- Sweden

- /

- Consumer Services

- /

- NGM:HOME B

HomeMaid AB (publ) (NGM:HOME B) Is About To Go Ex-Dividend, And It Pays A 5.8% Yield

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see HomeMaid AB (publ) (NGM:HOME B) is about to trade ex-dividend in the next 3 days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. In other words, investors can purchase HomeMaid's shares before the 8th of June in order to be eligible for the dividend, which will be paid on the 14th of June.

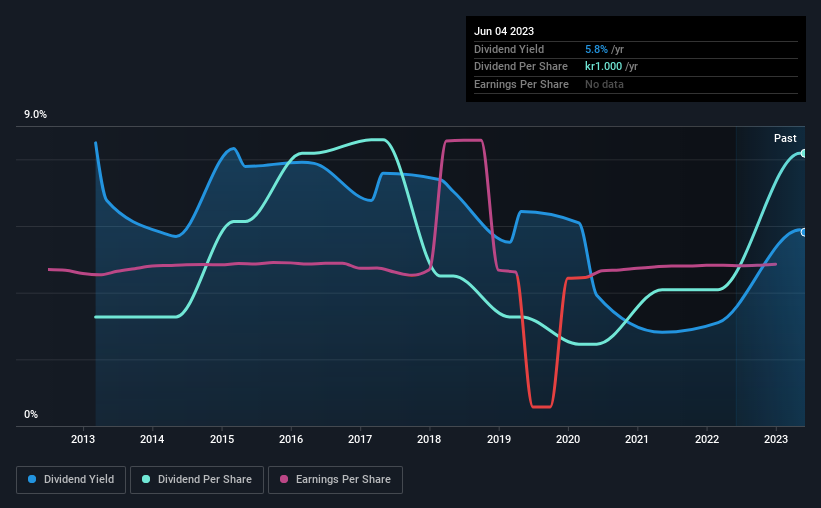

The company's upcoming dividend is kr1.00 a share, following on from the last 12 months, when the company distributed a total of kr1.00 per share to shareholders. Last year's total dividend payments show that HomeMaid has a trailing yield of 5.8% on the current share price of SEK17.2. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to check whether the dividend payments are covered, and if earnings are growing.

Check out our latest analysis for HomeMaid

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. HomeMaid paid out 106% of its earnings, which is more than we're comfortable with, unless there are mitigating circumstances. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. Over the last year it paid out 53% of its free cash flow as dividends, within the usual range for most companies.

It's good to see that while HomeMaid's dividends were not covered by profits, at least they are affordable from a cash perspective. If executives were to continue paying more in dividends than the company reported in profits, we'd view this as a warning sign. Extraordinarily few companies are capable of persistently paying a dividend that is greater than their profits.

Click here to see how much of its profit HomeMaid paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings fall far enough, the company could be forced to cut its dividend. Fortunately for readers, HomeMaid's earnings per share have been growing at 12% a year for the past five years.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. HomeMaid has delivered an average of 9.6% per year annual increase in its dividend, based on the past 10 years of dividend payments. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

Final Takeaway

Is HomeMaid worth buying for its dividend? Growing earnings per share and a normal cashflow payout ratio is an ok combination, but we're concerned that the company is paying out such a high percentage of its income as dividends. Overall, it's hard to get excited about HomeMaid from a dividend perspective.

However if you're still interested in HomeMaid as a potential investment, you should definitely consider some of the risks involved with HomeMaid. Every company has risks, and we've spotted 5 warning signs for HomeMaid (of which 2 can't be ignored!) you should know about.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HomeMaid might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NGM:HOME B

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)