- Sweden

- /

- Consumer Services

- /

- OM:ACAD

European Undervalued Small Caps With Insider Action To Consider In October 2025

Reviewed by Simply Wall St

As European markets reach record levels, driven by a rally in technology stocks and expectations for lower U.S. borrowing costs, small-cap stocks are gaining attention for their potential to outperform in such an environment. In this context, identifying small-cap companies with strong fundamentals and insider activity can offer unique opportunities amidst the broader market optimism.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Cairn Homes | 12.1x | 1.5x | 30.62% | ★★★★★★ |

| Boozt | 17.1x | 0.8x | 40.23% | ★★★★★☆ |

| BEWI | NA | 0.5x | 39.60% | ★★★★★☆ |

| Bytes Technology Group | 17.4x | 4.4x | 12.04% | ★★★★☆☆ |

| Renold | 10.7x | 0.7x | 0.34% | ★★★★☆☆ |

| Fastighets AB Trianon | 13.3x | 4.4x | -202.97% | ★★★★☆☆ |

| Pexip Holding | 35.5x | 5.2x | 41.47% | ★★★☆☆☆ |

| Nyab | 21.2x | 0.9x | 37.88% | ★★★☆☆☆ |

| Fevara | NA | 0.9x | 38.58% | ★★★☆☆☆ |

| CVS Group | 46.2x | 1.3x | 36.54% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

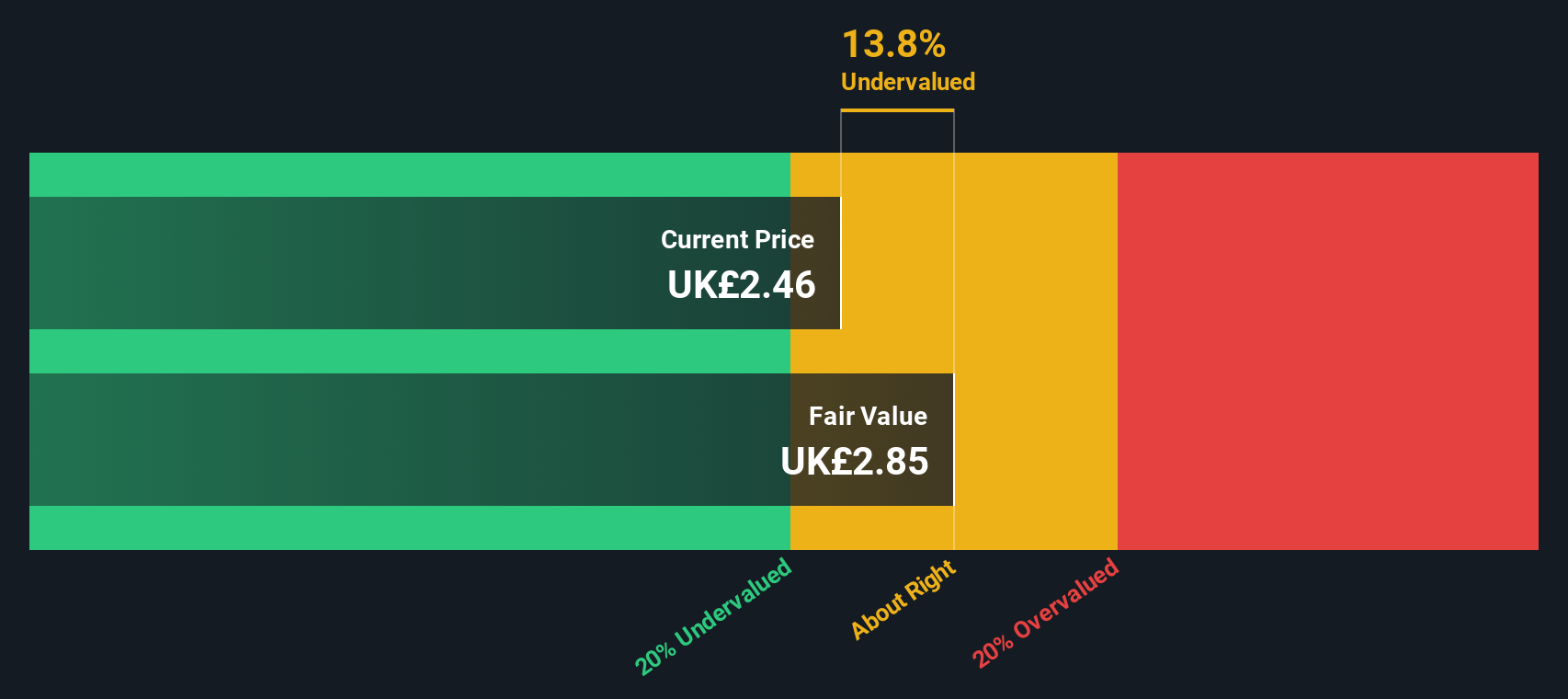

Hollywood Bowl Group (LSE:BOWL)

Simply Wall St Value Rating: ★★★★★★

Overview: Hollywood Bowl Group operates a chain of ten-pin bowling centers across the UK, with a focus on providing family-friendly entertainment and leisure activities, and has a market capitalization of approximately £0.45 billion.

Operations: The company generates revenue primarily from recreational activities, with a recent revenue figure of £240.46 million. Cost of goods sold stands at £89.63 million, impacting the gross profit margin, which is currently 62.73%. Operating expenses are significant at £89.41 million, contributing to a net income margin of 11.89%.

PE: 14.8x

Hollywood Bowl Group, a small European player in the entertainment sector, has caught attention with insider confidence shown through recent share purchases in early 2025. Despite relying solely on external borrowing for funding, which introduces higher risk, their earnings are projected to grow at an annual rate of 14%. This growth potential suggests that the stock might be trading below its intrinsic value. The company's strategic positioning within the leisure industry could support future expansion and profitability.

- Click here to discover the nuances of Hollywood Bowl Group with our detailed analytical valuation report.

Gain insights into Hollywood Bowl Group's past trends and performance with our Past report.

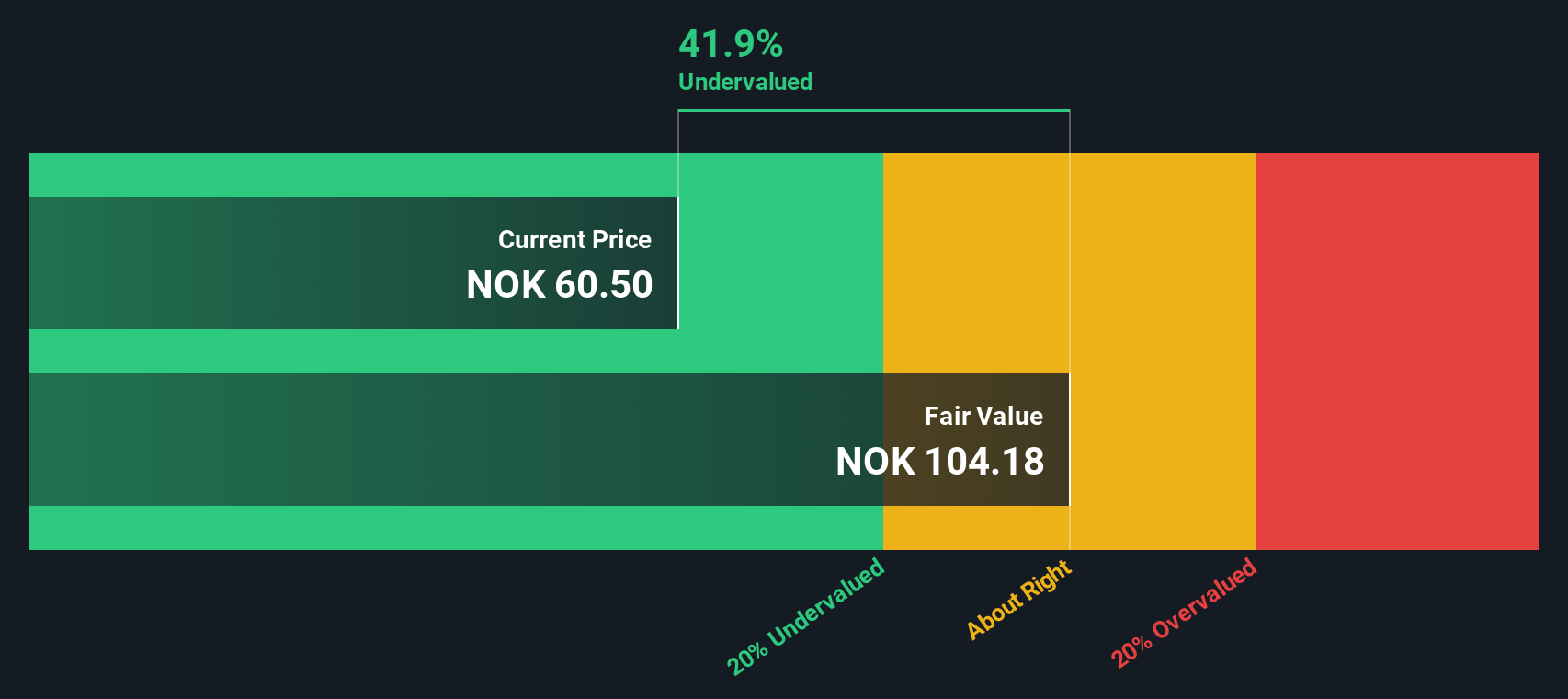

Pexip Holding (OB:PEXIP)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Pexip Holding provides video communication and collaboration services, with a market capitalization of NOK 1.65 billion.

Operations: Pexip Holding generates revenue primarily from the sale of collaboration services, reaching NOK 1.19 billion in recent periods. The company has seen fluctuations in its gross profit margin, which was at 41.38% as of the latest data point. Operating expenses have consistently impacted net income, with a notable improvement in net income margin to 14.76%.

PE: 35.5x

Pexip Holding, a player in the European small-cap space, shows potential with insider confidence as Trond Johannessen acquired 8,000 shares for NOK 334,960. Despite relying on riskier external borrowing for funding, their recent financial performance is promising. For the second quarter of 2025, sales rose to NOK 281 million from NOK 266 million the previous year. The company also completed a buyback of over 1.6% of its shares for NOK 99.9 million by August. Earnings are expected to grow annually by over 20%, suggesting room for future growth despite current challenges.

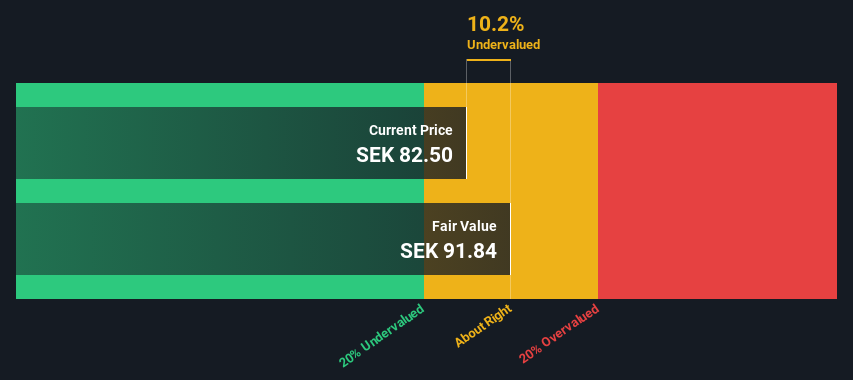

AcadeMedia (OM:ACAD)

Simply Wall St Value Rating: ★★★★★☆

Overview: AcadeMedia is a leading education provider operating in adult education, compulsory and upper secondary schools, as well as preschool and international segments, with a market capitalization of SEK 7.28 billion.

Operations: AcadeMedia's revenue streams are primarily derived from Preschool & International, Upper Secondary Schools, Compulsory School, and Adult Education. The company's cost structure is heavily influenced by the Cost of Goods Sold (COGS), which reached SEK 13.10 billion in June 2025. Over recent periods, AcadeMedia's gross profit margin has shown a notable trend with a figure of 31.14% as of June 2025.

PE: 11.7x

AcadeMedia, a growing education provider in Europe, recently reported a 12.68% annual earnings growth forecast. Despite relying on external borrowing for funding, the company shows insider confidence with the Chief Financial Officer purchasing 3,000 shares worth approximately SEK 299K in September 2025. Expanding its footprint in Germany, AcadeMedia plans to add over 500 preschool places across seven new units by 2028 amid strong demand and a significant shortage of preschool spots. Recent earnings reveal increased sales and net income compared to last year, alongside an improved dividend proposal of SEK 2.25 per share.

- Delve into the full analysis valuation report here for a deeper understanding of AcadeMedia.

Understand AcadeMedia's track record by examining our Past report.

Where To Now?

- Get an in-depth perspective on all 50 Undervalued European Small Caps With Insider Buying by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ACAD

AcadeMedia

Operates as an independent education provider in Sweden, Norway, the Netherlands, and Germany.

Undervalued with solid track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)