Industry (SEK 10.47 billion), and Construction & Services (SEK 16.77 billion). The total revenue is SEK 32.89 billion after accounting for a segment adjustment of -SEK 20 million.

Ratos, a small-cap Swedish investment company, has demonstrated solid performance with earnings growing 34.1% annually over the past five years and a net profit margin of 6.7%. The company's net debt to equity ratio has improved from 56.6% to 33% in five years, showing prudent financial management. Recent results include SEK953M one-off gain impacting last year's financials and second-quarter sales of SEK9.11B compared to SEK10B previously, reflecting strategic shifts amidst new contracts worth SEK1.1B secured by its subsidiary SSEA Group in key regions like Stockholm and Gothenburg.

Rusta (OM:RUSTA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Rusta AB (publ) retails home and leisure products in Sweden, Norway, Finland, and Germany with a market cap of SEK11.42 billion.

Operations: Rusta AB (publ) generates revenue primarily from retailing home and leisure products across Sweden, Norway, Finland, and Germany. The company's market cap stands at SEK11.42 billion.

Rusta's recent performance showcases its robust growth and financial health. For the first quarter ending July 31, 2024, sales reached SEK 3.07 billion, up from SEK 2.96 billion a year prior, while net income rose to SEK 231 million from SEK 189 million. The company repurchased shares in the past year and has more cash than total debt, with EBIT covering interest payments by a factor of 3.4x. Additionally, Rusta's earnings surged by an impressive 47.3% over the past year and are projected to grow annually by around 21%.

- Get an in-depth perspective on Rusta's performance by reading our health report here.

Review our historical performance report to gain insights into Rusta's's past performance.

Svolder (OM:SVOL B)

Simply Wall St Value Rating: ★★★★★★

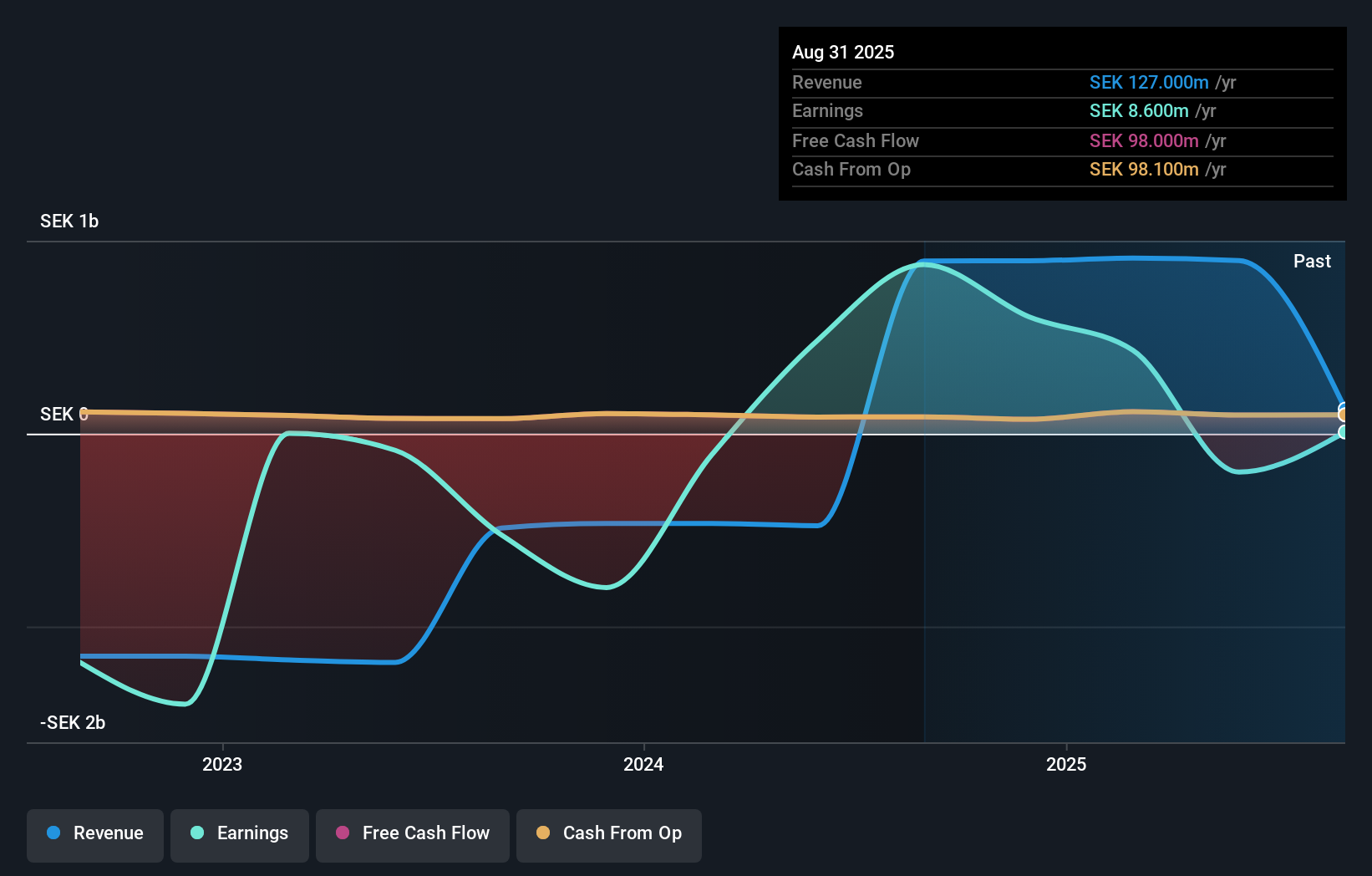

Overview: Svolder AB (publ) is a publicly owned investment manager with a market cap of SEK6.37 billion.

Operations: Revenue streams for Svolder AB (publ) are derived from its investment management activities. The company has a market cap of SEK6.37 billion.

Svolder AB, a small cap with no debt for the past five years, has shown significant improvement. Its price-to-earnings ratio stands at 7.1x, well below the Swedish market average of 23.4x. Recently becoming profitable, Svolder reported a net income of SEK 876 million for the full year ending August 31, 2024, compared to a net loss of SEK 525 million last year. Basic earnings per share from continuing operations reached SEK 8.6 this year from a basic loss per share of SEK 5.1 previously.

- Unlock comprehensive insights into our analysis of Svolder stock in this health report.

Evaluate Svolder's historical performance by accessing our past performance report.

Next Steps

- Click through to start exploring the rest of the 53 Swedish Undiscovered Gems With Strong Fundamentals now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:RATO B

Ratos

A private equity firm specializing in buyouts, turnarounds, add on acquisitions, and middle market transactions.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives