3 Stocks Trading At An Estimated Discount For Value Investors

Reviewed by Simply Wall St

As global markets navigate a mixed landscape of fluctuating consumer confidence, economic growth concerns, and shifting interest rates, investors are keenly observing the performance of major indices. Despite these challenges, opportunities arise for value investors seeking stocks that may be trading at an estimated discount. Identifying undervalued stocks involves assessing companies with strong fundamentals that have been overlooked by the broader market, offering potential for long-term growth amidst current economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Corporativo Fragua. de (BMV:FRAGUA B) | MX$631.28 | MX$1257.07 | 49.8% |

| SKS Technologies Group (ASX:SKS) | A$1.935 | A$3.86 | 49.8% |

| Shenzhen Lifotronic Technology (SHSE:688389) | CN¥15.24 | CN¥30.82 | 50.6% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1130.65 | ₹2253.01 | 49.8% |

| Lindab International (OM:LIAB) | SEK228.20 | SEK452.08 | 49.5% |

| S Foods (TSE:2292) | ¥2745.00 | ¥5472.35 | 49.8% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.50 | THB30.86 | 49.8% |

| Infomart (TSE:2492) | ¥308.00 | ¥574.47 | 46.4% |

| Surgical Science Sweden (OM:SUS) | SEK159.60 | SEK317.20 | 49.7% |

| SkyCity Entertainment Group (NZSE:SKC) | NZ$1.45 | NZ$2.90 | 49.9% |

Underneath we present a selection of stocks filtered out by our screen.

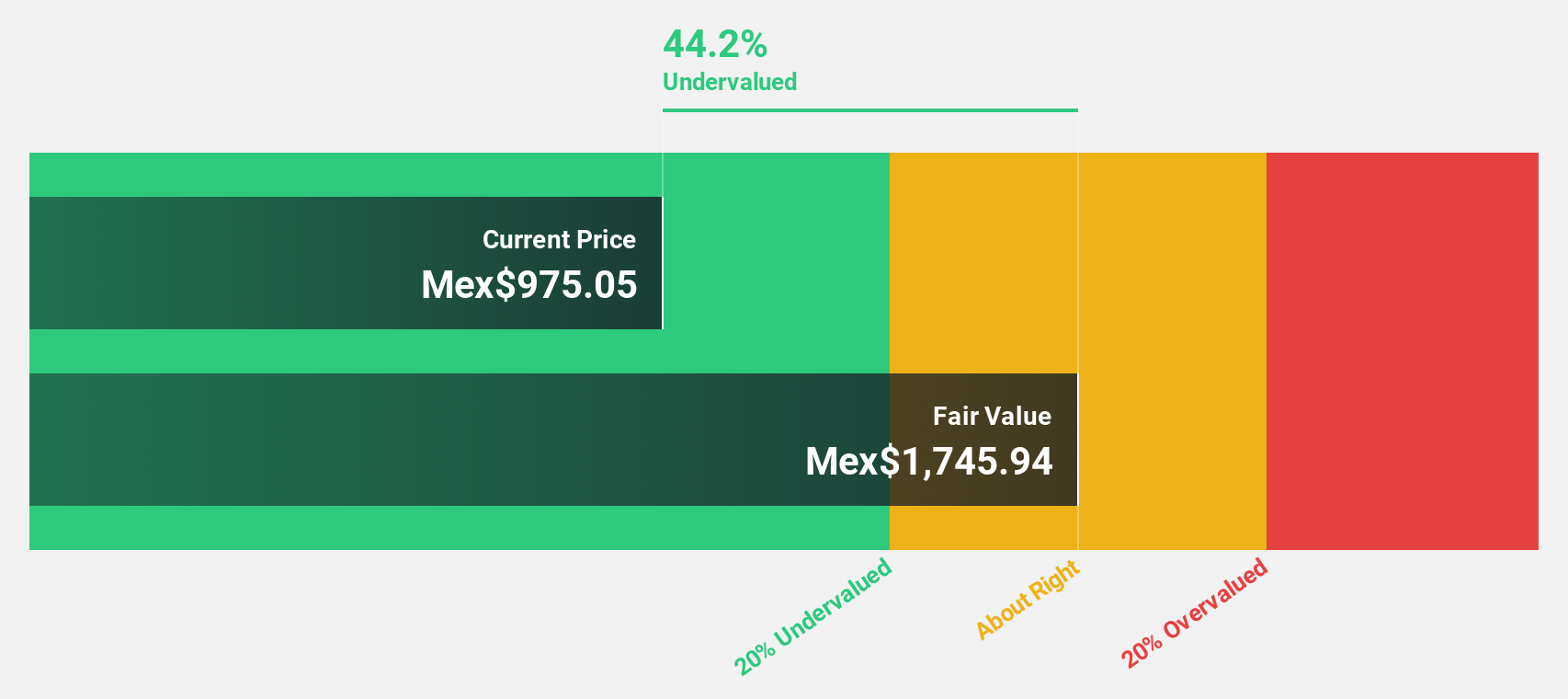

Vista Energy. de (BMV:VISTA A)

Overview: Vista Energy, S.A.B. de C.V., operates in the exploration and production of oil and gas across Latin America with a market capitalization of MX$103.67 billion.

Operations: The company's revenue primarily stems from its exploration and production activities in crude oil, natural gas, and LPG, generating $1.49 billion.

Estimated Discount To Fair Value: 46.1%

Vista Energy appears undervalued, trading 46.1% below its estimated fair value of MX$2019.78, with a forecasted revenue growth of 20.9% per year outpacing the market's 7.2%. Despite high debt levels and volatile share prices, earnings grew by 52.2% over the past year to US$165.46 million for Q3 2024, supported by increased production volumes across oil and gas segments. Recent successful fixed-income offerings totaling $600 million may bolster financial stability further.

- According our earnings growth report, there's an indication that Vista Energy. de might be ready to expand.

- Get an in-depth perspective on Vista Energy. de's balance sheet by reading our health report here.

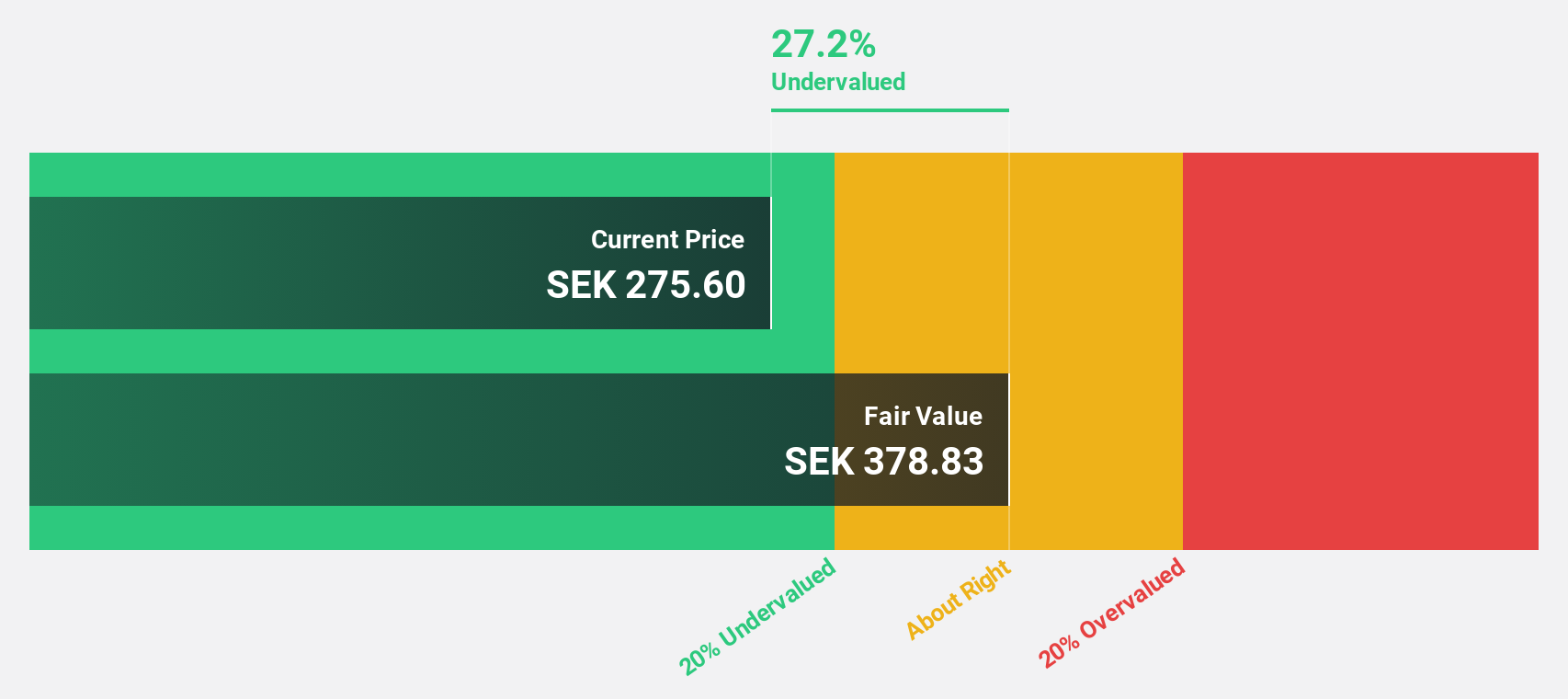

Thule Group (OM:THULE)

Overview: Thule Group AB (publ) is a sports and leisure company operating in Sweden and internationally, with a market cap of SEK36.14 billion.

Operations: The company generates revenue primarily from its Outdoor & Bags segment, amounting to SEK9.43 billion.

Estimated Discount To Fair Value: 16.7%

Thule Group is trading at SEK341.8, approximately 16.7% below its estimated fair value of SEK410.24, indicating potential undervaluation based on cash flows. Earnings are projected to grow significantly at 23.3% per year, surpassing the Swedish market's growth rate of 14.8%. Recent Q3 results show increased net income to SEK300 million from SEK262 million a year ago, alongside stable revenue growth and ongoing discussions about acquiring Quad Lock to enhance strategic positioning.

- The growth report we've compiled suggests that Thule Group's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Thule Group's balance sheet health report.

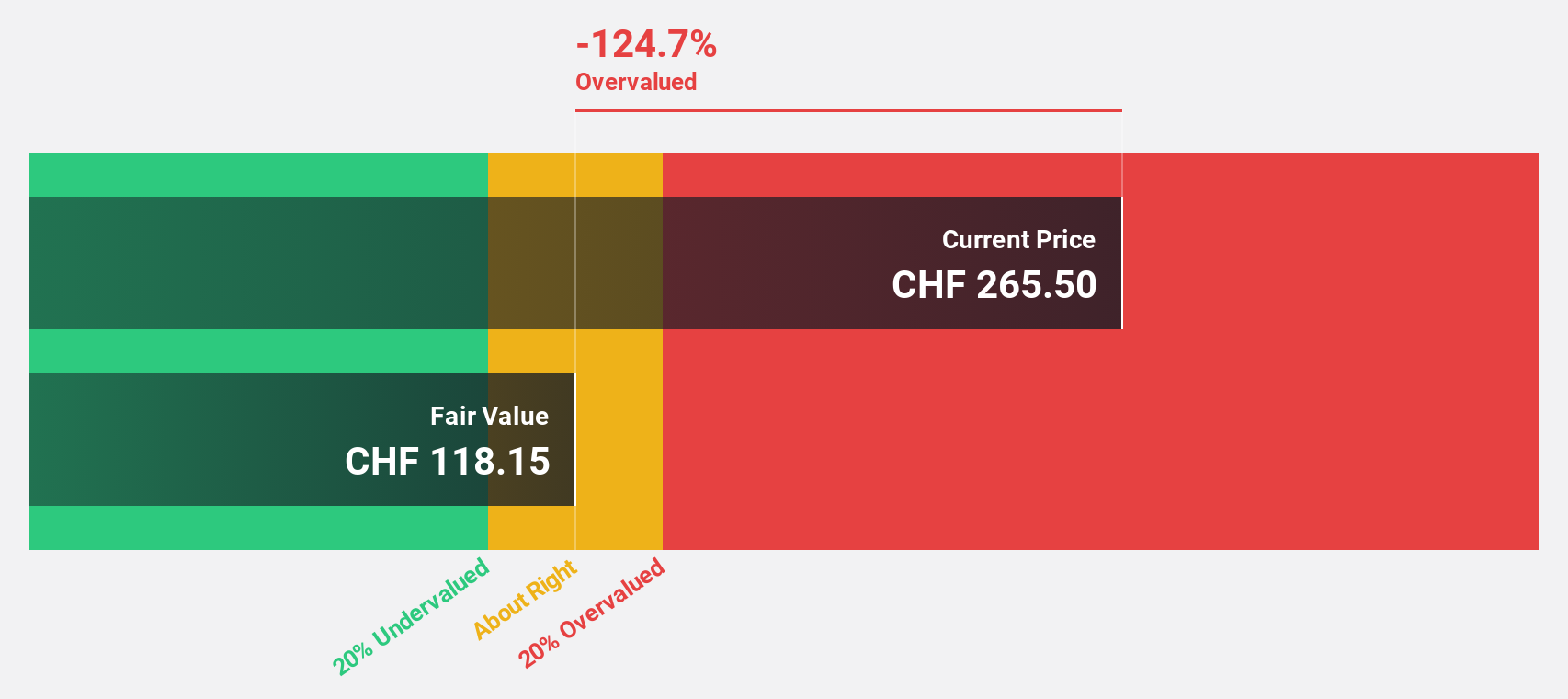

ALSO Holding (SWX:ALSN)

Overview: ALSO Holding AG is a technology services provider for the ICT industry, operating in Switzerland, Germany, the Netherlands, Poland, and internationally with a market cap of CHF2.77 billion.

Operations: The company's revenue segments include €4.62 billion from Central Europe and €5.24 billion from Northern/Eastern Europe.

Estimated Discount To Fair Value: 19.8%

ALSO Holding, trading at CHF226, is valued below its estimated fair value of CHF281.77, highlighting potential undervaluation based on cash flows. Earnings are expected to grow significantly at 27.62% annually, outpacing the Swiss market's 11.7%. Revenue growth forecasts of 12.5% per year exceed the market average of 4.2%. Despite a reliable dividend yield of 2.01%, return on equity is projected to remain relatively low at 15.4% in three years.

- Our growth report here indicates ALSO Holding may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of ALSO Holding.

Next Steps

- Investigate our full lineup of 871 Undervalued Stocks Based On Cash Flows right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thule Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:THULE

Thule Group

Engages in sports and leisure company in Sweden and internationally.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives