- Sweden

- /

- Construction

- /

- OM:TRAIN B

As Train Alliance Sweden AB (publ)'s (STO:TRAIN B) market cap increased kr198m, insiders who bought last year may be reflecting on buying more

Generally, when a single insider buys stock, it is usually not a big deal. However, when several insiders are buying, like in the case of Train Alliance Sweden AB (publ) (STO:TRAIN B), it sends a favourable message to the company's shareholders.

While insider transactions are not the most important thing when it comes to long-term investing, we do think it is perfectly logical to keep tabs on what insiders are doing.

Check out our latest analysis for Train Alliance Sweden

Train Alliance Sweden Insider Transactions Over The Last Year

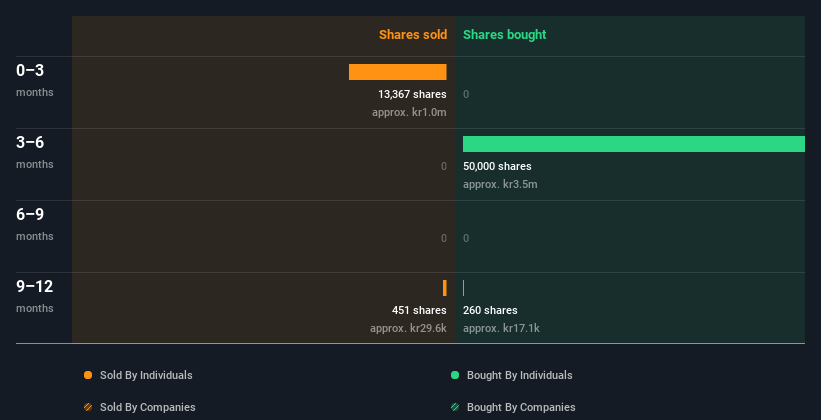

Over the last year, we can see that the biggest insider purchase was by Chairman of the Board Otto Persson for kr3.5m worth of shares, at about kr70.70 per share. Even though the purchase was made at a significantly lower price than the recent price (kr82.50), we still think insider buying is a positive. Because the shares were purchased at a lower price, this particular buy doesn't tell us much about how insiders feel about the current share price.

Happily, we note that in the last year insiders paid kr3.6m for 50.26k shares. On the other hand they divested 13.82k shares, for kr1.0m. In the last twelve months there was more buying than selling by Train Alliance Sweden insiders. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

There are always plenty of stocks that insiders are buying. So if that suits your style you could check each stock one by one or you could take a look at this free list of companies. (Hint: insiders have been buying them).

Insiders at Train Alliance Sweden Have Sold Stock Recently

Over the last three months, we've seen significant insider selling at Train Alliance Sweden. In total, Director Sven Jemsten sold kr1.0m worth of shares in that time, and we didn't record any purchases whatsoever. This may suggest that some insiders think that the shares are not cheap.

Insider Ownership of Train Alliance Sweden

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. It appears that Train Alliance Sweden insiders own 17% of the company, worth about kr377m. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

So What Do The Train Alliance Sweden Insider Transactions Indicate?

An insider hasn't bought Train Alliance Sweden stock in the last three months, but there was some selling. In contrast, they appear keener if you look at the last twelve months. And insider ownership remains quite considerable. So we're not too bothered by recent selling. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. Our analysis shows 4 warning signs for Train Alliance Sweden (3 are a bit unpleasant!) and we strongly recommend you look at these before investing.

But note: Train Alliance Sweden may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

Valuation is complex, but we're here to simplify it.

Discover if Train Alliance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:TRAIN B

Train Alliance

Engages in the development of production facilities for railway-related operations in infrastructure and logistics in Sweden.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives