- United Kingdom

- /

- Electrical

- /

- AIM:VLX

December 2025's European Undervalued Small Caps With Insider Buying

Reviewed by Simply Wall St

As of late November 2025, European markets have shown resilience, with the pan-European STOXX Europe 600 Index rising by 2.35% and major single-country indexes also posting gains. This positive momentum comes amid subdued inflation across the eurozone and tax policy changes in the UK, creating a dynamic environment for small-cap stocks that may offer unique opportunities for investors seeking value in an evolving economic landscape. In this context, understanding key indicators such as insider buying can be crucial when evaluating potential small-cap investments in Europe.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Norcros | 13.0x | 0.7x | 44.73% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 36.25% | ★★★★★☆ |

| Eastnine | 11.6x | 7.3x | 49.22% | ★★★★★☆ |

| Senior | 23.9x | 0.8x | 26.34% | ★★★★★☆ |

| Eurocell | 16.6x | 0.3x | 39.23% | ★★★★☆☆ |

| Social Housing REIT | NA | 6.9x | 37.43% | ★★★★☆☆ |

| Norbit | 29.3x | 4.9x | 14.17% | ★★★☆☆☆ |

| Kendrion | 28.9x | 0.7x | 41.47% | ★★★☆☆☆ |

| Yubico | 30.5x | 3.2x | -16.57% | ★★★☆☆☆ |

| CVS Group | 46.4x | 1.3x | 25.72% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Volex (AIM:VLX)

Simply Wall St Value Rating: ★★★☆☆☆

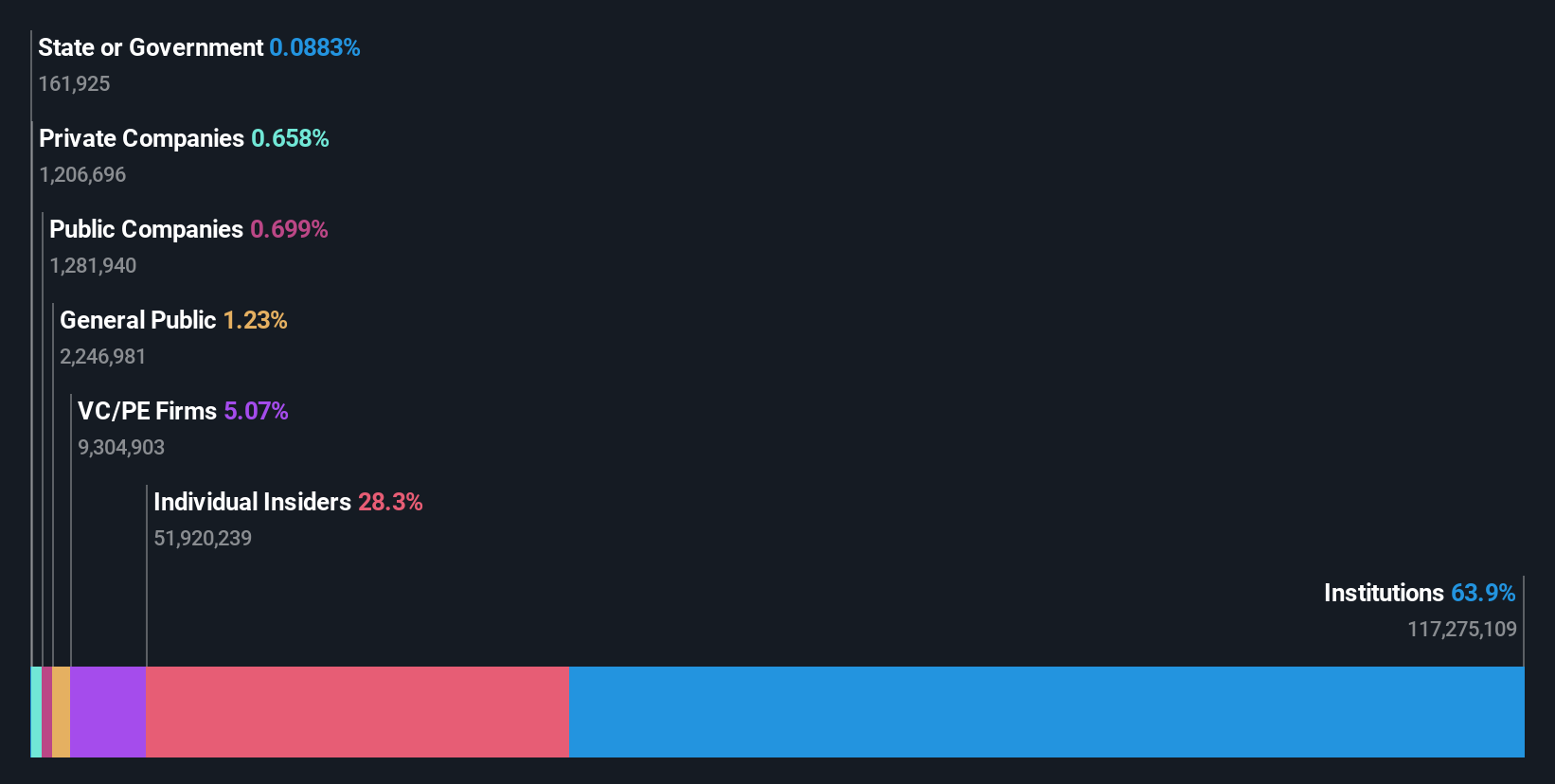

Overview: Volex is a global manufacturer specializing in integrated manufacturing services and power products, with a market capitalization of approximately £0.74 billion.

Operations: Volex's revenue has shown a consistent upward trend, reaching $1.15 billion by the end of 2025. The company has experienced fluctuations in its gross profit margin, which was 22.10% in late 2025. Operating expenses have increased over time, with general and administrative expenses being a significant component of these costs.

PE: 17.4x

Volex, a European-based company in the manufacturing sector, has shown promising growth with sales reaching US$583.9 million for the half year ending September 2025, up from US$518.2 million the previous year. Net income also rose to US$28.5 million from US$19.3 million, reflecting strong performance despite reliance on external borrowing for funding. Insider confidence is evident as leadership changes bring experienced executives like Dave Webster and Nat Rothschild into key roles, potentially steering Volex towards sustained growth and stability in its diverse markets.

- Navigate through the intricacies of Volex with our comprehensive valuation report here.

Explore historical data to track Volex's performance over time in our Past section.

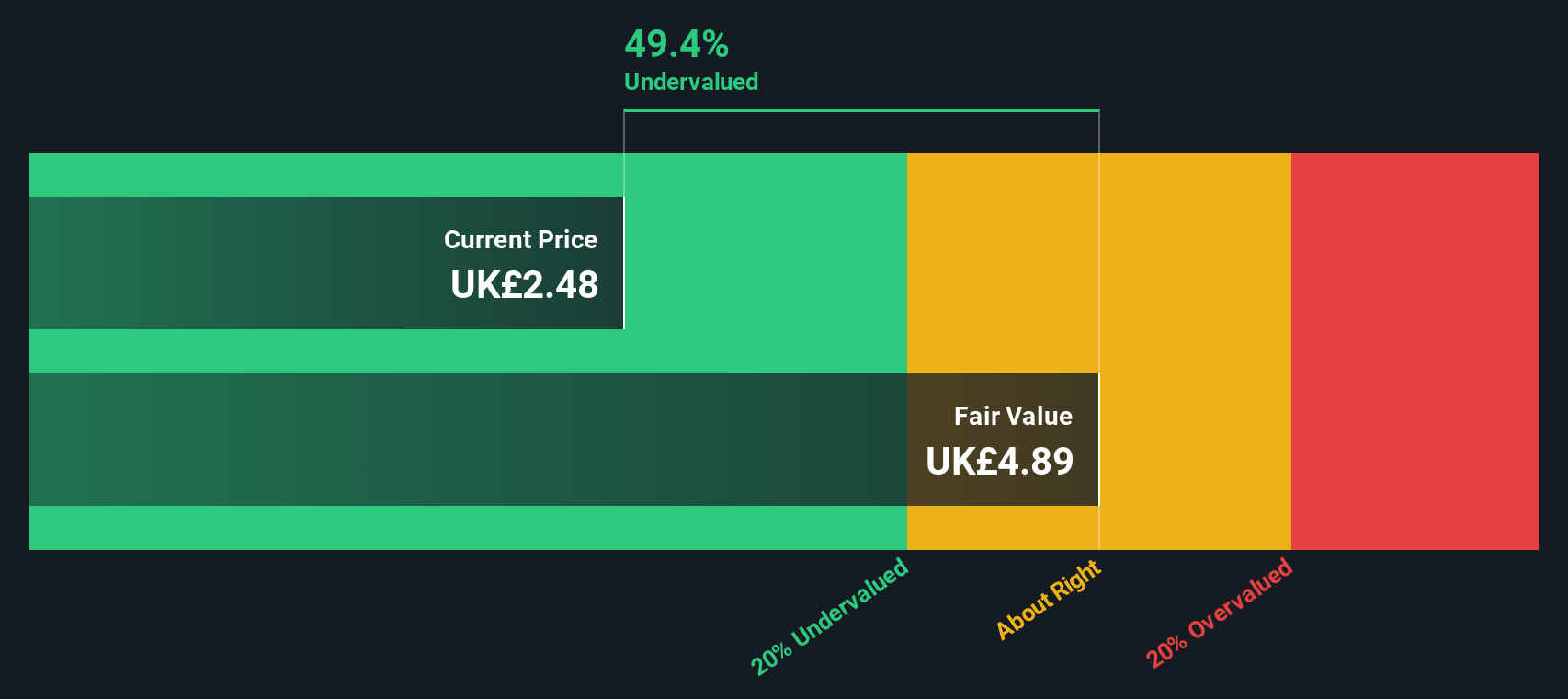

Greencore Group (LSE:GNC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Greencore Group is a leading manufacturer of convenience foods in the UK and Ireland, with a market capitalization of approximately £0.57 billion.

Operations: The company's revenue primarily comes from its Convenience Foods UK & Ireland segment, with a gross profit margin showing fluctuations over time, reaching 33.23% in the latest period. Operating expenses consistently form a significant portion of total costs, impacting net income margins. Notably, recent data indicates an improvement in net income margin to 2.96%.

PE: 18.4x

Greencore Group, a prominent player in the European food sector, reported increased sales of £1.95 billion and net income of £57.6 million for the year ending September 2025, showcasing steady financial growth. Insider confidence is evident with recent share purchases by key executives this quarter. Despite relying solely on external borrowing, which carries higher risk, the company has proposed a dividend increase to 2.6 pence per share. Earnings are projected to grow annually by over 20%, indicating potential future value for investors seeking opportunities in smaller companies within Europe’s market landscape.

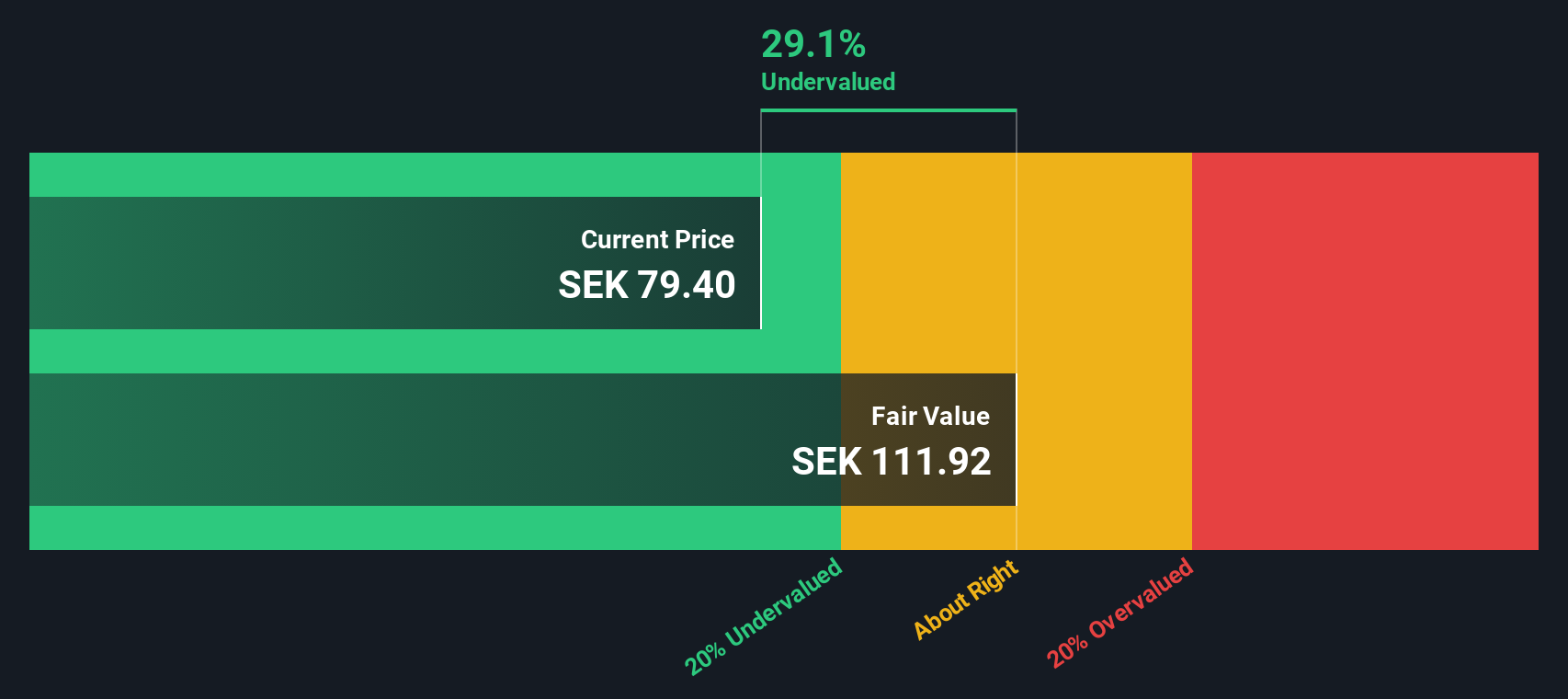

Systemair (OM:SYSR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Systemair specializes in the manufacture and sale of ventilation products, with a market cap of SEK 19.43 billion.

Operations: The primary revenue stream is from the manufacture and sale of ventilation products, with recent revenue reaching SEK 12.28 billion. The gross profit margin has shown an upward trend, recently recorded at 36.39%. Operating expenses primarily consist of sales and marketing, which amounted to SEK 2.74 billion in the latest period.

PE: 24.0x

Systemair, a notable player in the ventilation industry, is gaining attention for its potential value. The company's earnings are projected to grow by 18% annually. Despite relying entirely on external borrowing for funding, which poses higher risk compared to customer deposits, insider confidence is evident through recent share purchases in November 2025. This activity suggests optimism about future performance. As the company navigates these dynamics, it presents an intriguing opportunity within Europe's smaller companies landscape.

- Click here and access our complete valuation analysis report to understand the dynamics of Systemair.

Evaluate Systemair's historical performance by accessing our past performance report.

Taking Advantage

- Explore the 73 names from our Undervalued European Small Caps With Insider Buying screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:VLX

Volex

Manufactures and sells power and connectivity in North America, Europe, and Asia.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026