- Sweden

- /

- Commercial Services

- /

- OM:ITAB

Top Swedish Dividend Stocks To Watch In September 2024

Reviewed by Simply Wall St

As European markets continue to rally, buoyed by slower inflation and potential interest rate cuts from the European Central Bank, investors are increasingly looking towards stable dividend stocks for reliable income. In this context, Swedish dividend stocks present an attractive option due to their consistent payouts and strong market positions.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.44% | ★★★★★★ |

| Betsson (OM:BETS B) | 5.71% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.67% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 3.89% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.56% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.08% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.93% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.47% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.92% | ★★★★★☆ |

| Loomis (OM:LOOMIS) | 3.61% | ★★★★☆☆ |

Click here to see the full list of 21 stocks from our Top Swedish Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

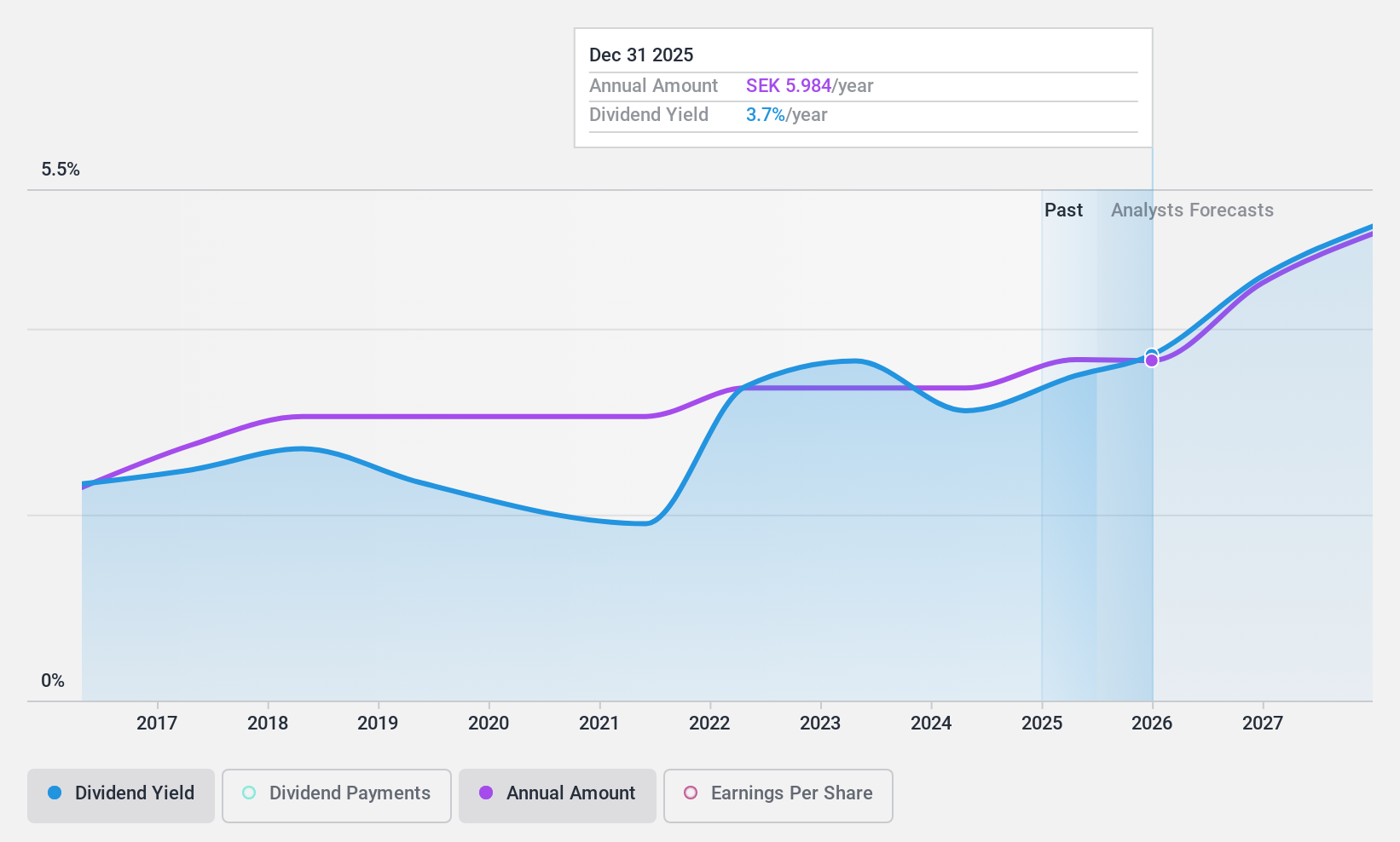

Afry (OM:AFRY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Afry AB offers engineering, design, and advisory services across infrastructure, industry, energy, and digitalization sectors in North and South America, Finland, and Central Europe with a market cap of SEK20.67 billion.

Operations: Afry AB's revenue segments include Energy (SEK3.69 billion), Infrastructure (SEK10.43 billion), Process Industries (SEK5.47 billion), Management Consulting (SEK1.69 billion), and Industrial & Digital Solutions (SEK6.83 billion).

Dividend Yield: 3%

Afry's dividend payments are well-covered by both earnings (52.1% payout ratio) and cash flows (38.8% cash payout ratio), indicating sustainability. However, its 3.01% yield is below the top 25% of Swedish dividend payers and has been volatile over the past decade. Recent Q2 2024 earnings showed strong growth, with net income rising to SEK 377 million from SEK 201 million a year ago, suggesting potential for future stability in dividends despite past inconsistencies.

- Unlock comprehensive insights into our analysis of Afry stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Afry is priced lower than what may be justified by its financials.

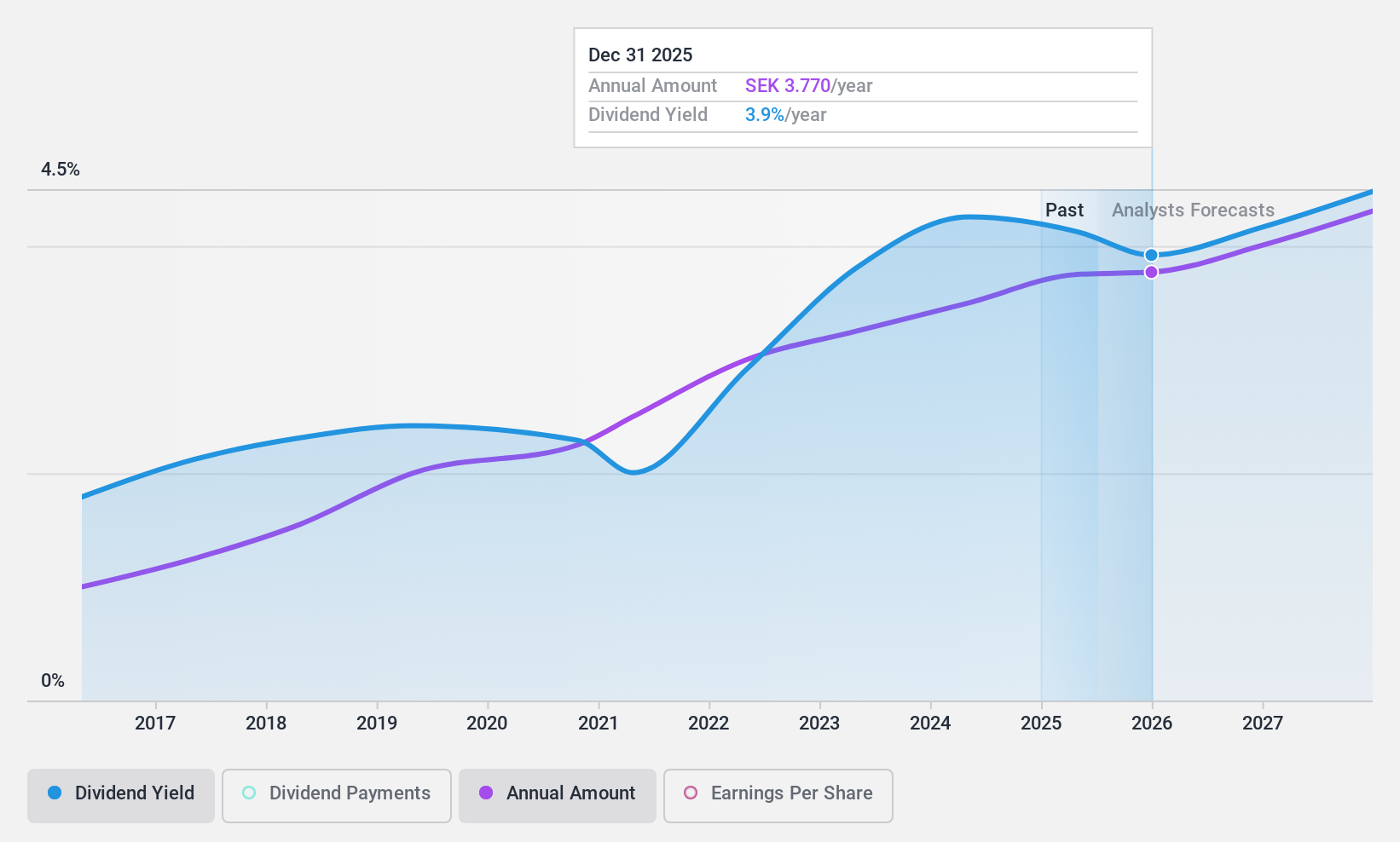

Bravida Holding (OM:BRAV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bravida Holding AB (publ) offers technical services and installations for buildings and industrial facilities across Sweden, Norway, Denmark, and Finland, with a market cap of SEK16.44 billion.

Operations: Bravida Holding AB (publ) generates revenue from providing technical services and installations for buildings and industrial facilities in Sweden, Norway, Denmark, and Finland.

Dividend Yield: 4.4%

Bravida Holding's recent earnings report showed a decline in net income to SEK 236 million for Q2 2024 from SEK 296 million a year ago, impacting its dividend outlook. Despite this, Bravida’s dividend is well-covered by both earnings (65% payout ratio) and cash flows (34.8% cash payout ratio). The company has been paying dividends for less than ten years but maintains a stable track record with a yield of 4.35%, placing it among the top Swedish dividend payers.

- Take a closer look at Bravida Holding's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Bravida Holding shares in the market.

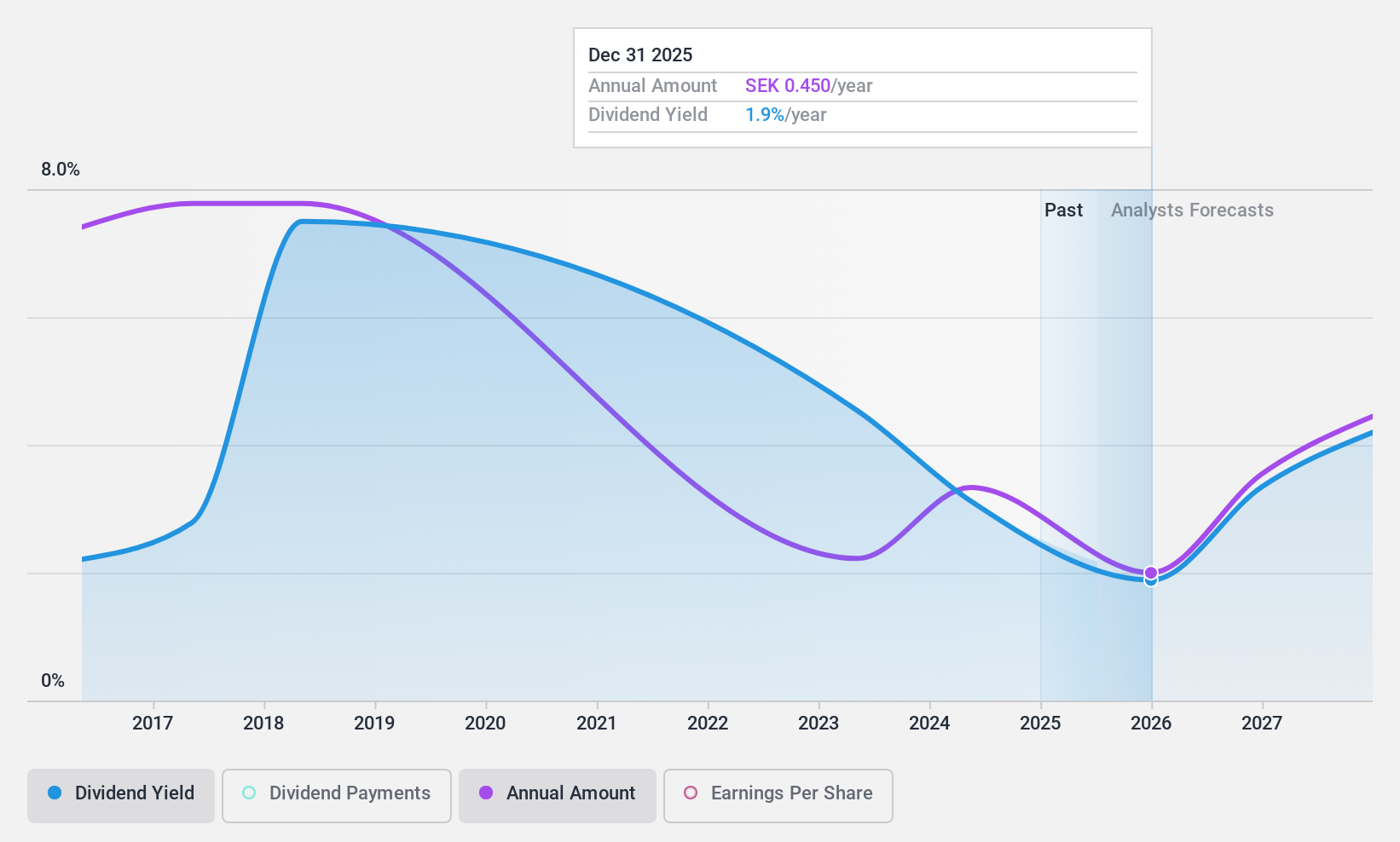

ITAB Shop Concept (OM:ITAB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ITAB Shop Concept AB (publ) offers solution design, customized shop fittings, checkouts, consumer flow solutions, professional lighting systems, and digitally interactive solutions for physical stores with a market cap of SEK5.38 billion.

Operations: ITAB Shop Concept AB (publ) generates revenue from solution design, customized shop fittings, checkouts, consumer flow solutions, professional lighting systems, and digitally interactive solutions for physical stores.

Dividend Yield: 3%

ITAB Shop Concept's dividend payments are well covered by both earnings (42.3% payout ratio) and cash flows (28.2% cash payout ratio), though they have been volatile over the past decade. The stock is trading at 22.6% below its estimated fair value, offering good relative value compared to peers. Recent earnings showed significant growth, with Q2 net income rising to SEK 95 million from SEK 56 million a year ago, supported by a new EUR 22 million contract in the UK market.

- Get an in-depth perspective on ITAB Shop Concept's performance by reading our dividend report here.

- According our valuation report, there's an indication that ITAB Shop Concept's share price might be on the cheaper side.

Summing It All Up

- Access the full spectrum of 21 Top Swedish Dividend Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ITAB

ITAB Shop Concept

Provides solution design, customized shop fittings, checkouts, consumer flow solutions, professional lighting systems, and digitally interactive solutions for the physical stores.

Flawless balance sheet with solid track record and pays a dividend.