If You Like EPS Growth Then Check Out Svedbergs i Dalstorp (STO:SVED B) Before It's Too Late

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like Svedbergs i Dalstorp (STO:SVED B). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Svedbergs i Dalstorp

How Quickly Is Svedbergs i Dalstorp Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. Over the last three years, Svedbergs i Dalstorp has grown EPS by 13% per year. That's a good rate of growth, if it can be sustained.

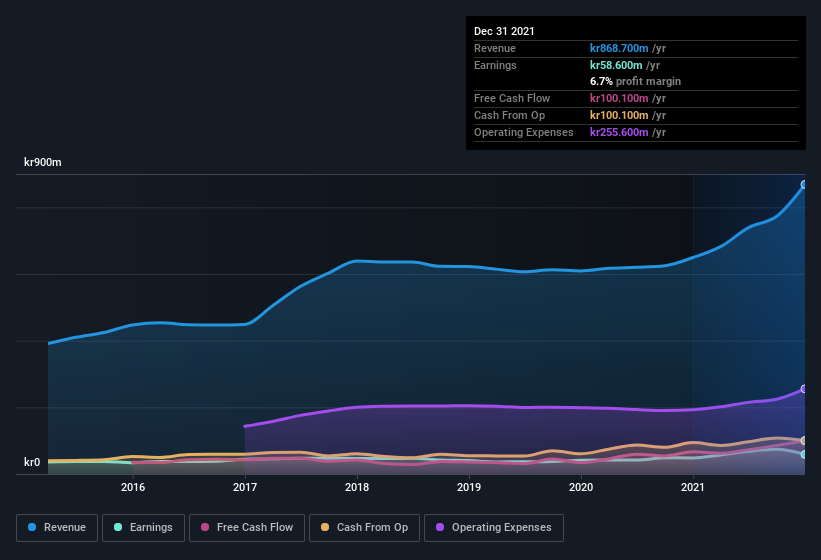

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Svedbergs i Dalstorp's EBIT margins were flat over the last year, revenue grew by a solid 34% to kr869m. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Svedbergs i Dalstorp isn't a huge company, given its market capitalization of kr879m. That makes it extra important to check on its balance sheet strength.

Are Svedbergs i Dalstorp Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Despite -kr1.6m worth of sales, Svedbergs i Dalstorp insiders have overwhelmingly been buying the stock, spending kr5.1m on purchases in the last twelve months. On balance, to me, this signals their optimism. It is also worth noting that it was Chief Executive Officer of Cassoe AS Michael Cassoe who made the biggest single purchase, worth kr738k, paying kr73.79 per share.

Should You Add Svedbergs i Dalstorp To Your Watchlist?

One important encouraging feature of Svedbergs i Dalstorp is that it is growing profits. While some companies are struggling to grow EPS, Svedbergs i Dalstorp seems free from that morose affliction. The cherry on top is the insider share purchases, which provide an extra impetus to keep and eye on this stock, at the very least. We should say that we've discovered 3 warning signs for Svedbergs i Dalstorp (1 is a bit unpleasant!) that you should be aware of before investing here.

As a growth investor I do like to see insider buying. But Svedbergs i Dalstorp isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:SVED B

Svedbergs Group

Develops, manufactures, and markets bathroom products in the Nordic region, the United Kingdom, and the Netherlands.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026