- Sweden

- /

- Diversified Financial

- /

- OM:ORES

Investment AB Öresund (OM:ORES) Net Margin Drop Challenges Dividend Stability Narrative

Reviewed by Simply Wall St

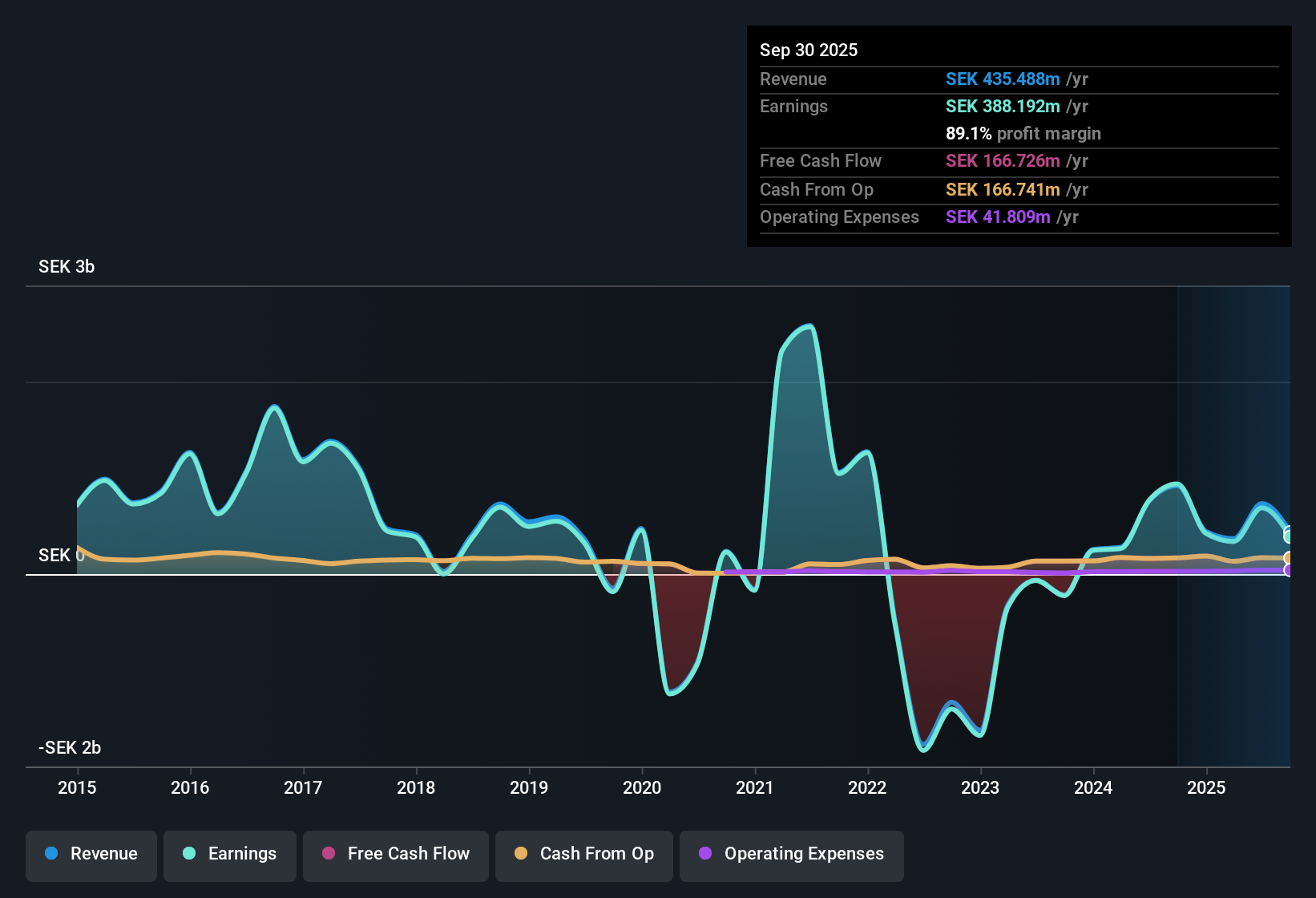

Investment AB Öresund (OM:ORES) reported a net profit margin of 89.1%, a step down from last year, while earnings have declined by 7% per year over the last five years. Shares currently reflect a Price-To-Earnings ratio of 13.5x, which is higher than the peer group average of 13x but below the European Diversified Financial industry’s 16.3x. Despite high quality reported earnings, the ongoing negative growth and shrinking margins put the spotlight on risks for both dividend sustainability and the outlook for future earnings.

See our full analysis for Investment AB Öresund.The next section lines up these figures against widely followed narratives, offering a clear look at which stories hold up and which may need to be reconsidered.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Drops Spark Dividend Doubts

- The net profit margin now stands at 89.1%, marking a clear step down from last year and signaling that profits as a share of total revenue are shrinking.

- Signs of potential stress for dividend seekers stand out, as the high margin may look reassuring at first blush yet persistent margin reduction puts growing pressure on the company’s ability to keep payouts steady.

- The margin decline raises red flags about dividend sustainability, especially when combined with a 7% annual earnings contraction over five years.

- The defensive appeal that investors look for can easily fade if shrinking margins start to erode the reliable income Öresund is known for.

Shrinking Earnings Undermine Growth Narrative

- Earnings have been falling by 7% every year for the last five years, moving in the opposite direction from what long-term investors typically want to see in a stable holding.

- While portfolio stability and manager discipline are often highlighted as strengths, the ongoing negative earnings trend directly challenges the idea that underlying holdings will unlock value soon.

- Lack of positive earnings momentum means even solid portfolio moves might not show up in headline numbers for a while.

- With profits on the decline each year, bulls anticipating a re-rating or sudden value realization may find these results an uphill battle.

Valuation Stuck Between Peers and Sector

- Öresund’s Price-To-Earnings ratio of 13.5x puts it above the peer group average of 13x but below the broader European Diversified Financial industry at 16.3x, so shares look neither especially cheap nor overly expensive against its two benchmarks.

- Apparent value disconnects feed into mixed expectations: some see the stock as a relative bargain compared with the wider industry, yet the premium to peers suggests confidence in earnings stability that may not be fully backed by recent profit performance.

- Investors get no clear “value play” signal with shares lingering between peer and sector averages, especially with continued earnings declines in the background.

- This middle ground invites debate: supporters might cite high quality reported earnings as justification for the mild premium, while skeptics point to industry-wide standards that Öresund is still undercutting.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Investment AB Öresund's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Öresund’s shrinking margins and persistent annual earnings declines challenge its reputation for reliable income and long-term growth stability.

Searching for steadier performers? Shift your focus to companies delivering consistent growth and reliability by checking out stable growth stocks screener now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ORES

Investment AB Öresund

Operates as an investment company that engages in the asset management activities in Sweden.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives