- Sweden

- /

- Consumer Durables

- /

- OM:NOBI

Revenues Tell The Story For Nobia AB (publ) (STO:NOBI) As Its Stock Soars 28%

Despite an already strong run, Nobia AB (publ) (STO:NOBI) shares have been powering on, with a gain of 28% in the last thirty days. Looking further back, the 18% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

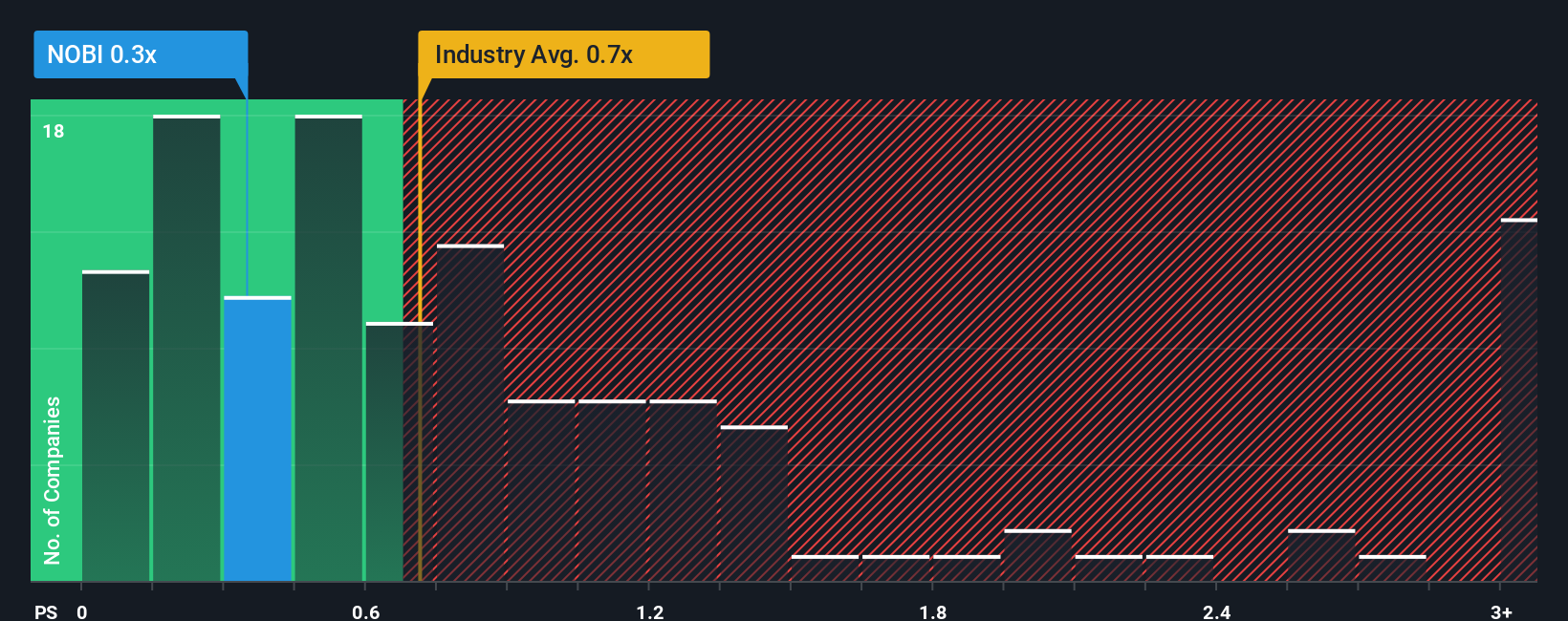

Even after such a large jump in price, it's still not a stretch to say that Nobia's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Consumer Durables industry in Sweden, where the median P/S ratio is around 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Nobia

How Has Nobia Performed Recently?

Nobia's negative revenue growth of late has neither been better nor worse than most other companies. The P/S ratio is probably moderate because investors think the company's revenue trend will continue to follow the rest of the industry. You'd much rather the company improve its revenue if you still believe in the business. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's revenue continues tracking the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Nobia.Do Revenue Forecasts Match The P/S Ratio?

Nobia's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.8%. The last three years don't look nice either as the company has shrunk revenue by 26% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 0.7% during the coming year according to the two analysts following the company. That's shaping up to be similar to the 1.3% growth forecast for the broader industry.

With this in mind, it makes sense that Nobia's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Nobia's P/S

Nobia appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A Nobia's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Consumer Durables industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Nobia you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Nobia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:NOBI

Nobia

Engages in the development, manufacture, and sale of kitchen solutions in Sweden, Denmark, Norway, Finland, the United Kingdom, Germany, the Netherlands, Austria, Iceland, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives