Spotlight On December 2024's Stocks Estimated To Be Trading Below Fair Value

Reviewed by Simply Wall St

In the midst of a volatile December 2024, global markets have been grappling with cautious Federal Reserve commentary and political uncertainties, leading to declines across major indices. Despite these challenges, the search for undervalued stocks remains crucial as investors look for opportunities that may offer potential value amidst broader market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| HangzhouS MedTech (SHSE:688581) | CN¥62.17 | CN¥124.03 | 49.9% |

| Shenzhen Lifotronic Technology (SHSE:688389) | CN¥15.43 | CN¥30.85 | 50% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1133.35 | ₹2252.97 | 49.7% |

| Lindab International (OM:LIAB) | SEK226.40 | SEK450.98 | 49.8% |

| Absolent Air Care Group (OM:ABSO) | SEK255.00 | SEK509.76 | 50% |

| NCSOFT (KOSE:A036570) | ₩205500.00 | ₩409953.04 | 49.9% |

| STIF Société anonyme (ENXTPA:ALSTI) | €24.60 | €49.15 | 49.9% |

| Informa (LSE:INF) | £7.992 | £15.92 | 49.8% |

| Surgical Science Sweden (OM:SUS) | SEK159.10 | SEK317.10 | 49.8% |

| RENK Group (DB:R3NK) | €18.342 | €36.46 | 49.7% |

Let's uncover some gems from our specialized screener.

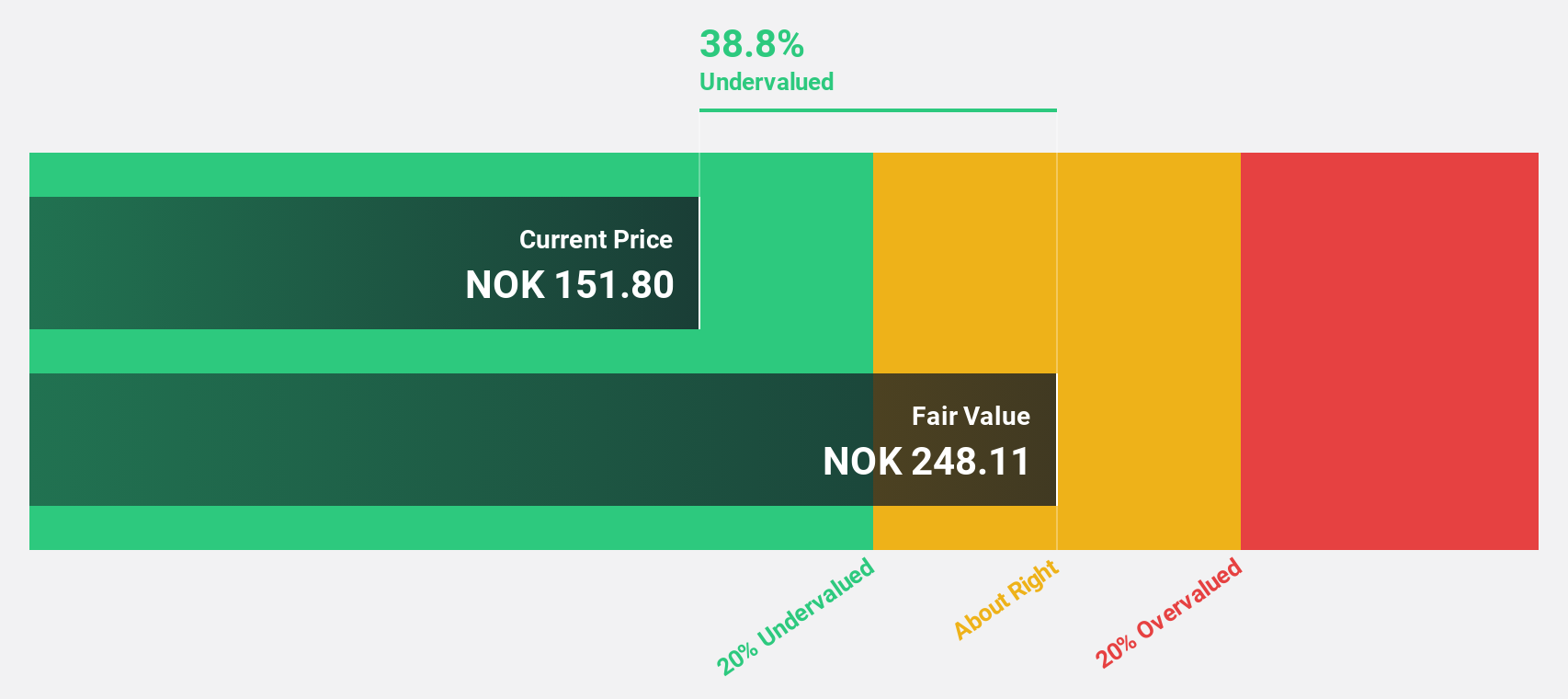

Atea (OB:ATEA)

Overview: Atea ASA offers IT infrastructure and related solutions to businesses and public sector organizations in the Nordic countries and Baltic regions, with a market cap of NOK15.53 billion.

Operations: The company's revenue segments are as follows: Norway with NOK8.28 billion, Sweden contributing NOK12.44 billion, Denmark at NOK7.37 billion, Finland bringing in NOK3.62 billion, the Baltics with NOK1.76 billion, and Group Shared Services accounting for NOK9.20 billion.

Estimated Discount To Fair Value: 42.9%

Atea ASA is trading 42.9% below its estimated fair value of NOK243.19, highlighting its potential undervaluation based on discounted cash flows. Recent earnings show stable performance with a slight increase in Q3 net income to NOK 192 million. The company's revenue and earnings are expected to grow faster than the Norwegian market, at rates of 8.3% and 18.9% per year, respectively, although the dividend yield of 5.04% is not well covered by earnings.

- Our comprehensive growth report raises the possibility that Atea is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Atea.

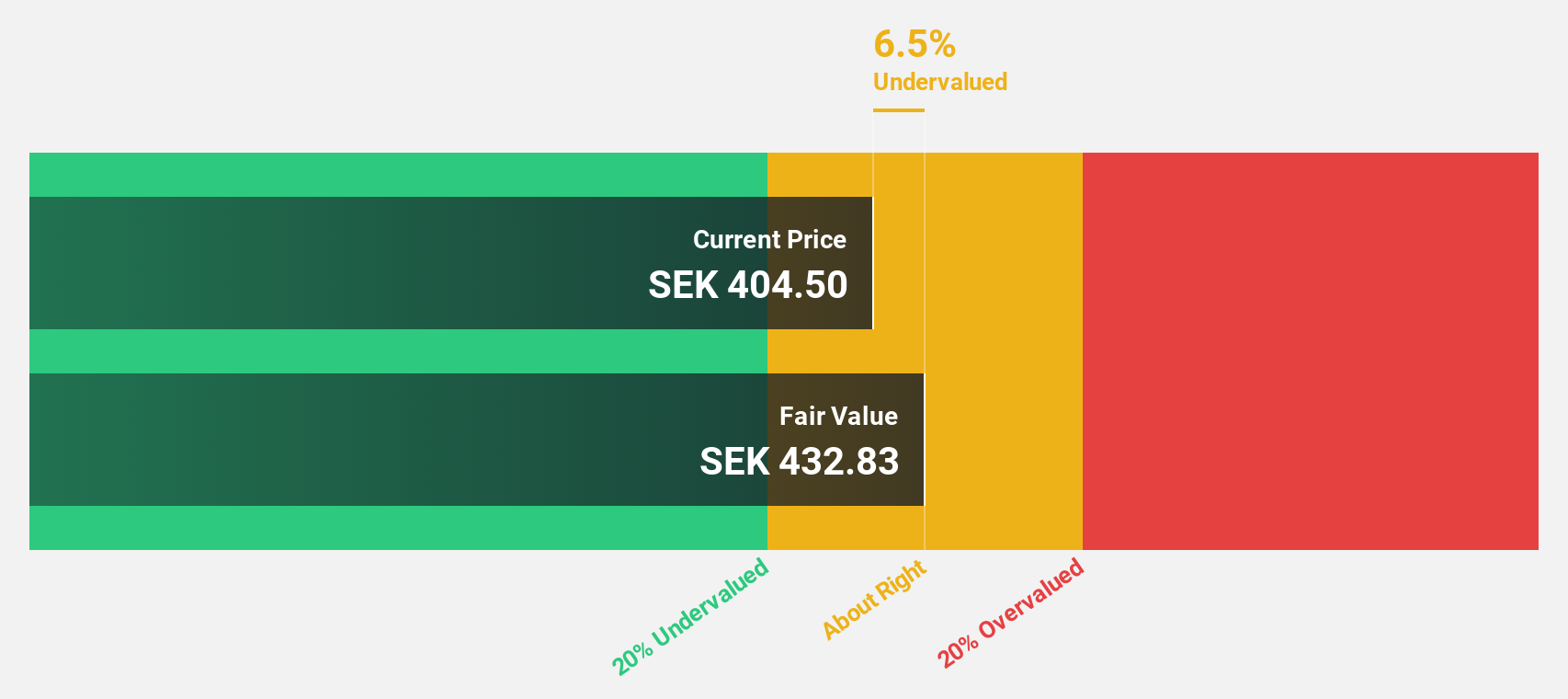

Lime Technologies (OM:LIME)

Overview: Lime Technologies AB (publ) offers SaaS-based CRM solutions in the Nordic region and has a market cap of approximately SEK4.73 billion.

Operations: The company generates revenue of SEK656.49 million from selling and implementing CRM systems.

Estimated Discount To Fair Value: 31.6%

Lime Technologies is trading at SEK356, significantly below its estimated fair value of SEK520.22, suggesting potential undervaluation based on cash flows. The company reported solid Q3 results with revenue increasing to SEK158.58 million from SEK133.86 million year-on-year and net income rising to SEK21.41 million from SEK18.13 million. Despite high debt levels, earnings are forecasted to grow 23.46% annually, outpacing the Swedish market's growth rate of 14.7%.

- Our growth report here indicates Lime Technologies may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Lime Technologies.

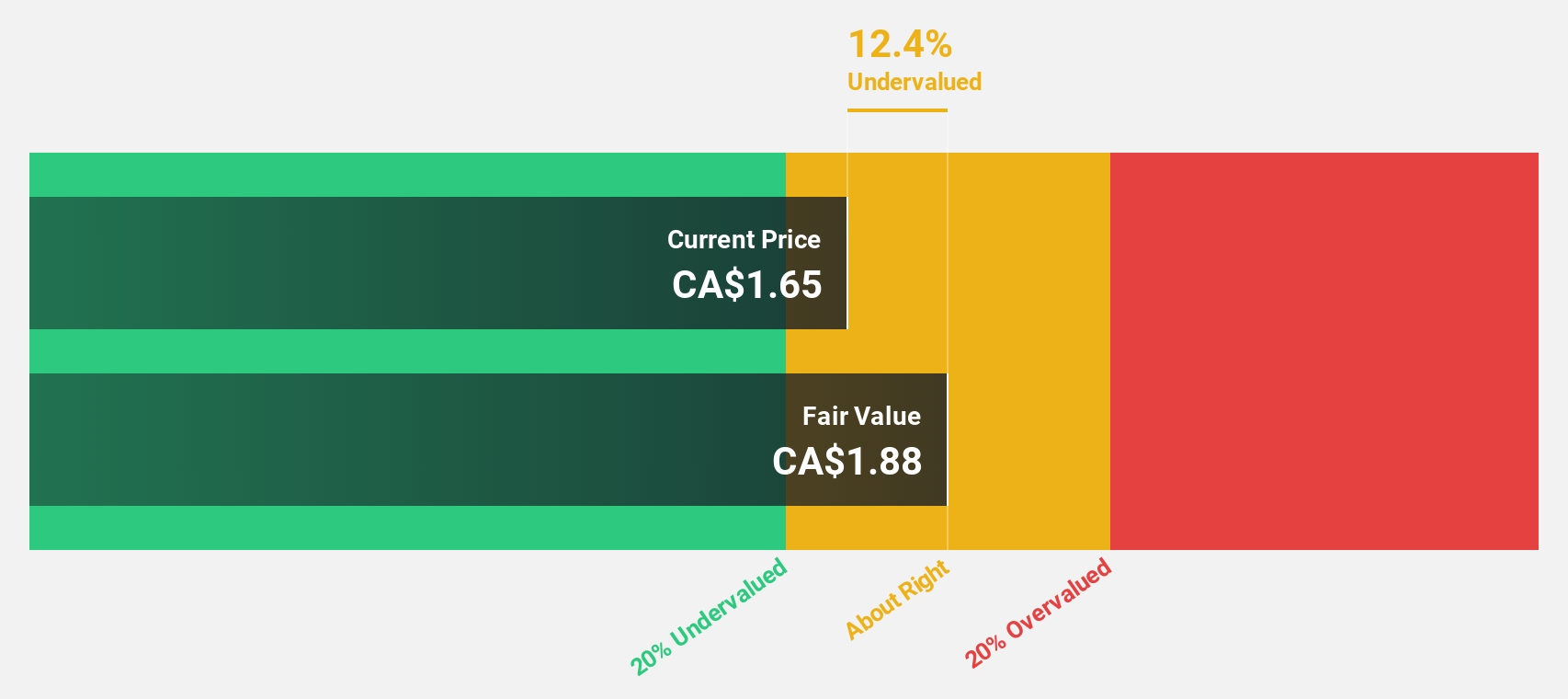

Africa Oil (TSX:AOI)

Overview: Africa Oil Corp. is an oil and gas exploration and production company operating in Kenya, Nigeria, and South Africa with a market cap of CA$824.27 million.

Operations: Africa Oil Corp. generates its revenue through its oil and gas exploration and production activities across Kenya, Nigeria, and South Africa.

Estimated Discount To Fair Value: 40.5%

Africa Oil is trading at CA$1.87, significantly below its estimated fair value of CA$3.14, highlighting potential undervaluation based on cash flows. Despite a challenging Q3 with revenue dropping to US$18.3 million from US$51.3 million and a net loss of US$289.2 million, the company is expected to become profitable within three years with revenue growth forecasted at 72% annually, outpacing the Canadian market's 7.1%.

- According our earnings growth report, there's an indication that Africa Oil might be ready to expand.

- Unlock comprehensive insights into our analysis of Africa Oil stock in this financial health report.

Next Steps

- Navigate through the entire inventory of 871 Undervalued Stocks Based On Cash Flows here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:LIME

Lime Technologies

Provides software as a service (SaaS) based customer relationship management (CRM) solutions in the Nordic region.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives