- Sweden

- /

- Consumer Durables

- /

- OM:EMBELL

Embellence Group AB (publ) Just Beat EPS By 87%: Here's What Analysts Think Will Happen Next

Embellence Group AB (publ) (STO:EMBELL) investors will be delighted, with the company turning in some strong numbers with its latest results. It was overall a positive result, with revenues beating expectations by 3.2% to hit kr191m. Embellence Group also reported a statutory profit of kr0.56, which was an impressive 87% above what the analyst had forecast. This is an important time for investors, as they can track a company's performance in its report, look at what expert is forecasting for next year, and see if there has been any change to expectations for the business. So we collected the latest post-earnings statutory consensus estimate to see what could be in store for next year.

See our latest analysis for Embellence Group

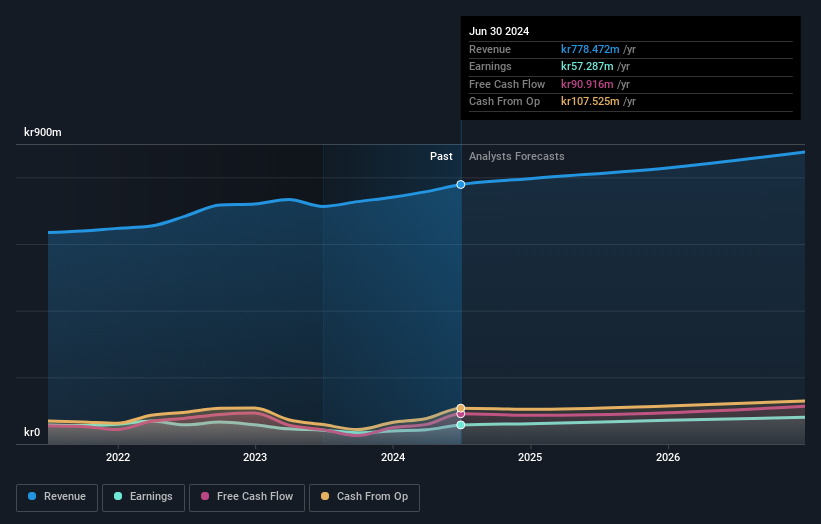

Taking into account the latest results, the consensus forecast from Embellence Group's sole analyst is for revenues of kr796.0m in 2024. This reflects a satisfactory 2.3% improvement in revenue compared to the last 12 months. Per-share earnings are expected to accumulate 6.4% to kr2.70. Yet prior to the latest earnings, the analyst had been anticipated revenues of kr781.0m and earnings per share (EPS) of kr2.41 in 2024. Although the revenue estimates have not really changed, we can see there's been a substantial gain in earnings per share expectations, suggesting that the analyst has become more bullish after the latest result.

The consensus price target rose 12% to kr36.50, suggesting that higher earnings estimates flow through to the stock's valuation as well.

Of course, another way to look at these forecasts is to place them into context against the industry itself. We would highlight that Embellence Group's revenue growth is expected to slow, with the forecast 4.6% annualised growth rate until the end of 2024 being well below the historical 6.6% p.a. growth over the last three years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 1.6% annually. So it's pretty clear that, while Embellence Group's revenue growth is expected to slow, it's still expected to grow faster than the industry itself.

The Bottom Line

The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around Embellence Group's earnings potential next year. Happily, there were no major changes to revenue forecasts, with the business still expected to grow faster than the wider industry. There was also a nice increase in the price target, with the analyst clearly feeling that the intrinsic value of the business is improving.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. At least one analyst has provided forecasts out to 2026, which can be seen for free on our platform here.

However, before you get too enthused, we've discovered 1 warning sign for Embellence Group that you should be aware of.

Valuation is complex, but we're here to simplify it.

Discover if Embellence Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EMBELL

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026