Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Bravida Holding AB (publ) (STO:BRAV) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Bravida Holding

What Is Bravida Holding's Net Debt?

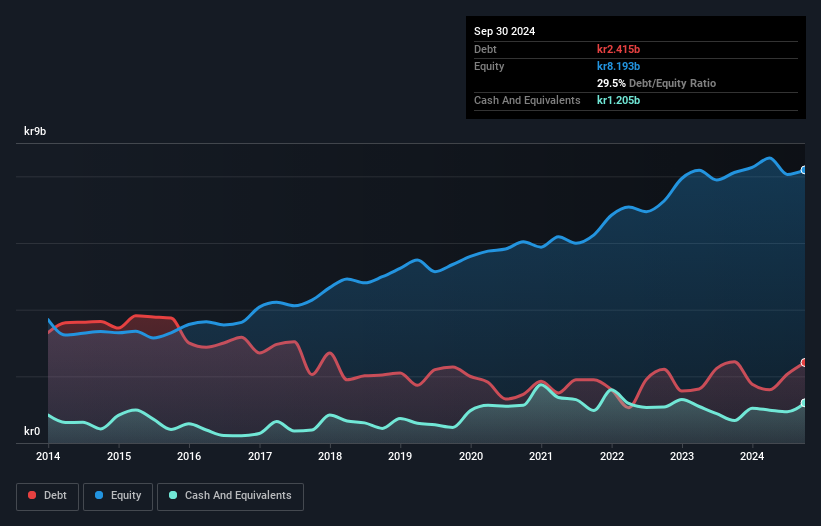

The chart below, which you can click on for greater detail, shows that Bravida Holding had kr2.42b in debt in September 2024; about the same as the year before. However, because it has a cash reserve of kr1.21b, its net debt is less, at about kr1.21b.

How Healthy Is Bravida Holding's Balance Sheet?

The latest balance sheet data shows that Bravida Holding had liabilities of kr14.4b due within a year, and liabilities of kr2.25b falling due after that. Offsetting this, it had kr1.21b in cash and kr9.55b in receivables that were due within 12 months. So it has liabilities totalling kr5.89b more than its cash and near-term receivables, combined.

This deficit isn't so bad because Bravida Holding is worth kr16.8b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Bravida Holding has net debt of just 0.76 times EBITDA, indicating that it is certainly not a reckless borrower. And it boasts interest cover of 9.5 times, which is more than adequate. But the bad news is that Bravida Holding has seen its EBIT plunge 15% in the last twelve months. If that rate of decline in earnings continues, the company could find itself in a tight spot. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Bravida Holding can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Bravida Holding recorded free cash flow worth a fulsome 99% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Our View

When it comes to the balance sheet, the standout positive for Bravida Holding was the fact that it seems able to convert EBIT to free cash flow confidently. However, our other observations weren't so heartening. In particular, EBIT growth rate gives us cold feet. When we consider all the elements mentioned above, it seems to us that Bravida Holding is managing its debt quite well. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. We'd be motivated to research the stock further if we found out that Bravida Holding insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you're looking to trade Bravida Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bravida Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BRAV

Bravida Holding

Provides technical services and installations for buildings and industrial facilities in Sweden, Norway, Denmark, and Finland.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives