- Sweden

- /

- Consumer Durables

- /

- OM:JM

Will Smucker’s Lawsuit Against Trader Joe’s Over Uncrustables Shape JM’s (OM:JM) Competitive Edge?

Reviewed by Sasha Jovanovic

- J.M. Smucker recently filed a federal lawsuit against Trader Joe’s, alleging that the grocer’s crustless peanut butter and jelly sandwiches infringe on trademarks related to Smucker’s Uncrustables brand by mimicking its design and packaging.

- This legal dispute underscores Smucker’s strong commitment to defending the unique characteristics and market position of one of its flagship product lines.

- We'll explore how Smucker's proactive legal action to protect Uncrustables could shape its investment story going forward.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is JM's Investment Narrative?

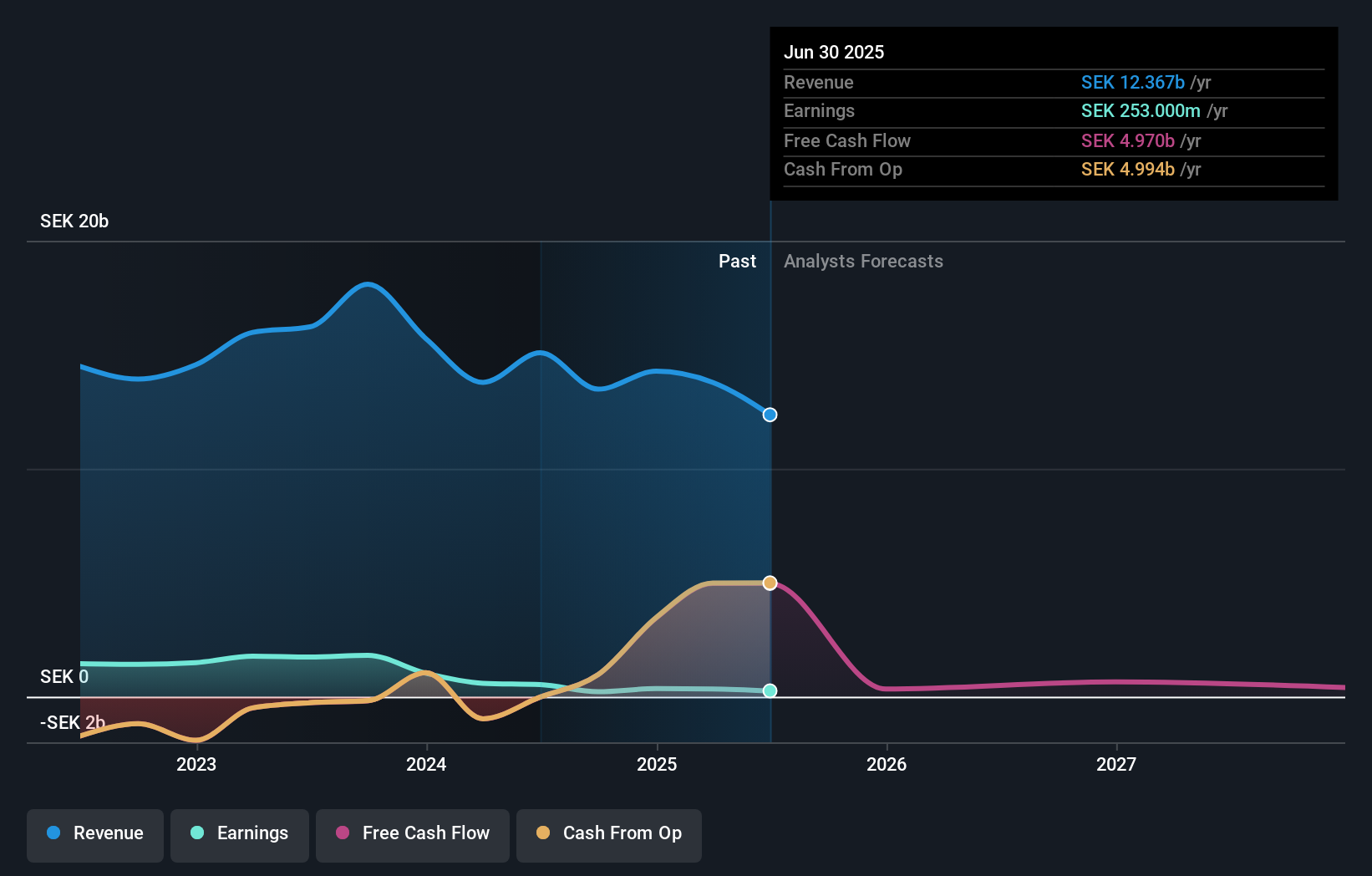

Owning shares in JM calls for confidence in the company’s ability to return to earnings growth and strengthen its margins after a period of clear pressure. Recent project launches and acquisitions suggest management is focused on long-term value creation and expanding the project pipeline, while the board and executive changes may help renew its direction. However, declining revenue and profits remain near-term obstacles, and the fair value gap to analyst targets is modest. The latest lawsuit over a rival sandwich product could have an impact on short-term sentiment depending on the speed and outcome of any legal action, yet, based on recent share price moves and prior analysis, this event does not appear to meaningfully affect the most important catalysts for shareholders, such as earnings recovery or execution on new developments. Current risks remain centered on margin pressure, debt levels, and the sustainability of dividend growth.

But margin challenges could matter sooner than some expect. JM's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 3 other fair value estimates on JM - why the stock might be worth as much as 76% more than the current price!

Build Your Own JM Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JM research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free JM research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JM's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:JM

JM

JM AB (publ) constructs, develops, and sells housing and residential areas in the Nordic region.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)