- Sweden

- /

- Commercial Services

- /

- OM:BONG

European Penny Stocks: Cyberoo And 2 Promising Picks

Reviewed by Simply Wall St

As European markets show resilience with notable gains across major indices, the investment landscape continues to evolve, offering diverse opportunities. Penny stocks, though often seen as a throwback to earlier trading days, remain a relevant area for investors seeking potential growth in smaller or newer companies. These stocks can present unique opportunities when backed by strong financials, and this article will explore three such promising picks that combine balance sheet strength with potential for significant returns.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| DigiTouch (BIT:DGT) | €1.99 | €27.5M | ✅ 3 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €227.2M | ✅ 2 ⚠️ 2 View Analysis > |

| Hove (CPSE:HOVE) | DKK4.55 | DKK115.04M | ✅ 2 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.44 | SEK209.29M | ✅ 2 ⚠️ 2 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.962 | €77.63M | ✅ 2 ⚠️ 4 View Analysis > |

| Faes Farma (BME:FAE) | €4.495 | €1.4B | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.045 | €282.66M | ✅ 4 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.076 | €8.03M | ✅ 2 ⚠️ 3 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.906 | €30.34M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 274 stocks from our European Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Cyberoo (BIT:CYB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cyberoo S.p.A. offers managed and cybersecurity services in Italy with a market cap of €63.31 million.

Operations: The company's revenue is primarily derived from Cyber Security & Device Security services (€18.13 million), followed by Managed Services (€4.57 million) and Digital Transformation (€0.11 million).

Market Cap: €63.31M

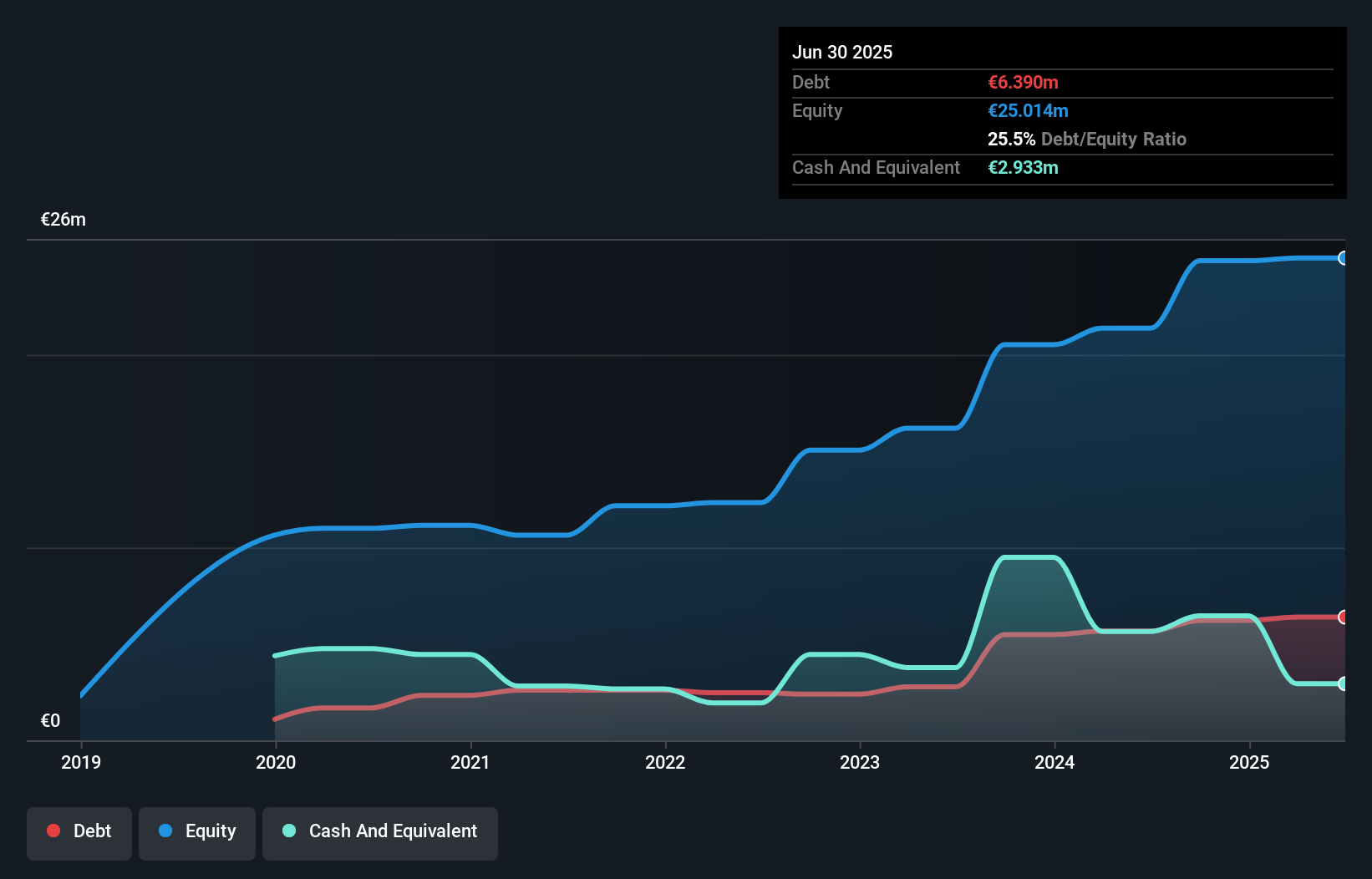

Cyberoo S.p.A. has demonstrated consistent revenue growth, with earnings increasing by 4.2% over the past year, surpassing the IT industry's decline. The company's financial health is stable, with short-term assets exceeding liabilities and a satisfactory net debt to equity ratio of 13.8%. Despite a decrease in net profit margins from 15.8% to 15.1%, Cyberoo's earnings are well-covered by operating cash flow and interest payments are adequately managed with EBIT coverage at 10.8x. Recent half-year results show modest sales growth, although net income has decreased compared to the previous year, highlighting potential profitability challenges ahead.

- Get an in-depth perspective on Cyberoo's performance by reading our balance sheet health report here.

- Gain insights into Cyberoo's outlook and expected performance with our report on the company's earnings estimates.

Bong (OM:BONG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bong AB (publ) specializes in producing light packaging and envelope products across Central Europe, South Europe, North Africa, the Nordics, and the United Kingdom, with a market cap of SEK141.51 million.

Operations: The company's revenue segments include SEK233.04 million from the Nordics, SEK844 million from Central Europe, and SEK288.19 million from the United Kingdom.

Market Cap: SEK141.51M

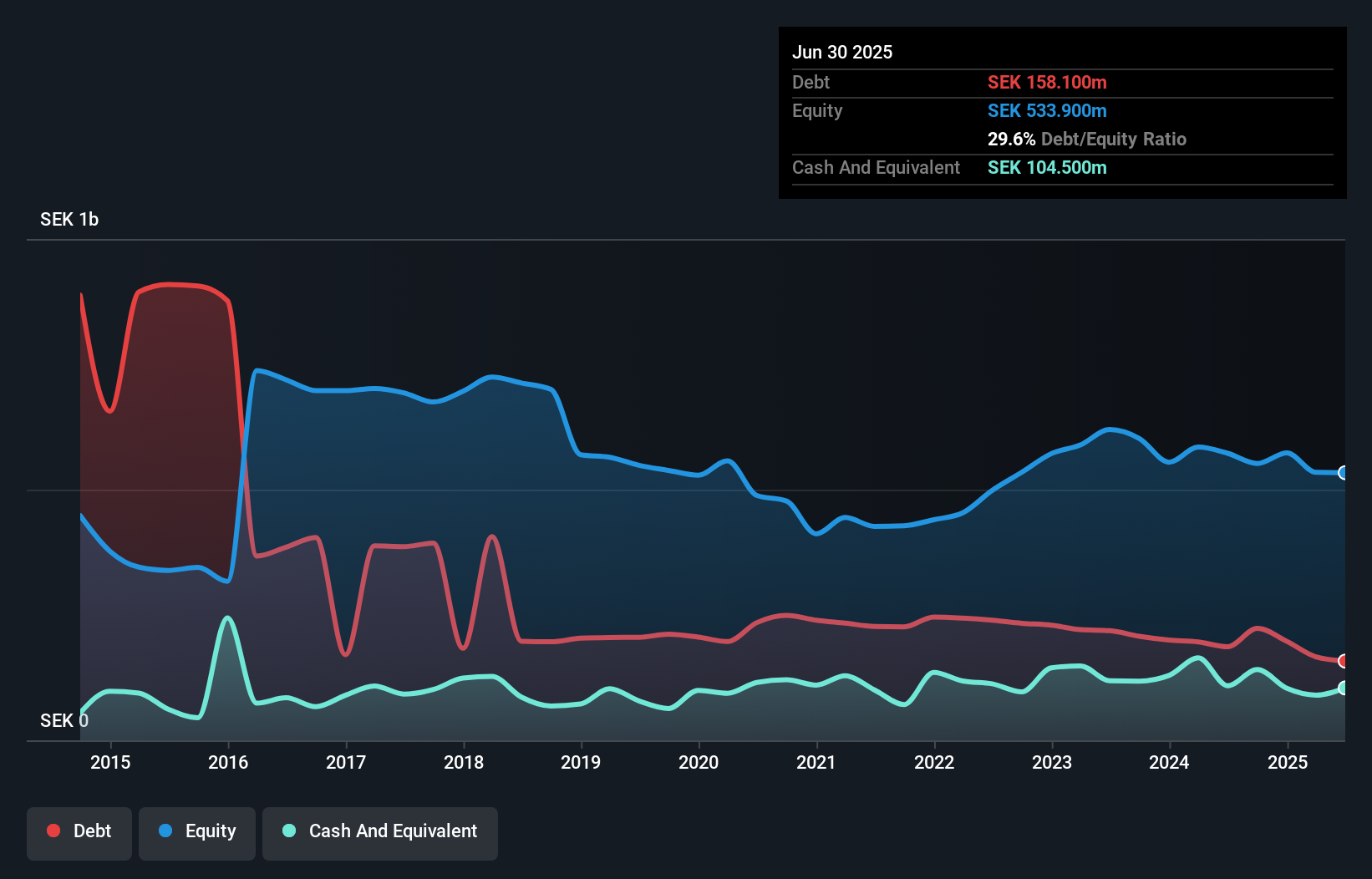

Bong AB, while currently unprofitable with a negative return on equity of -5.12%, maintains a robust financial position. The company has sufficient cash runway for over three years due to positive and growing free cash flow. Its short-term assets of SEK586.9 million exceed both its long-term liabilities and short-term liabilities, indicating strong liquidity management. Bong's net debt to equity ratio stands at a satisfactory 10%, reflecting prudent debt management. Although the share price has been volatile recently, it trades significantly below estimated fair value, suggesting potential for future appreciation if profitability improves.

- Click to explore a detailed breakdown of our findings in Bong's financial health report.

- Explore historical data to track Bong's performance over time in our past results report.

MDI Energia (WSE:MDI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: MDI Energia S.A. operates in the renewable energy sector both in Poland and internationally, with a market capitalization of PLN34.53 million.

Operations: The company generates revenue from the construction of civil and water engineering facilities, amounting to PLN227.47 million.

Market Cap: PLN34.53M

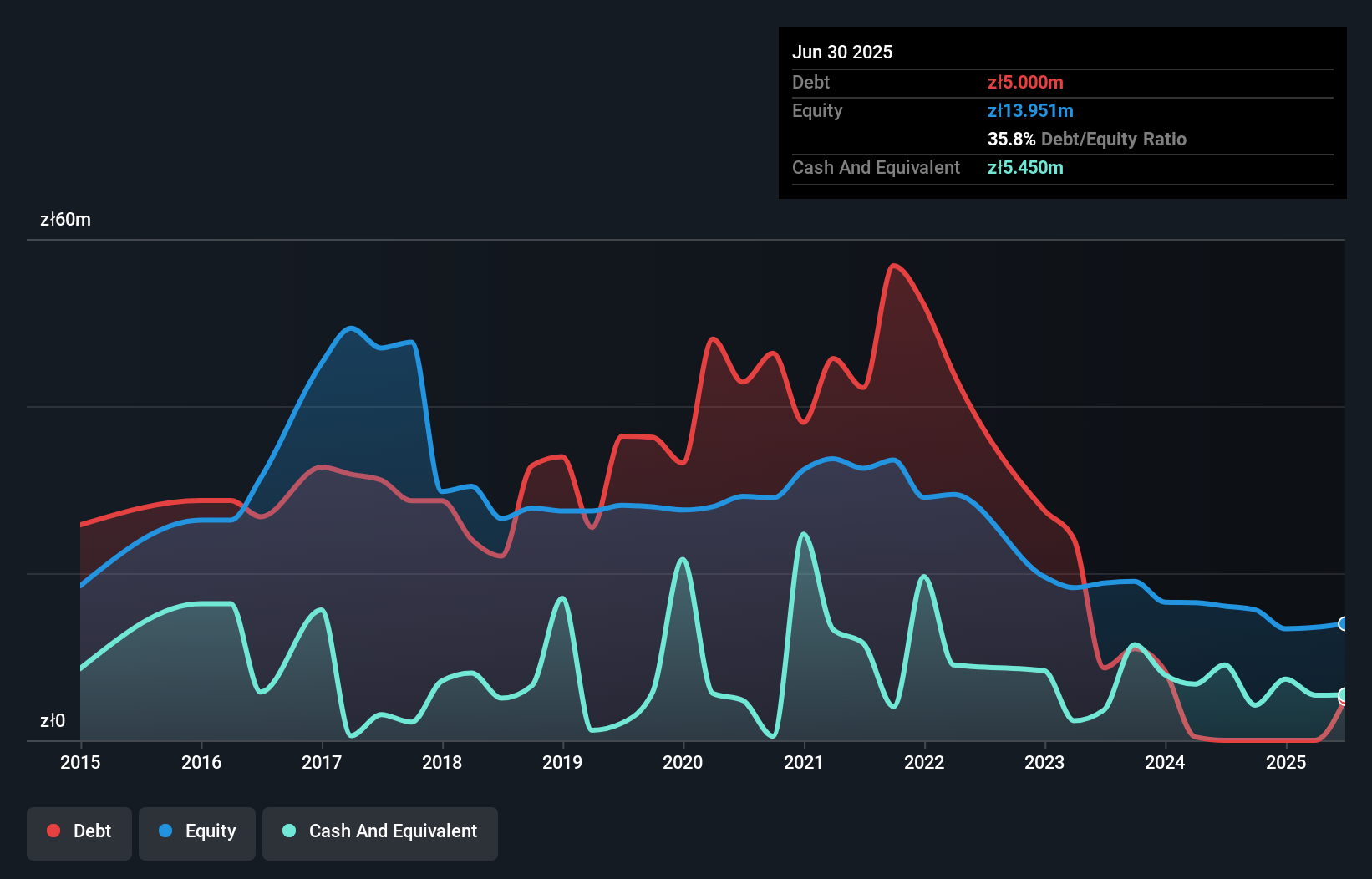

MDI Energia, operating in the renewable energy sector, has shown some financial resilience despite being unprofitable. The company reported a net income of PLN 0.603 million for the first half of 2025, marking an improvement from a previous net loss. With revenues reaching PLN 128.73 million over six months and short-term assets exceeding liabilities, MDI demonstrates sound liquidity management. However, its cash runway remains under a year, highlighting potential funding challenges ahead. The company's debt to equity ratio improved significantly over five years to 35.8%, reflecting effective debt reduction efforts amidst high share price volatility.

- Click here and access our complete financial health analysis report to understand the dynamics of MDI Energia.

- Learn about MDI Energia's historical performance here.

Summing It All Up

- Explore the 274 names from our European Penny Stocks screener here.

- Ready For A Different Approach? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bong might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BONG

Bong

Provides light packaging and envelope products in Central Europe, South Europe, North Africa, Nordics, and the United Kingdom.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)