- Sweden

- /

- Real Estate

- /

- OM:FPAR A

Undervalued Small Caps With Insider Action To Watch In February 2025

Reviewed by Simply Wall St

In February 2025, global markets are navigating a complex landscape marked by tariff uncertainties and mixed economic signals, with U.S. job growth falling short of expectations and manufacturing showing signs of recovery. Amidst these fluctuations, small-cap stocks have faced pressure alongside major indices like the S&P 600, which reflects broader market sentiment influenced by geopolitical developments and economic data. In such an environment, identifying promising small-cap opportunities involves looking for companies with strong fundamentals that can potentially weather volatility while capitalizing on insider activities that may indicate confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 20.8x | 5.3x | 22.25% | ★★★★★★ |

| Maharashtra Seamless | 10.5x | 1.6x | 47.81% | ★★★★★☆ |

| Speedy Hire | NA | 0.2x | 25.65% | ★★★★★☆ |

| Logistri Fastighets | 12.5x | 8.8x | 37.00% | ★★★★☆☆ |

| Franchise Brands | 40.5x | 2.1x | 22.22% | ★★★★☆☆ |

| CVS Group | 29.2x | 1.2x | 37.35% | ★★★★☆☆ |

| Optima Health | NA | 1.5x | 47.73% | ★★★★☆☆ |

| Mark Dynamics Indonesia | 12.8x | 4.1x | 2.69% | ★★★☆☆☆ |

| Fourlis Holdings | 8.2x | 0.4x | -192.29% | ★★★☆☆☆ |

| Mukand | 16.3x | 0.3x | 1.13% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

FastPartner (OM:FPAR A)

Simply Wall St Value Rating: ★★★☆☆☆

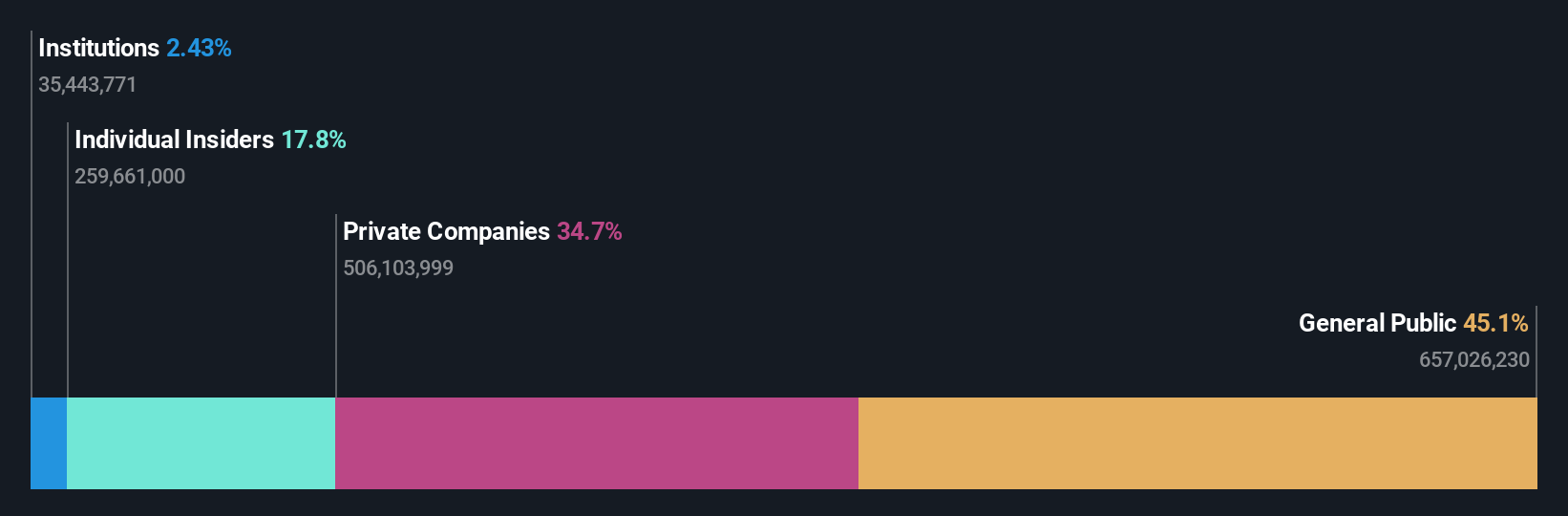

Overview: FastPartner is a real estate company focused on property management across multiple regions, with a market capitalization of SEK 10.5 billion.

Operations: The company generates revenue primarily from property management across three regions, with Region 1 contributing the largest share. Over recent periods, gross profit margin has shown an upward trend, reaching 71.45% by September 2023. Operating expenses are relatively stable compared to revenue growth, while non-operating expenses have significantly impacted net income in recent quarters.

PE: -45.8x

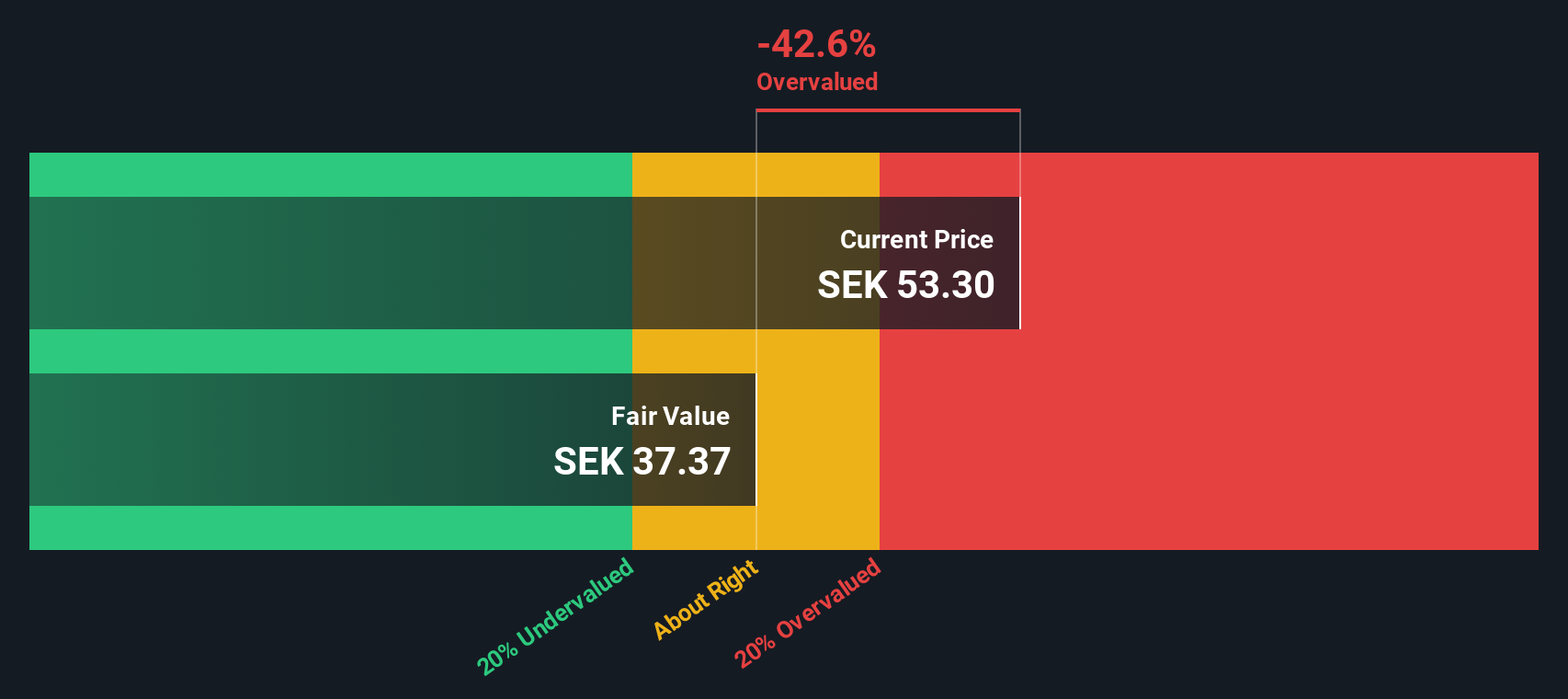

FastPartner, a company with smaller market capitalization, recently showcased significant insider confidence as they purchased 50,000 shares valued at approximately SEK 3.55 million in February 2025. Their financial position reveals potential challenges with interest payments not well covered by earnings and reliance on higher-risk external borrowing. However, the company reported a turnaround in profitability for 2024, with net income of SEK 648 million versus a substantial loss the previous year. Earnings are projected to grow by over 63% annually, indicating promising future prospects despite current funding risks.

- Navigate through the intricacies of FastPartner with our comprehensive valuation report here.

Review our historical performance report to gain insights into FastPartner's's past performance.

Sdiptech (OM:SDIP B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sdiptech is a technology group focused on providing infrastructure solutions for urban environments, with a market cap of approximately SEK 9.34 billion.

Operations: Sdiptech's revenue streams have shown growth over time, with recent figures reaching SEK 5.23 billion. The company's cost of goods sold (COGS) has increased alongside revenue, impacting gross profit margins, which reached 32.78% by the end of 2024. Operating expenses and non-operating expenses are significant components of the cost structure, affecting net income margins that were reported at 8% for the same period.

PE: 20.6x

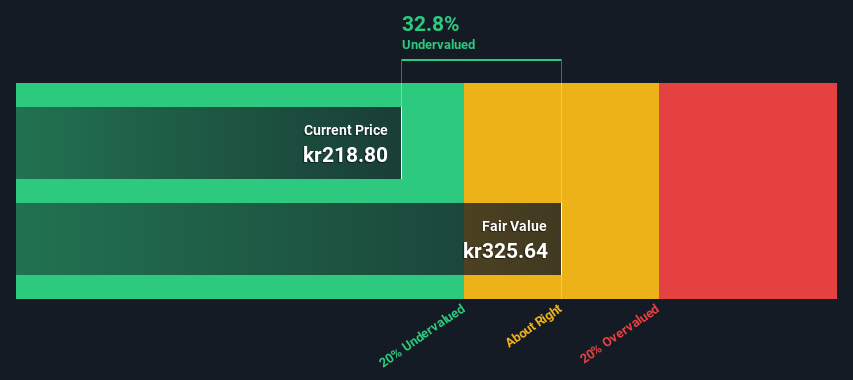

Sdiptech, a company in the infrastructure technology sector, shows potential as an undervalued stock. Recent insider confidence is evident with share purchases in early 2025. The company's earnings for Q4 2024 highlighted sales of SEK 1,336 million and net income of SEK 107 million, reflecting growth from the previous year. With a projected annual earnings growth of 16.65%, Sdiptech's strategic leadership changes and fixed-income offerings suggest a focus on expansion despite its higher-risk funding structure reliant on external borrowing.

- Dive into the specifics of Sdiptech here with our thorough valuation report.

Gain insights into Sdiptech's historical performance by reviewing our past performance report.

China XLX Fertiliser (SEHK:1866)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: China XLX Fertiliser is engaged in the production and sale of various chemical products, including urea, compound fertilisers, methanol, and other related products, with a market capitalisation of CN¥5.32 billion.

Operations: The primary revenue streams for the company include Urea, Compound Fertiliser, and Methanol. The gross profit margin has shown fluctuations over time, peaking at 24.49% in June 2021 and dipping to 15.58% in June 2023. Operating expenses have consistently impacted profitability with General & Administrative Expenses being a significant component within this category.

PE: 4.0x

China XLX Fertiliser, a smaller company in the fertiliser sector, presents an intriguing opportunity with its shares perceived as undervalued. Recent insider confidence is evident as Executive Director Qingjin Zhang purchased 270,000 shares for approximately US$1.09 million between late 2024 and early 2025, increasing their holdings by nearly 169%. Despite carrying high debt levels due to reliance on external borrowing, the company anticipates an annual earnings growth of around 8%, suggesting potential future value amidst industry challenges.

- Click to explore a detailed breakdown of our findings in China XLX Fertiliser's valuation report.

Understand China XLX Fertiliser's track record by examining our Past report.

Next Steps

- Access the full spectrum of 188 Undervalued Small Caps With Insider Buying by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FPAR A

FastPartner

A real estate company, owns, develops, and manages residential and commercial properties in Sweden.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives