- Sweden

- /

- Consumer Finance

- /

- OM:HOFI

Revenue Downgrade: Here's What Analysts Forecast For Hoist Finance AB (publ) (STO:HOFI)

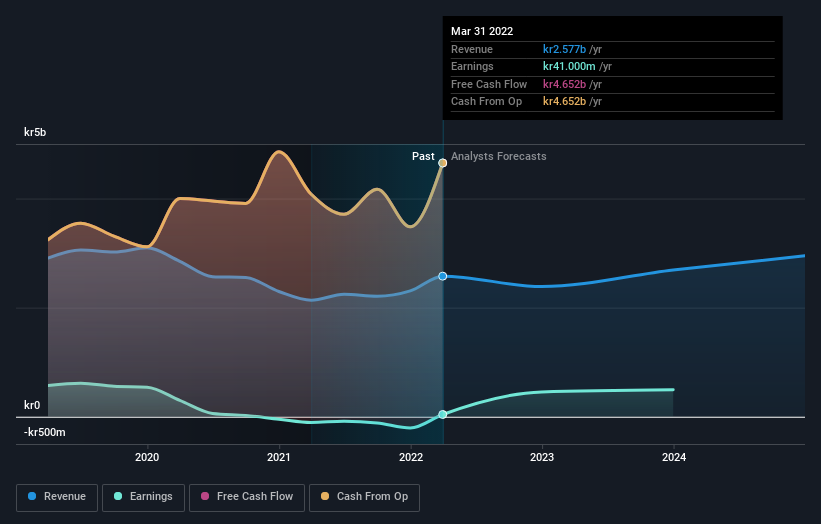

The latest analyst coverage could presage a bad day for Hoist Finance AB (publ) (STO:HOFI), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic. At kr28.60, shares are up 4.5% in the past 7 days. We'd be curious to see if the downgrade is enough to reverse investor sentiment on the business.

Following the downgrade, the consensus from two analysts covering Hoist Finance is for revenues of kr2.4b in 2022, implying a discernible 7.4% decline in sales compared to the last 12 months. Before the latest update, the analysts were foreseeing kr2.9b of revenue in 2022. It looks like forecasts have become a fair bit less optimistic on Hoist Finance, given the measurable cut to revenue estimates.

Check out our latest analysis for Hoist Finance

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. Over the past five years, revenues have declined around 0.7% annually. Worse, forecasts are essentially predicting the decline to accelerate, with the estimate for an annualised 7.4% decline in revenue until the end of 2022. Compare this against analyst estimates for companies in the broader industry, which suggest that revenues (in aggregate) are expected to grow 7.0% annually. So while a broad number of companies are forecast to grow, unfortunately Hoist Finance is expected to see its sales affected worse than other companies in the industry.

The Bottom Line

The clear low-light was that analysts slashing their revenue forecasts for Hoist Finance this year. They also expect company revenue to perform worse than the wider market. Given the stark change in sentiment, we'd understand if investors became more cautious on Hoist Finance after today.

Worse, Hoist Finance is labouring under a substantial debt burden, which - if today's forecasts prove accurate - the forecast downgrade could potentially exacerbate. To see more of our financial analysis, you can click through to our free platform to learn more about its balance sheet and specific concerns we've identified.

We also provide an overview of the Hoist Finance Board and CEO remuneration and length of tenure at the company, and whether insiders have been buying the stock, here.

Valuation is complex, but we're here to simplify it.

Discover if Hoist Finance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:HOFI

Hoist Finance

A credit market company, engages in the loan acquisition and management operations in Europe.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives