Top 3 Dividend Stocks On The Swedish Exchange In September 2024

Reviewed by Simply Wall St

As global markets navigate a period of rate cuts by the European Central Bank and anticipated actions from the Federal Reserve, Sweden's stock market has shown resilience in the face of economic uncertainties. Against this backdrop, dividend stocks on the Swedish Exchange continue to attract investors seeking stable income streams. In evaluating dividend stocks, factors such as consistent payout history, strong financial health, and adaptability to current market conditions are crucial. Here are three top dividend stocks on the Swedish Exchange for September 2024 that exemplify these qualities.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Betsson (OM:BETS B) | 5.80% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.63% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.60% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 3.54% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.08% | ★★★★★☆ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.36% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.81% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.40% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.63% | ★★★★★☆ |

| Bahnhof (OM:BAHN B) | 3.72% | ★★★★☆☆ |

Click here to see the full list of 21 stocks from our Top Swedish Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

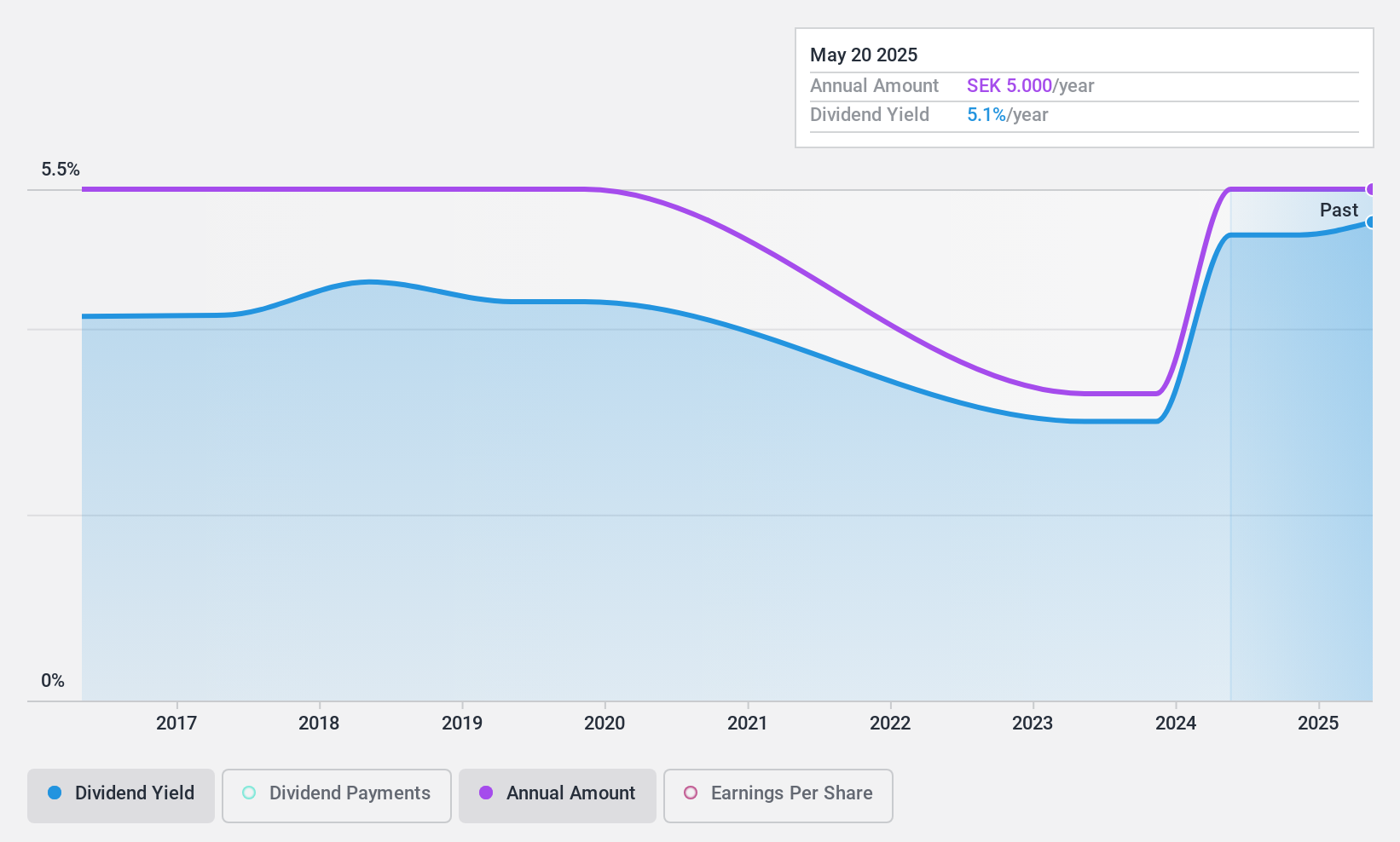

Betsson (OM:BETS B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Betsson AB (publ) operates and manages online gaming businesses across the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, Central Asia, and internationally with a market cap of SEK 17.45 billion.

Operations: Betsson AB (publ) generates revenue primarily from its Casinos & Resorts segment, which amounted to €1.01 billion.

Dividend Yield: 5.8%

Betsson's dividends are covered by both earnings (Payout Ratio: 50.3%) and cash flows (Cash Payout Ratio: 50.8%), indicating sustainability. However, the dividend track record has been volatile over the past decade, despite recent growth in dividend payments. The company is trading at a significant discount to its estimated fair value, enhancing its appeal for value investors. Recent debt financing activities could impact future cash flow stability but currently do not affect dividend coverage directly.

- Get an in-depth perspective on Betsson's performance by reading our dividend report here.

- Our valuation report unveils the possibility Betsson's shares may be trading at a discount.

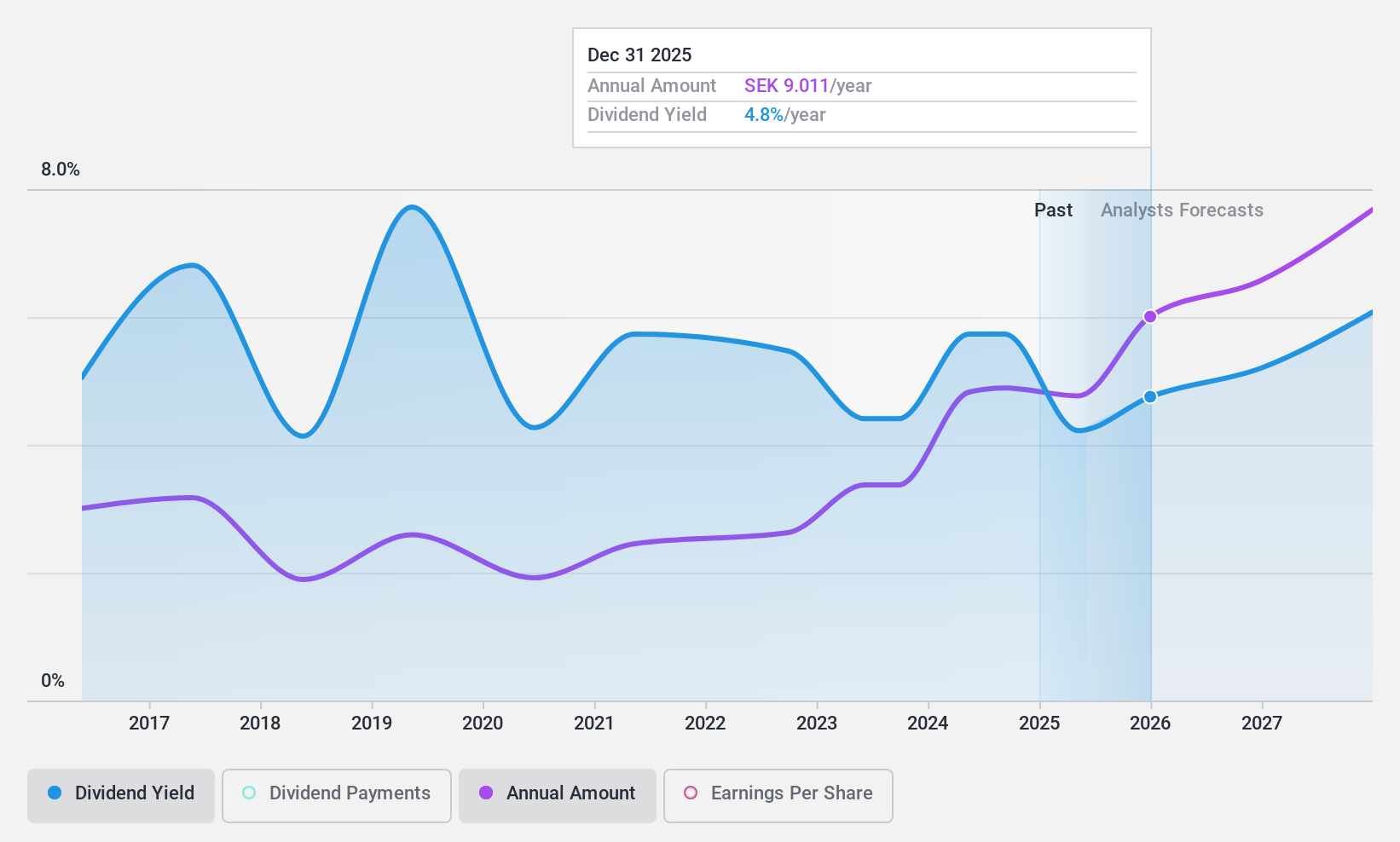

Duni (OM:DUNI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Duni AB (publ) develops, manufactures, and sells concepts and products for meal serving, take-away, and packaging in Sweden and internationally with a market cap of SEK4.89 billion.

Operations: Duni AB (publ) generates revenue from two main segments: Dining solutions, which contributed SEK4.52 billion, and Food packaging solutions, which brought in SEK3.05 billion.

Dividend Yield: 4.8%

Duni's dividend payments have increased over the past decade but have been volatile, with occasional drops exceeding 20%. Despite this, dividends are well covered by both earnings (63.9% payout ratio) and cash flows (42.9% cash payout ratio). The stock is trading at a significant discount to its estimated fair value. Recent earnings reports show a decline in net income and sales for H1 2024 compared to the previous year, which may impact future dividend stability.

- Take a closer look at Duni's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Duni is trading behind its estimated value.

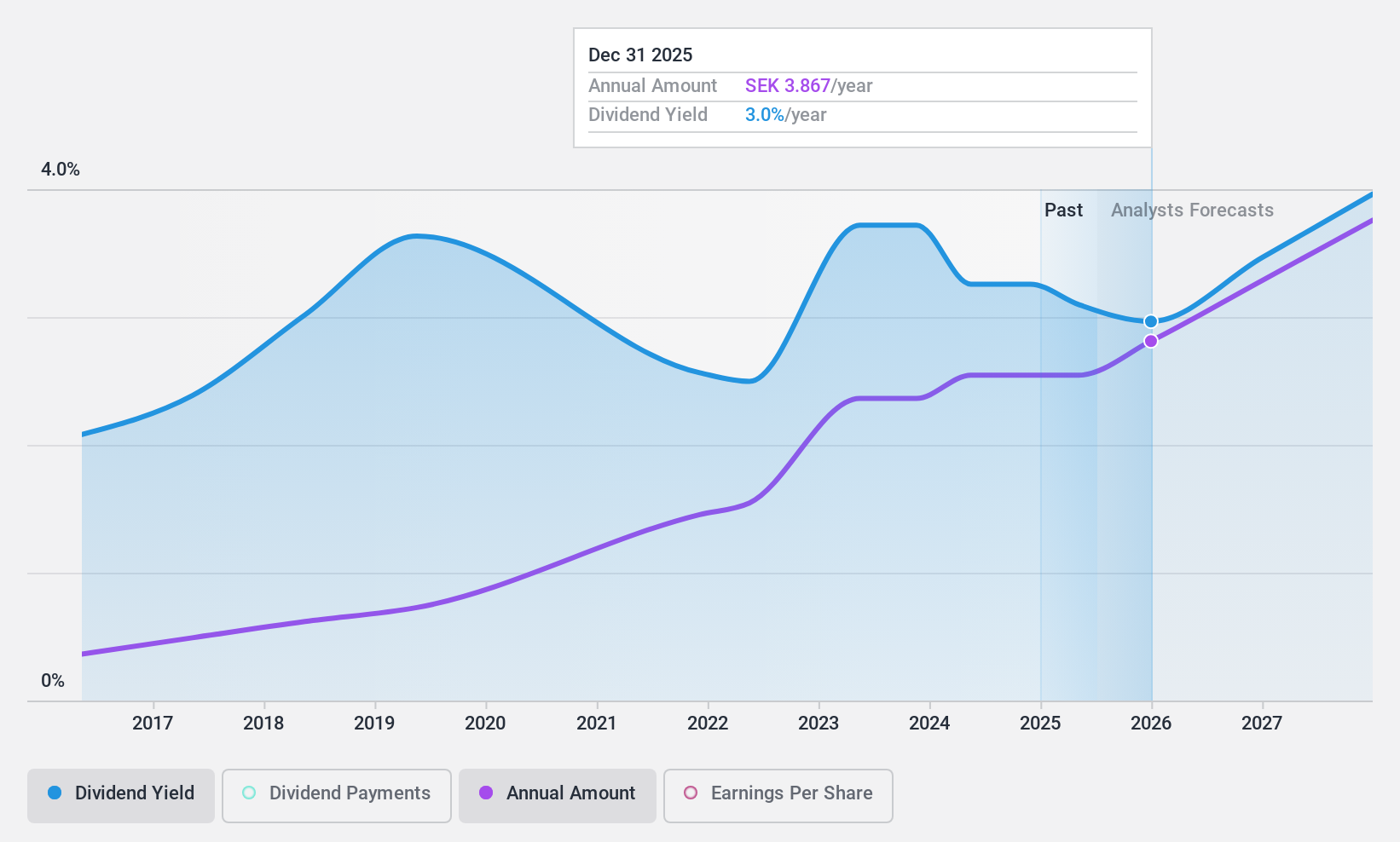

New Wave Group (OM:NEWA B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New Wave Group AB (publ) designs, acquires, and develops brands and products in the corporate, sports, gifts, and home furnishings sectors across Sweden, the United States, Central Europe, Nordic countries, Southern Europe, and internationally with a market cap of SEK15.29 billion.

Operations: New Wave Group AB (publ) generates revenue from three main segments: Corporate (SEK4.68 billion), Sports & Leisure (SEK3.91 billion), and Gifts & Home Furnishings (SEK877.40 million).

Dividend Yield: 3%

New Wave Group's dividend payments are well covered by both earnings (47.9% payout ratio) and cash flows (37.8% cash payout ratio), though they have been volatile over the past decade. The stock trades at a 37% discount to its estimated fair value, but its dividend yield (3.04%) is lower than the top 25% of Swedish dividend payers. Recent earnings reports show a decline in net income for H1 2024, which could affect future dividends.

- Click to explore a detailed breakdown of our findings in New Wave Group's dividend report.

- Upon reviewing our latest valuation report, New Wave Group's share price might be too pessimistic.

Where To Now?

- Click here to access our complete index of 21 Top Swedish Dividend Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Wave Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NEWA B

New Wave Group

Designs, acquires, and develops brands and products in the corporate, sports, gifts, and home furnishings sectors in Sweden, the United States, Central Europe, rest of Nordiac countries, Southern Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.