- Sweden

- /

- Retail Distributors

- /

- OM:ZZ B

3 European Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As European markets recently experienced a downturn, with the STOXX Europe 600 Index ending 1.10% lower amid profit-taking and political uncertainties, investors are increasingly looking for stable options to weather the volatility. In this context, dividend stocks can offer a reliable income stream and potential for capital appreciation, making them an attractive choice for enhancing portfolios in uncertain times.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.30% | ★★★★★★ |

| Sulzer (SWX:SUN) | 3.15% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.84% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.58% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.17% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.29% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.65% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.29% | ★★★★★☆ |

| Bravida Holding (OM:BRAV) | 4.06% | ★★★★★★ |

| Banque Cantonale de Genève (SWX:BCGE) | 26.53% | ★★★★★★ |

Click here to see the full list of 230 stocks from our Top European Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

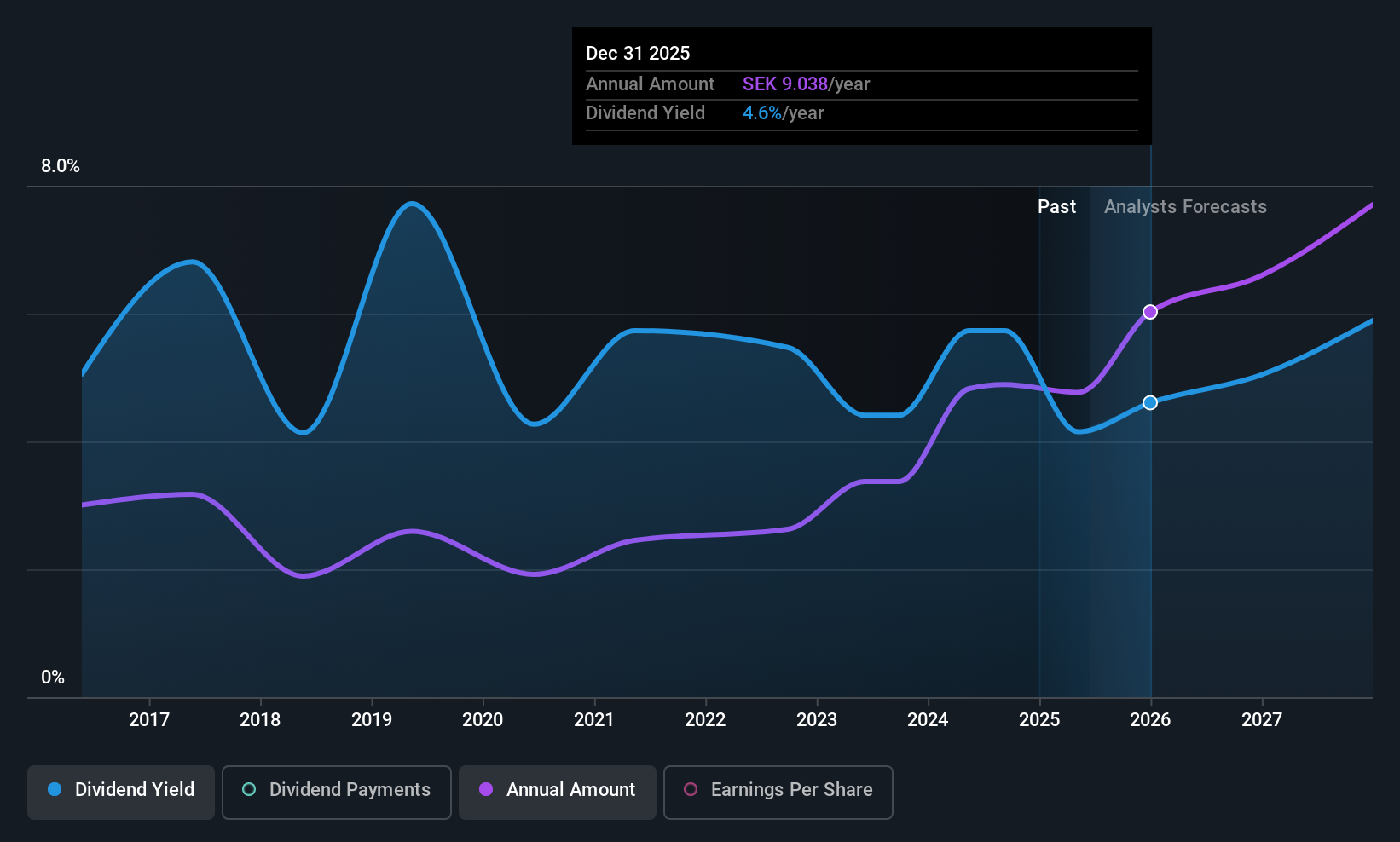

Betsson (OM:BETS B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Betsson AB (publ) operates and manages online gaming businesses across various regions including the Nordic countries, Latin America, and Europe, with a market cap of SEK20.79 billion.

Operations: Betsson AB generates its revenue primarily from its Casinos & Resorts segment, which accounts for €1.18 billion.

Dividend Yield: 4.8%

Betsson's dividend payments are well-covered, with a payout ratio of 46.9% and a cash payout ratio of 40.6%. Despite being in the top 25% of Swedish dividend payers, its dividends have been volatile over the past decade. The company trades at a significant discount to its estimated fair value and peers, suggesting good relative value. Recent earnings growth supports future payouts, but insider selling may raise concerns about stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Betsson.

- Upon reviewing our latest valuation report, Betsson's share price might be too pessimistic.

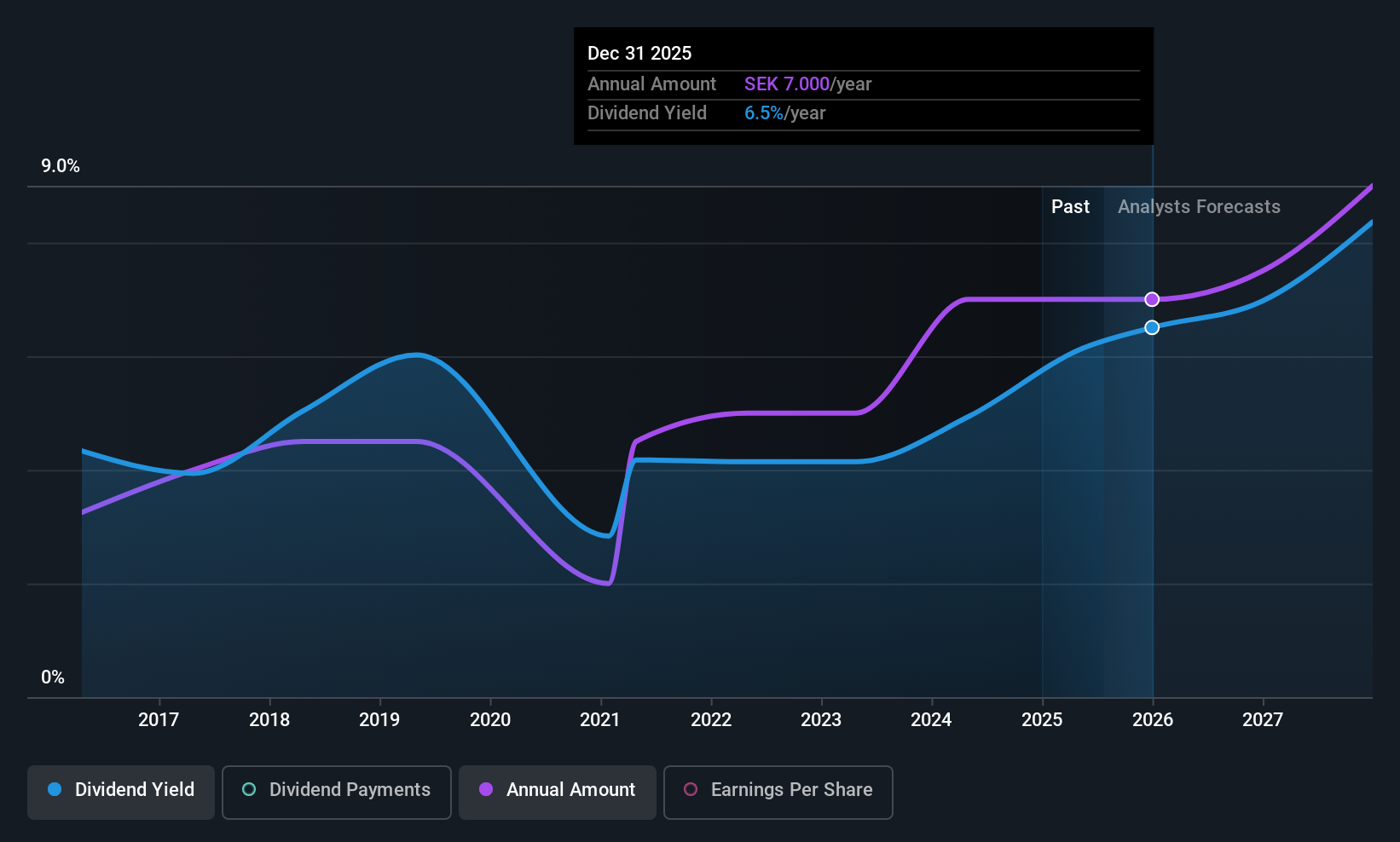

Ework Group (OM:EWRK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ework Group AB (publ) provides total talent solutions across IT/OT, research and development, engineering, and business development in several European countries, with a market cap of SEK1.86 billion.

Operations: Ework Group AB (publ) generates revenue through its comprehensive talent solutions services in IT/OT, research and development, engineering, and business development across Sweden, Norway, Finland, Germany, Denmark, Poland, and Slovakia.

Dividend Yield: 6.5%

Ework Group's dividend yield of 6.52% ranks in the top 25% of Swedish payers, yet it is not well covered by earnings, with a payout ratio of 102.9%. While dividends are supported by cash flows and have grown over the past decade, they remain volatile and unreliable. Trading at a substantial discount to fair value suggests potential upside. Recent executive changes and expansion into Germany may influence future performance amid declining recent earnings results.

- Unlock comprehensive insights into our analysis of Ework Group stock in this dividend report.

- The valuation report we've compiled suggests that Ework Group's current price could be quite moderate.

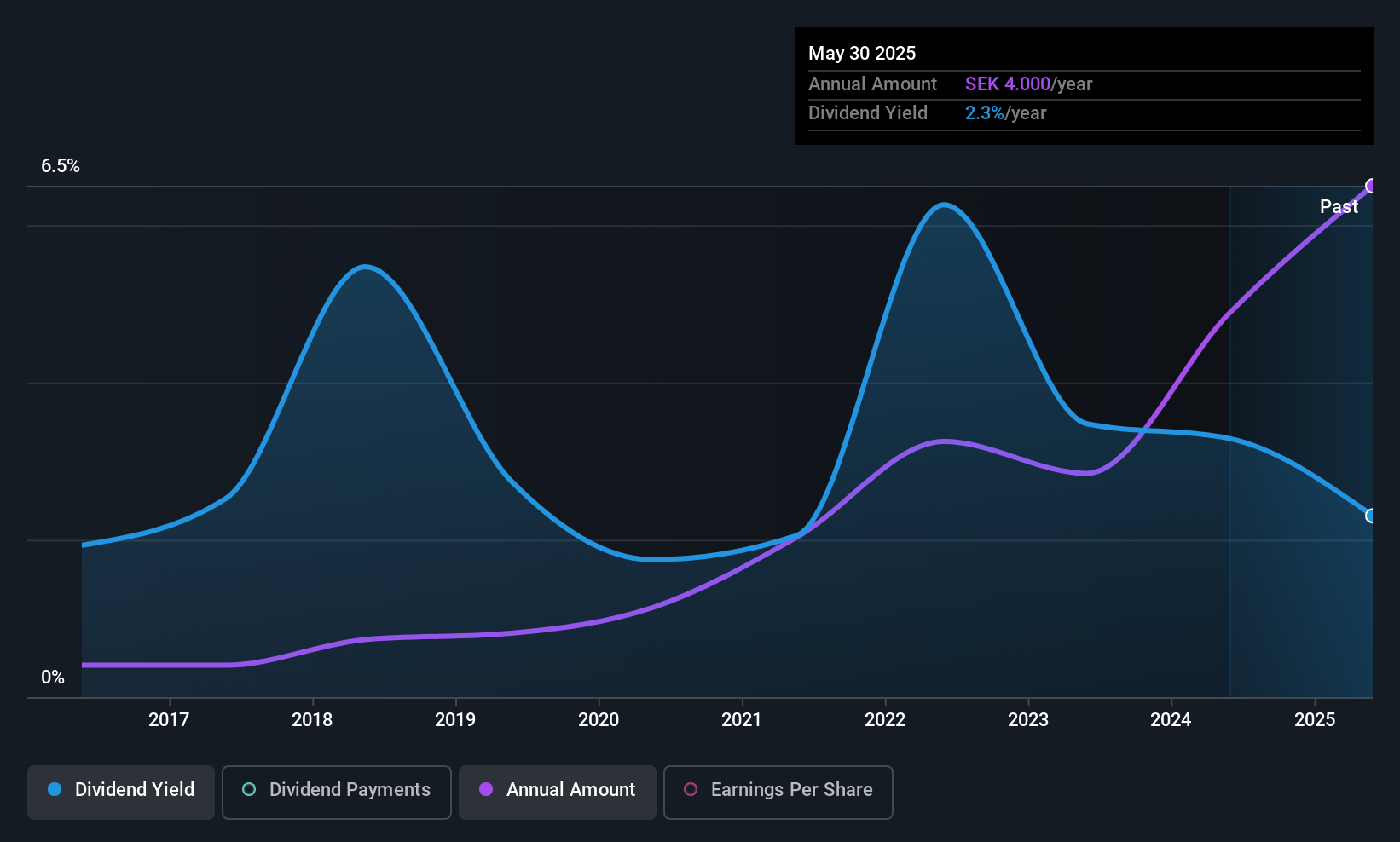

Zinzino (OM:ZZ B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zinzino AB (publ) is a direct sales company that offers dietary supplements and skincare products both in Sweden and internationally, with a market cap of SEK4.73 billion.

Operations: Zinzino AB (publ) generates its revenue from two main segments: Faun, contributing SEK177.77 million, and Zinzino (including VMA Life), which accounts for SEK2.68 billion.

Dividend Yield: 3.1%

Zinzino's dividend, yielding 3.07%, is lower than the top Swedish payers but has shown stability and growth over the past decade. The payout ratio of 70.5% indicates dividends are well-covered by earnings, supported further by a cash payout ratio of 52%. Recent revenue growth—54% year-to-date—highlights strong sales momentum, potentially bolstered by innovative product launches like the gut Health Test. However, share price volatility remains a concern for investors seeking stability.

- Get an in-depth perspective on Zinzino's performance by reading our dividend report here.

- Our valuation report unveils the possibility Zinzino's shares may be trading at a discount.

Where To Now?

- Reveal the 230 hidden gems among our Top European Dividend Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zinzino might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ZZ B

Zinzino

A direct sales company, provides dietary supplements and skincare products in Sweden and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives