- Sweden

- /

- Consumer Durables

- /

- OM:NOBI

Nobia AB (publ)'s (STO:NOBI) Subdued P/S Might Signal An Opportunity

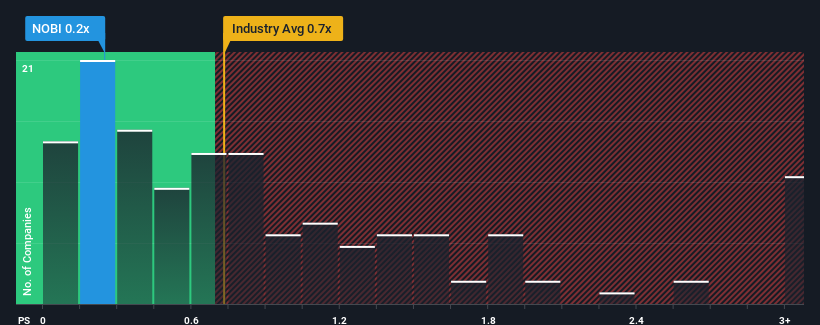

Nobia AB (publ)'s (STO:NOBI) price-to-sales (or "P/S") ratio of 0.2x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Consumer Durables industry in Sweden have P/S ratios greater than 0.9x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Nobia

What Does Nobia's P/S Mean For Shareholders?

Nobia could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Nobia's future stacks up against the industry? In that case, our free report is a great place to start.How Is Nobia's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Nobia's is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 9.5%. This means it has also seen a slide in revenue over the longer-term as revenue is down 12% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue growth will show minor resilience over the next year growing only by 2.3%. This isn't typically strong growth, but with the rest of the industry predicted to shrink by 1.9%, that would be a solid result.

With this in consideration, we find it intriguing that Nobia's P/S falls short of its industry peers. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Nobia's analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't contributing to its P/S anywhere near as much as we would have predicted. We believe there could be some underlying risks that are keeping the P/S modest in the context of above-average revenue growth. Amidst challenging industry conditions, a key concern is whether the company can sustain its superior revenue growth trajectory. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Plus, you should also learn about these 2 warning signs we've spotted with Nobia.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Nobia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:NOBI

Nobia

Engages in the development, manufacture, and sale of kitchen solutions in Sweden, Denmark, Norway, Finland, the United Kingdom, Germany, the Netherlands, Austria, Iceland, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives