We Ran A Stock Scan For Earnings Growth And AB Volvo (STO:VOLV B) Passed With Ease

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in AB Volvo (STO:VOLV B). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for AB Volvo

AB Volvo's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. It certainly is nice to see that AB Volvo has managed to grow EPS by 20% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

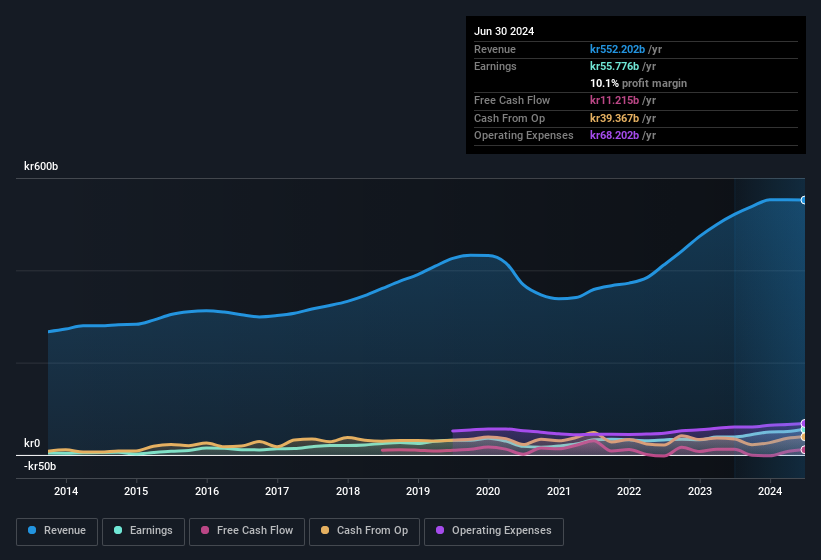

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of AB Volvo's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. The good news is that AB Volvo is growing revenues, and EBIT margins improved by 4.8 percentage points to 16%, over the last year. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for AB Volvo's future profits.

Are AB Volvo Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The kr4.3m worth of shares that insiders sold during the last 12 months pales in comparison to the kr315m they spent on acquiring shares in the company. This adds to the interest in AB Volvo because it suggests that those who understand the company best, are optimistic. It is also worth noting that it was Director Helena Stjernholm who made the biggest single purchase, worth kr307m, paying kr258 per share.

On top of the insider buying, it's good to see that AB Volvo insiders have a valuable investment in the business. Indeed, they have a considerable amount of wealth invested in it, currently valued at kr25b. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

Is AB Volvo Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into AB Volvo's strong EPS growth. On top of that, insiders own a significant stake in the company and have been buying more shares. So it's fair to say that this stock may well deserve a spot on your watchlist. What about risks? Every company has them, and we've spotted 2 warning signs for AB Volvo (of which 1 is a bit concerning!) you should know about.

Keen growth investors love to see insider activity. Thankfully, AB Volvo isn't the only one. You can see a a curated list of Swedish companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:VOLV B

AB Volvo

Manufactures and sells trucks, buses, construction equipment, and marine and industrial engines in Europe, the United States, Asia, Africa, and Oceania.

Good value average dividend payer.