- Sweden

- /

- Industrials

- /

- OM:IDUN B

Sweden's Undiscovered Gems Shining Bright In October 2024

Reviewed by Simply Wall St

As global markets face headwinds from rising U.S. Treasury yields and tepid economic growth in major regions, investors are increasingly looking towards smaller, less volatile markets for potential opportunities. In Sweden, the focus on small-cap companies is gaining traction as these firms often offer unique value propositions and resilience in times of broader market uncertainty. Identifying a good stock in this environment involves looking for companies with strong fundamentals, innovative business models, and the ability to adapt to changing economic conditions—qualities that can make them stand out even when larger indices face pressure.

Top 10 Undiscovered Gems With Strong Fundamentals In Sweden

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Softronic | NA | 3.67% | 7.08% | ★★★★★★ |

| Bahnhof | NA | 9.02% | 15.02% | ★★★★★★ |

| AB Traction | NA | 7.12% | 6.96% | ★★★★★★ |

| Firefly | NA | 16.04% | 32.29% | ★★★★★★ |

| Svolder | NA | -22.68% | -24.17% | ★★★★★★ |

| Investment AB Öresund | NA | 0.07% | 0.45% | ★★★★★★ |

| Linc | NA | 12.52% | 16.39% | ★★★★★★ |

| Byggmästare Anders J Ahlström Holding | NA | 30.31% | -9.00% | ★★★★★★ |

| Bulten | 62.00% | 16.31% | 20.43% | ★★★★☆☆ |

| Nederman Holding | 73.66% | 10.94% | 15.88% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Hoist Finance (OM:HOFI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hoist Finance AB (publ) is a credit market company involved in loan acquisition and management operations across Europe, with a market cap of SEK8.57 billion.

Operations: Hoist Finance generates revenue primarily from unsecured loans, amounting to SEK3.04 billion, and secured loans contributing SEK935 million. The company's net profit margin reflects its financial efficiency in managing these revenue streams.

Hoist Finance, a notable player in the financial sector, has seen its debt to equity ratio improve from 181.2% to 116.6% over five years, although net debt remains high at 111.7%. The company reported a robust earnings growth of 106.8% last year, far outpacing the Consumer Finance industry’s modest 1.4%. With a price-to-earnings ratio of just 10x compared to Sweden's market average of 23.3x, it appears undervalued. Recently completing SEK 1.25 billion in fixed-income offerings and initiating share repurchases up to SEK 100 million indicates strategic capital management aimed at enhancing shareholder value.

- Get an in-depth perspective on Hoist Finance's performance by reading our health report here.

Gain insights into Hoist Finance's historical performance by reviewing our past performance report.

Idun Industrier (OM:IDUN B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Idun Industrier AB (publ) is an investment holding company involved in the manufacture and sale of glass fiber reinforced fat- and oil separators, with a market capitalization of approximately SEK2.92 billion.

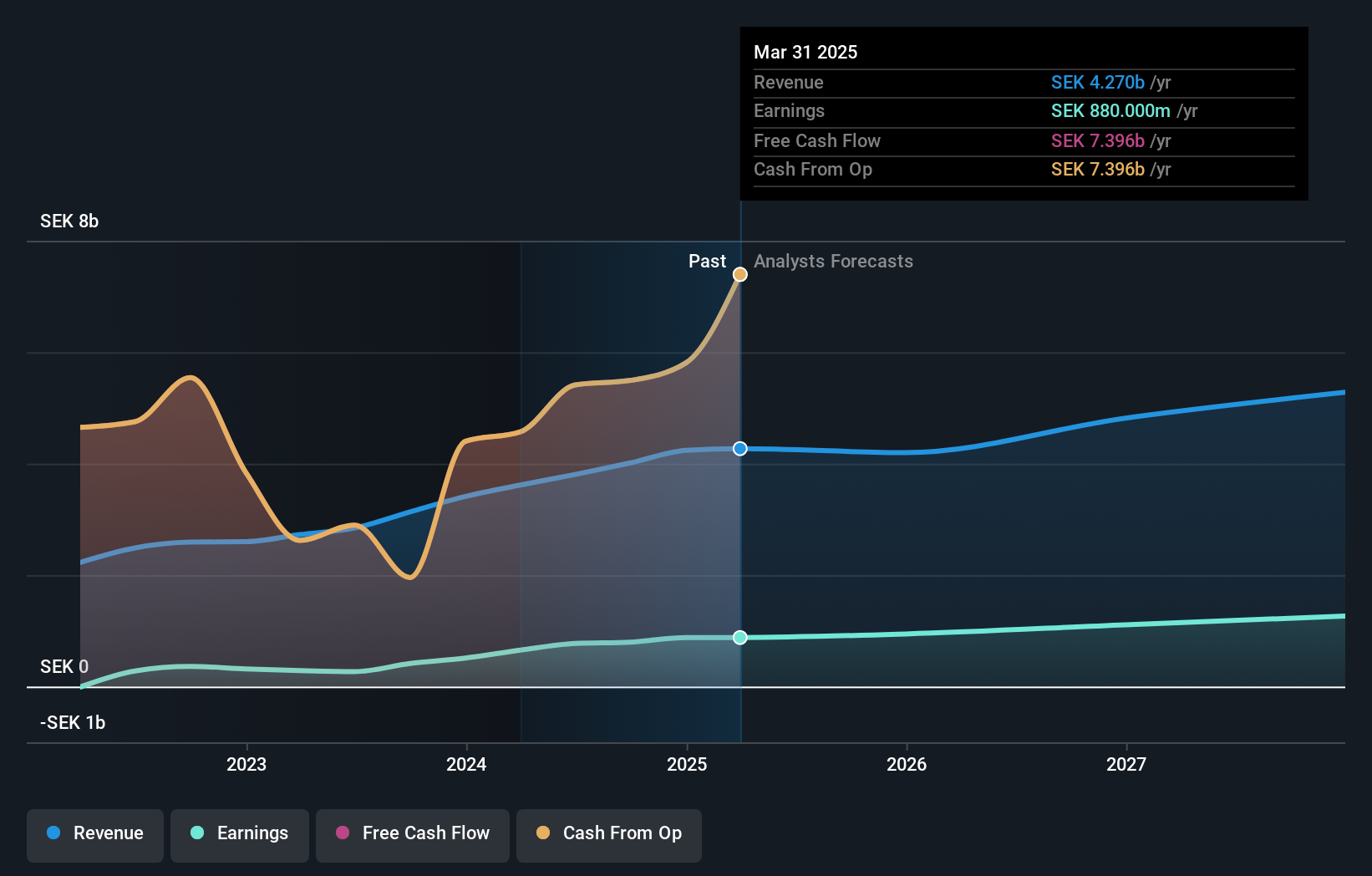

Operations: Idun Industrier generates revenue primarily from its Manufacturing segment, contributing SEK1.34 billion, and Service & Maintenance, adding SEK815.60 million.

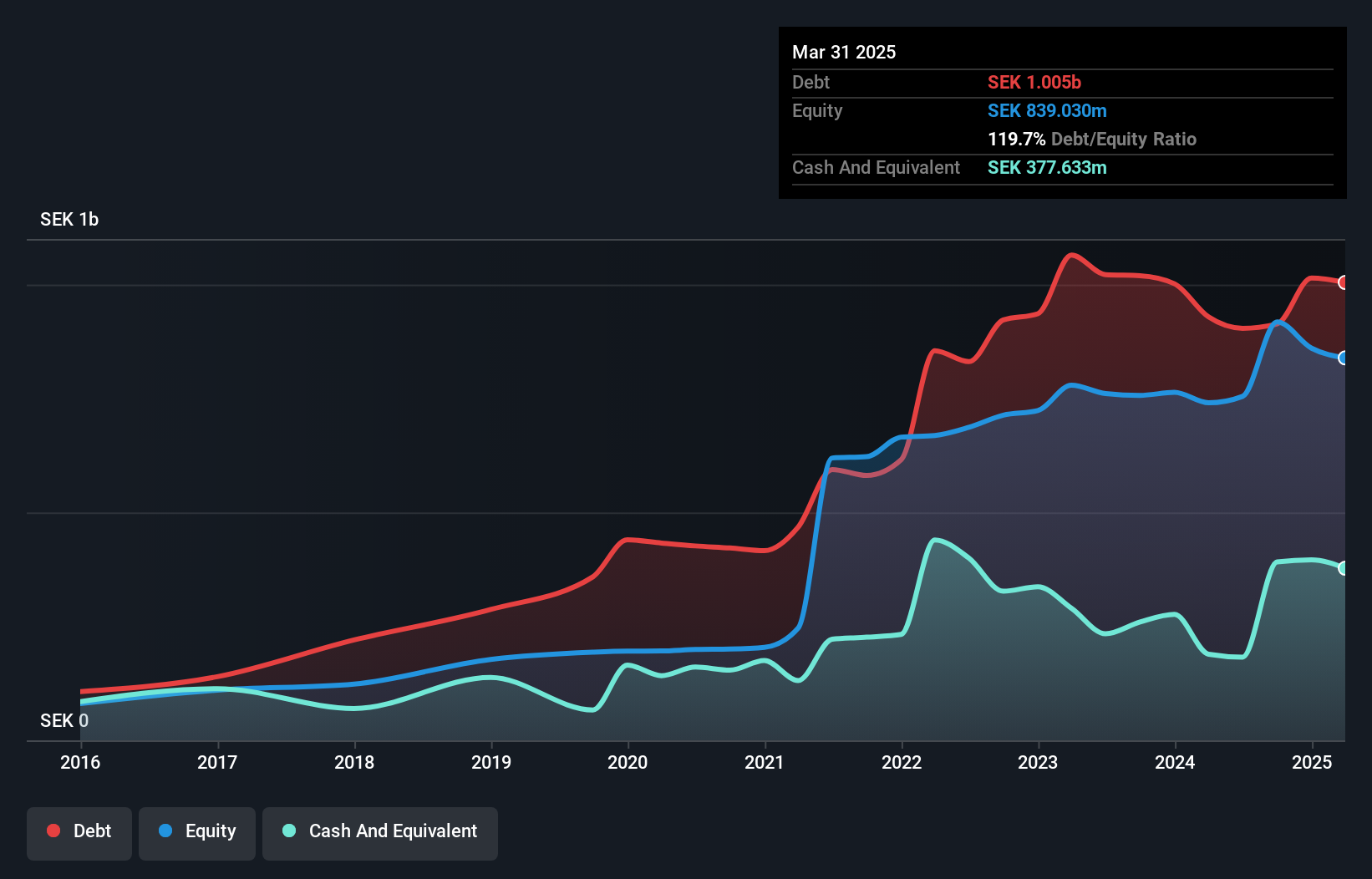

Idun Industrier, a Swedish industrial player, showcases a mixed financial picture. Over the past year, earnings surged by 20%, outpacing the industry average of 3%. However, its net debt to equity ratio remains high at 95.6%, and interest payments are not well covered with an EBIT coverage of just 2.5 times. Despite these concerns, Idun is trading at a value considered 30% below fair estimates and maintains positive free cash flow. Recent earnings reports reveal steady growth in net income to SEK 19.2 million for Q2 compared to SEK 18.21 million last year, indicating resilience amidst challenges.

- Delve into the full analysis health report here for a deeper understanding of Idun Industrier.

Review our historical performance report to gain insights into Idun Industrier's's past performance.

Norion Bank (OM:NORION)

Simply Wall St Value Rating: ★★★★☆☆

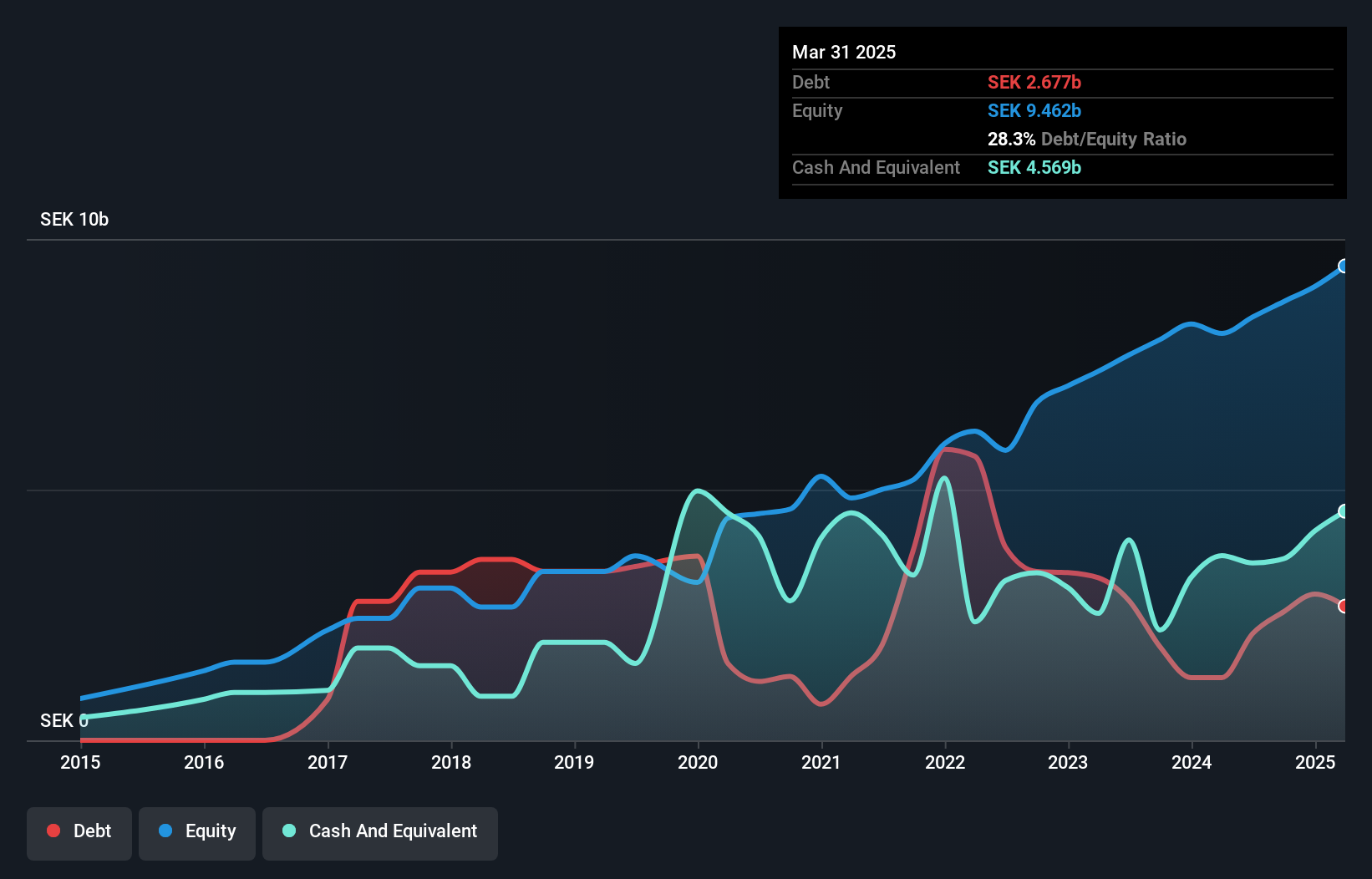

Overview: Norion Bank AB (publ) offers financial solutions for corporate and private individuals, focusing on small and medium-sized companies in Sweden, Finland, Norway, and internationally, with a market cap of SEK8.43 billion.

Operations: Norion Bank's revenue streams are primarily derived from its Real Estate (SEK1.21 billion), Consumer (SEK896 million), and Corporate segments (SEK728 million).

Norion Bank, with total assets of SEK59.3B and equity at SEK8.8B, leans heavily on low-risk customer deposits for funding, making up 91% of liabilities. Despite a high level of bad loans at 21.8%, the bank has a low allowance for these at 46%. Total deposits stand at SEK45.8B against loans of SEK48.5B, indicating solid lending activity relative to its deposit base. The company trades significantly below estimated fair value by 74%, suggesting potential undervaluation in the market context while earnings have grown modestly by 0.2% over the past year and are expected to rise annually by 11%.

Turning Ideas Into Actions

- Embark on your investment journey to our 57 Swedish Undiscovered Gems With Strong Fundamentals selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:IDUN B

Idun Industrier

An investment holding company, engages in the manufacture and sale of glass fiber reinforced fat- and oil separators in Sweden.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives