- Sweden

- /

- Capital Markets

- /

- OM:CS

Diversified Altcoin ETF Launch Could Be a Game Changer for CoinShares International (OM:CS)

Reviewed by Sasha Jovanovic

- CoinShares International Limited recently announced the launch of the CoinShares Altcoins ETF (DIME), a U.S.-listed fund on Nasdaq that provides diversified exposure to 10 top altcoins beyond Bitcoin and Ethereum through a portfolio of crypto ETPs accessible via traditional brokerage accounts.

- This product is among the first to allow U.S. investors to access a wider spectrum of the crypto market through a familiar ETF structure, addressing the gap left by the dominance of spot Bitcoin and Ethereum ETFs.

- We'll explore how the introduction of diversified altcoin access via a traditional ETF format could reshape CoinShares' investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is CoinShares International's Investment Narrative?

CoinShares International stands at the intersection of traditional finance and digital assets, and the launch of the CoinShares Altcoins ETF (DIME) on Nasdaq could be a meaningful short-term catalyst. By opening up diversified altcoin exposure to U.S. investors through a familiar ETF structure, CoinShares is actively addressing one of the sector’s most persistent bottlenecks: the inaccessibility of the broader crypto market via standard brokerage accounts. This move may accelerate product adoption and enhance the company’s profile, especially as interest in crypto investment products is reaching new heights globally. However, as CoinShares shifts toward this innovative avenue, it also faces fresh risks, including potential regulatory scrutiny and the volatility inherent in altcoin markets. The impact of DIME’s success or challenges may reshape near-term revenue prospects and recalibrate the risk profile for shareholders.

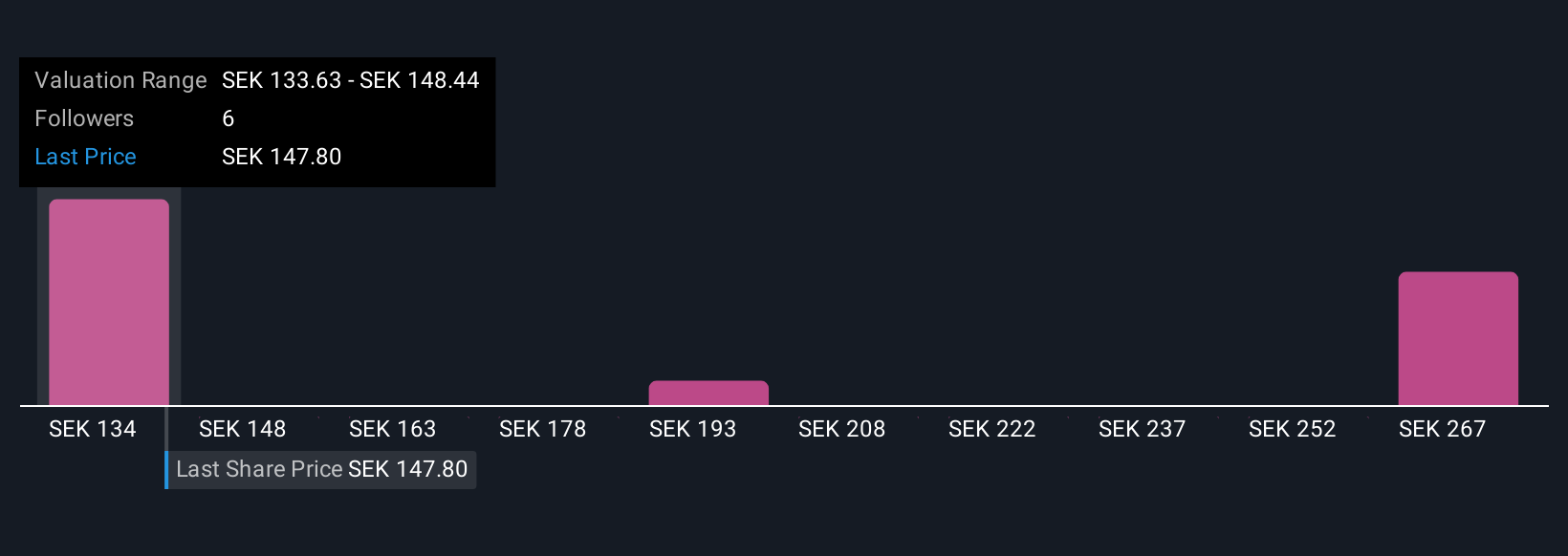

Yet, regulatory uncertainties and shifting investor sentiment around digital assets could be crucial to watch. CoinShares International's shares have been on the rise but are still potentially undervalued by 44%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on CoinShares International - why the stock might be worth as much as 76% more than the current price!

Build Your Own CoinShares International Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CoinShares International research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CoinShares International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CoinShares International's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CS

CoinShares International

Engages in the creating financial products with digital assets and blockchain technology business in Jersey.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives